-

Tech companies dominate earnings calendar this week

-

Tesla (TSLA.US) reported promising Q3 delivery figures

-

Biotechs Abbott (ABT.US) and Biogen expected to report lower revenue

-

Coca-Cola (KO.US) forecasted to report another sales drop

US banks dominated the earnings calendar last week. Earnings flow will be more diverse this week but tech companies will be the most closely watched ones, including reports from Tesla (TSLA.US) and Netflix (NFLX.US). Abbott Laboratories (ABT.US), developer of rapid Covid-19 tests, will also report as well as two big consumer goods companies - Coca-Cola (KO.US) and Protect & Gamble (PG.US).

Tesla (TSLA.US) halted recovery at $460, the level of the previous local peak. Stock still trades below pre-split valuations but Q3 deliveries data was promising. Solid earnings report could provide fuel for bulls to look towards all-time highs at $500. Source: xStation5

Tesla (TSLA.US) halted recovery at $460, the level of the previous local peak. Stock still trades below pre-split valuations but Q3 deliveries data was promising. Solid earnings report could provide fuel for bulls to look towards all-time highs at $500. Source: xStation5

Tech stocks

This week will be abundant in earnings releases from tech companies, including some big names. Tesla will publish Q3 results on Wednesday after the market closes. US electric vehicle manufacturers delivered better than expected Q3 delivery results and investors are eager to see if higher profits accompanied. IBM (Monday, after session) and Intel (Thursday, after session) are expected to report small revenue declines compared to a year ago and lower profits. Meanwhile, Netflix (Tuesday, after session) is expected to report record revenue. However, the question is whether strong subscriber growth remained after lockdowns were lifted.

