The market remains dominated by the ongoing sell-off in technology stocks and renewed pressure on precious metals, with overall tension expected to rise ahead of today’s high-impact macroeconomic releases.

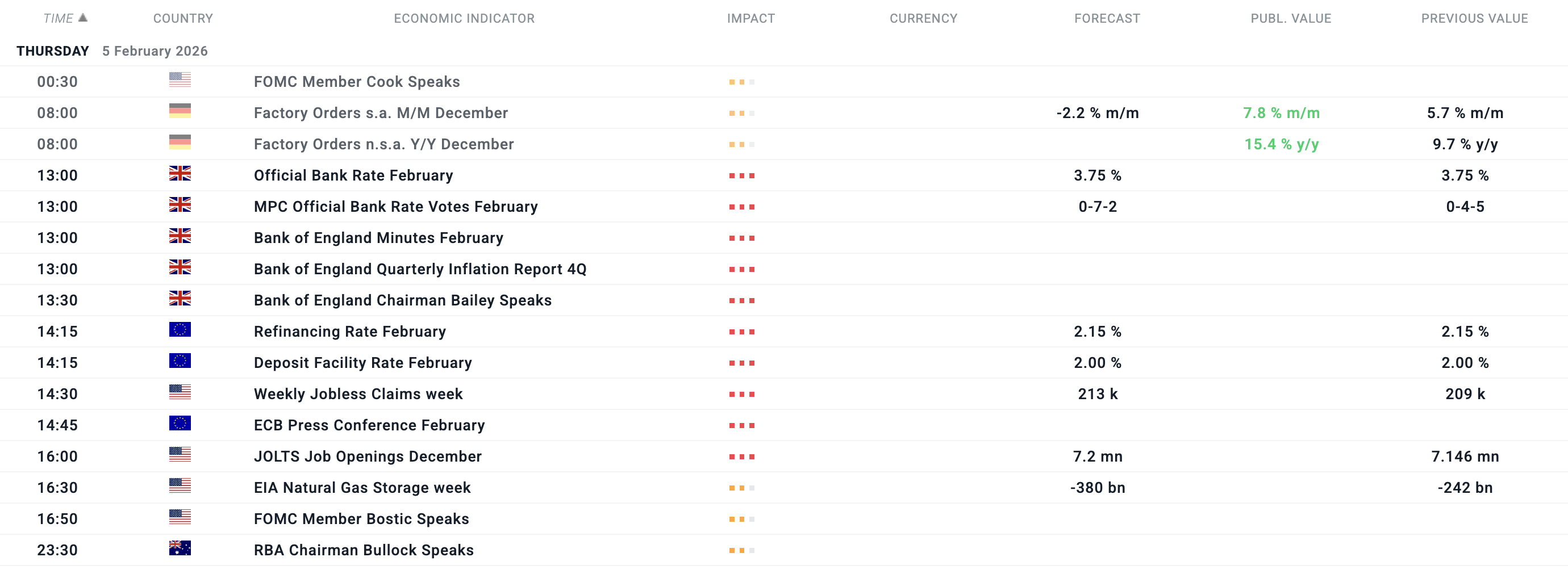

Thursday will be primarily shaped by central bank decisions in Europe. The Bank of England (BoE) will publish its interest rate decision at 12:00 PM GMT, followed by the European Central Bank (ECB) at 1:15 GMT.

While both institutions are expected to keep rates unchanged, the focus will be on the accompanying rhetoric. The BoE may signal a readiness for further cuts in the coming months, whereas the ECB is likely to reaffirm a favorable balance of risks, characterized by inflation reaching its target and gradual, albeit uneven, economic recovery in the Eurozone.

In the U.S., investors await another series of labor market data. Alongside weekly jobless claims, the JOLTS report on job openings will be released. Yesterday’s weaker-than-expected ADP employment report (showing only 22,000 new jobs) set a relatively pessimistic tone; therefore, any further signs of labor market weakness could stall the current gains seen in the U.S. dollar.

Financial results will be presented by companies including: Amazon, Shell, UniCredit, BNP Paribas, Philip Morris.

All times CET (GMT+1). Filtered by US, UK, Eurozone, Germany, France, Japan, Australia, New Zealand, medium and high importance. Source: xStation5

A tale of two earnings releases: Rolls Royce beats Nvidia, because its European

Economic calendar: US-Iran talks in Geneva in the spotlight

Nvidia delivers another monster earnings report, and forecasts big things to come

Daily Summary - Wall Street is waiting for Nvidia (25.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.