Shares of Electricite de France (EDF.FR), the French utility company, trade 7% higher today after surging as much as 10% at one point. Move was triggered by reports saying that French government wants to buy stakes of minority shareholders and delist the company. Reuters reported that French government may spend as much as €10 billion on 16.3% of EDF shares it does not currently own and its convertible debt. 16.3% equity stake was valued at €5.7 billion based on Tuesday's closing prices while convertible bonds were valued at around €3 billion. However, a spokesman for the French Finance Ministry rejected the report and declined to confirm the €10 billion figure mentioned. Sources that Bloomberg spoke with said that the figure was overstated.

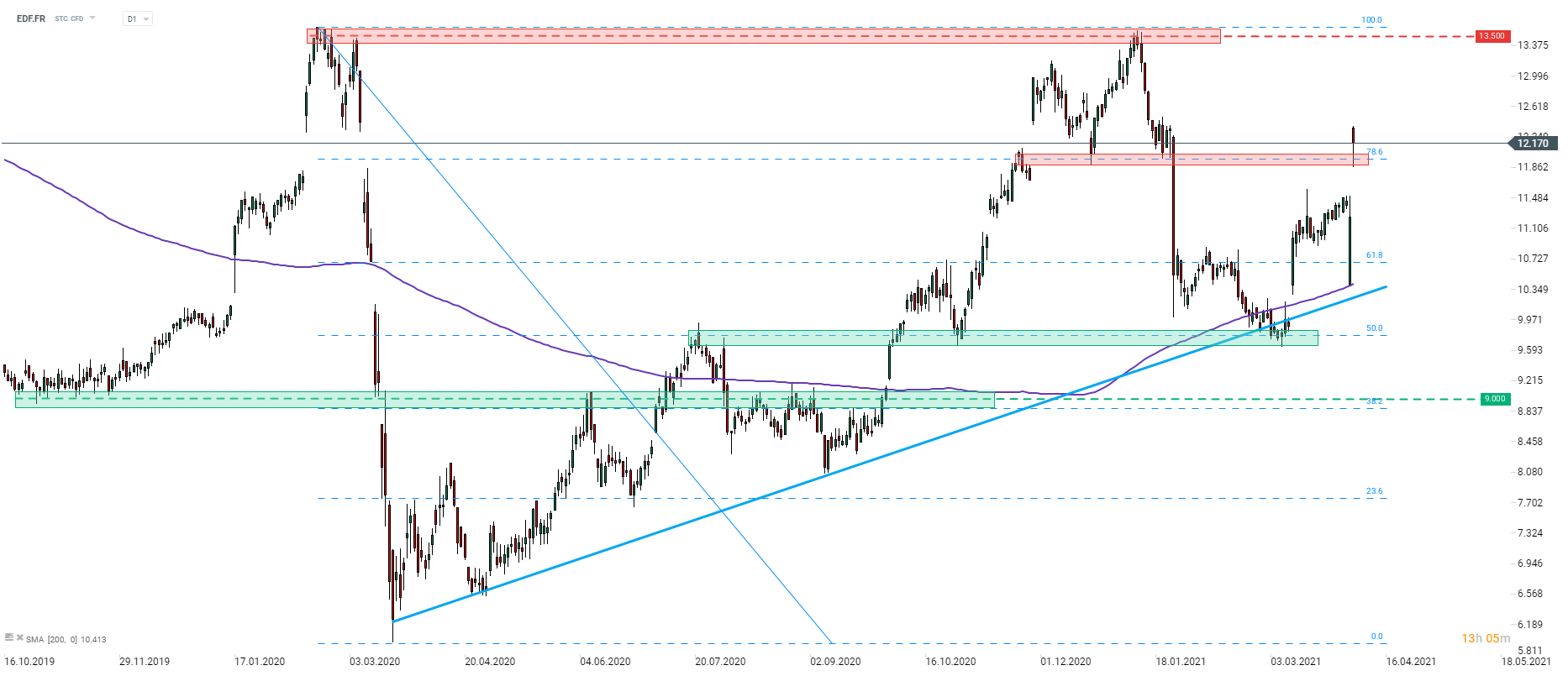

Share price of EDF opened above the 78.6% retracement of the 2020 pandemic drop today. While some gains were erased after the French authorities denied they are willing to spend €10 billion to delist Electricite de France, stock has managed to remain above the 78.6% retracement and it is the near-term support to watch. French authorities did not rule out the possibility of buying out minority shareholders completely, they have only denied €10 billion price tag reported by Retuers.

Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.