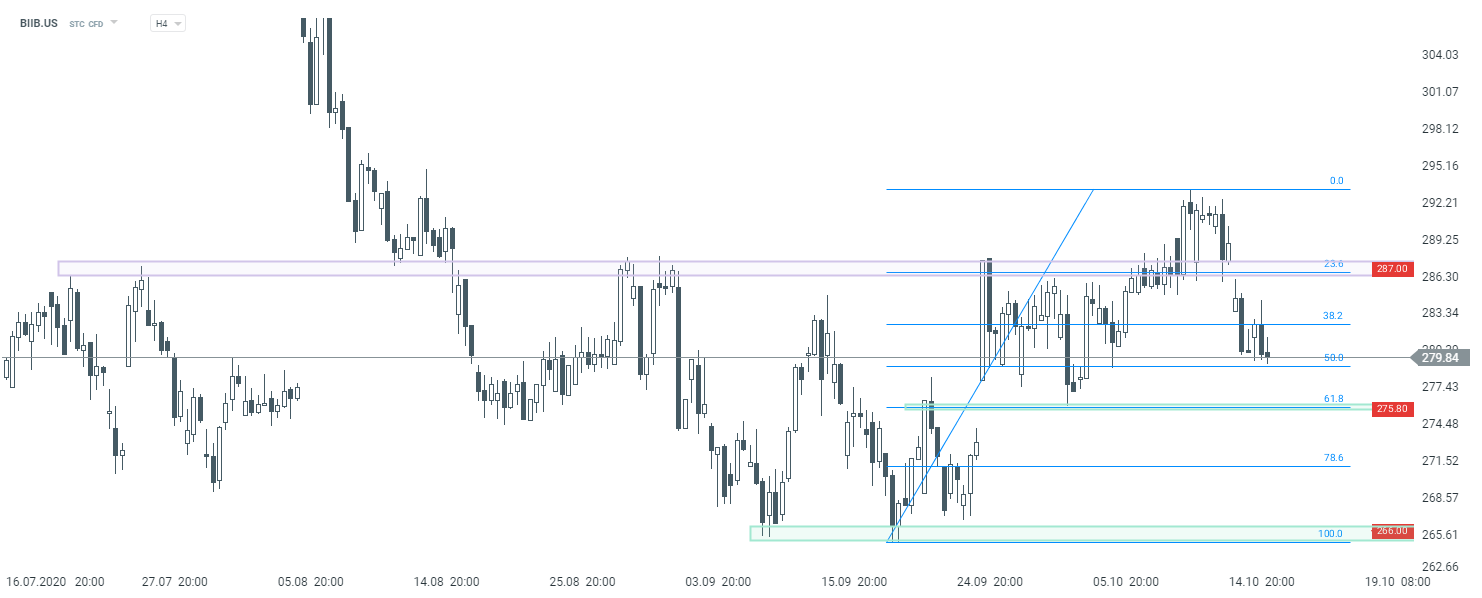

Biogen (BIIB.US) halted decline at 50% retracement of recent upward impulse last week. Poor expectations for the upcoming report create some downside risks but on the other hand, Biogen has a solid track record of delivering positive surprises. Source: xStation5

Biogen (BIIB.US) halted decline at 50% retracement of recent upward impulse last week. Poor expectations for the upcoming report create some downside risks but on the other hand, Biogen has a solid track record of delivering positive surprises. Source: xStation5

Biotechs

In spite of lifting lockdowns, the coronavirus pandemic is far from over. Case numbers remained high throughout summer and started to spike at the turn of Q3 and Q4. Abbott Laboratories (Wednesday, before session) designed a rapid Covid-19 test that is widely used in the United States. The company is expected to report revenue decline and higher profits. Other US biotech Biogen (Wednesday, before session) is seen delivering lower earnings and revenue as the company was not involved in development of any noteworthy Covid vaccines or treatments.

Coca-Cola (KO.US) started to recover from recent decline but began to struggle near 23.6% retracement of July-August upward move. Two key near-term zone to watch amid upcoming earnings release on Thursday are $51.40 (resistance) and $49 (support, 38.2% retracement). Source: xStation5

Coca-Cola (KO.US) started to recover from recent decline but began to struggle near 23.6% retracement of July-August upward move. Two key near-term zone to watch amid upcoming earnings release on Thursday are $51.40 (resistance) and $49 (support, 38.2% retracement). Source: xStation5

Consumer goods

Apart from technological and biotechnological companies, investors will be served reports from some big consumer goods companies. Those reports may show whether spending habits have changed due to Covid-19. Coca-Cola (Thursday, before session) is expected to report lower revenue and operating profit than a year ago as people around the world are less likely to dine out and drink beverages. On the other hand, Procter & Gamble (Tuesday, before open) is expected to post low single-digit growth of EPS and sales.

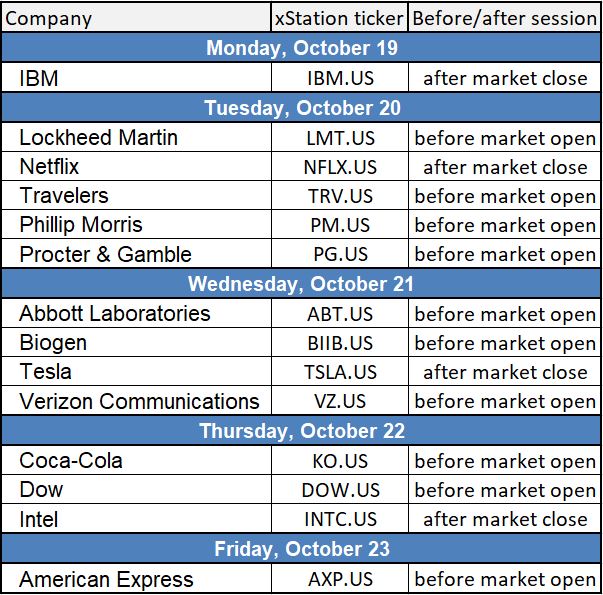

Key US earnings releases this week. Source: Bloomberg, XTB

Key US earnings releases this week. Source: Bloomberg, XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.