Eli Lilly reported an excellent 2Q24, posting strong revenue growth, earnings, and beating analysts' expectations. Thanks to lower cost dynamics, the company also managed to significantly improve margins.

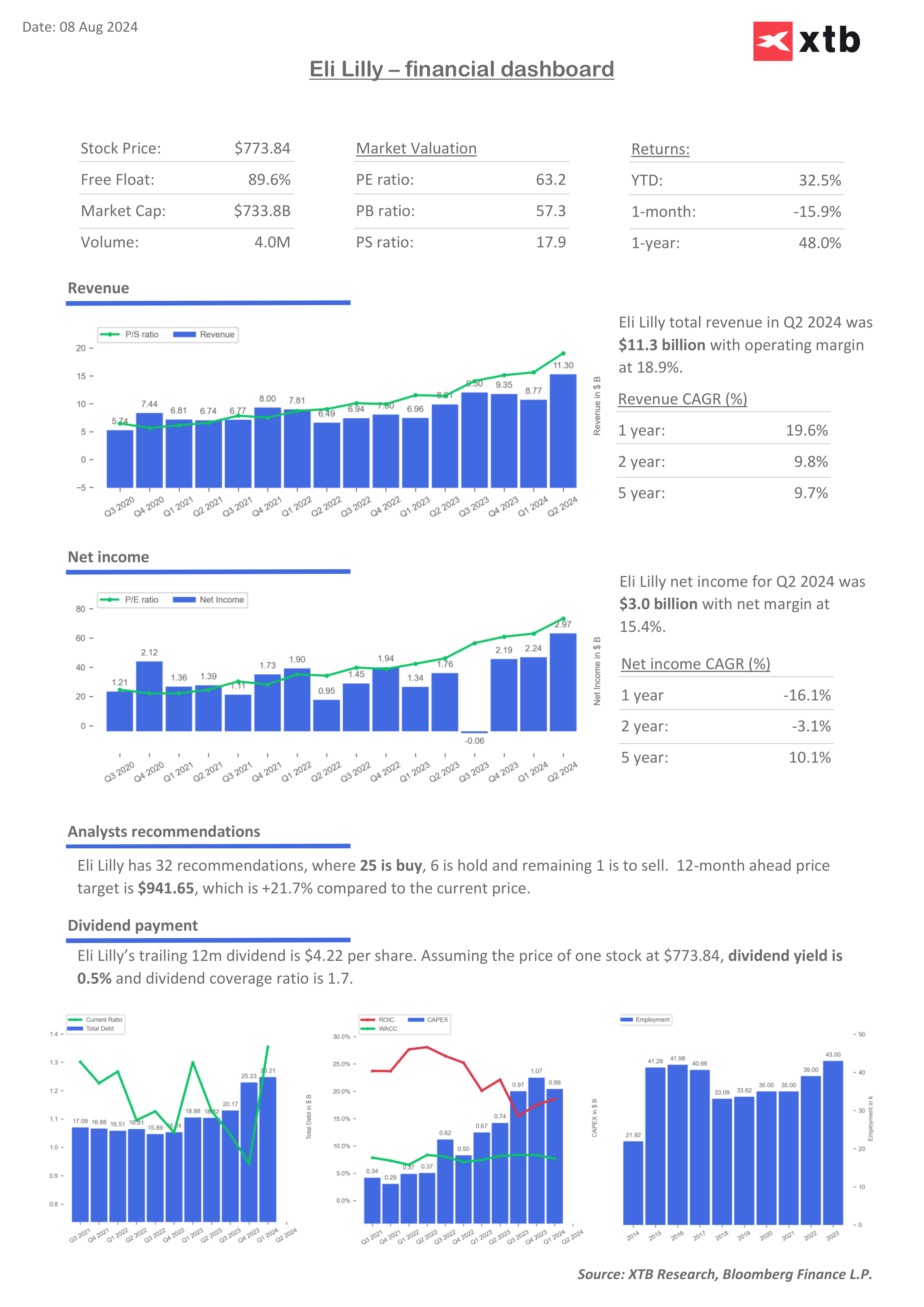

The company achieved record high revenues, breaking through the $10 billion quarterly. Eli Lilly reported $11.3 billion in revenue in 2Q24, thereby recording a 36% year-on-year growth and beating estimates of $9.98 billion. The strong sales growth was primarily driven by revenue from the company's key current segment, anti-obesity drugs. The drug Mounjaro became a major revenue contributor in 2Q24 (with $3.09 billion in revenues generated), and strong demand for Zepbound meant that the drug already accounts for roughly the same amount of quarterly revenues as Trulicity. It is worth noting that Trulicity accounted for more than 20% of the company's total revenue just a year ago.

It's not just robust revenue growth that contributed to Eli Lilly's success this quarter. The company continues to spend on research and development, which increased by 15.05% year-on-year in the quarter, while marketing, sales and administrative expenses rose by almost 10%. However, both figures are significantly lower than the averages of previous quarters (for the last four quarters, the average growth rates were 30.6% and 14.7%, respectively). As a result, the company improved its operating margin to 37.9% (up more than 10 p.p.) against 30.2% forecast.

At the adjusted EPS level, the company reported $3.92 versus $2.11 a year earlier.

One drug candidate (Tirzepatide targeting heart failure with preserved ejection fraction), which is in the phase 3 clinical trials, is showing very positive results so far. It reduces the risk of worsening heart disease by 38% (compared to placebo), and also reduces the weight of patients, both with and without diabetes, by 15.7%. The company has reached a milestone with its research and now promises to send the results to the FDA for approval by the end of this year.

At the same time, Eli Lilly raised its forecasts for the full year 2024.The lower limits of the new ranges for both revenue and adjusted earnings per share are above the upper limits of the previous report. The company anticipates that the ongoing supply slowdown in the market and supply shortages on its part will be resolved 'very soon'. On Wednesday, all doses of Zepbound and Mounjaro were listed as "available" in the FDA database.

2Q24 RESULTS

- Revenues $11.30 billion, +36% y/y; estimates $9.98 billion

- Trulicity revenues $1.25 billion; -31% y/y; $1.46 billion estimate

- Mounjaro revenue $3.09 billion; +215% y/y; $2.37 billion estimate

- Zepbound revenues $1.24 billion; estimate $818.9 million

- Humalog revenues $631.6 million; +43% y/y; $384 million estimate

- Taltz revenues $824.7 million; +17% y/y; $764.9 million estimate

- Jardiance revenues $769.6 million; +15% y/y; $806.7 million estimate

- Verzenio revenues $1.33 billion; +44% y/y; $1.23 billion estimate

- Gross margin 82%; +2.2 p.p. y/y; estimate 81.1%

- Research and development expenses $2.71 billion;+15.05% y/y; $2.79 billion estimate

- Marketing, sales and administration expenses $2.12 billion;+9.97% y/y; $2.15 billion estimate

- Adjusted operating profit: $4.29 billion; +90% y/y; estimated:

- Operating profit margin: 37.9% (previous year: 27.1%); estimate: 30.17%

- Net income: Adjusted earnings per share $3.92 vs. $2.11 y/y

2024 YEAR OUTLOOK:

- Revenues: $45.4 - $46.6 billion (previously: $42.4 - $43.6 billion), estimated: $42.98 billion

- Adjusted earnings per share: $16.1 - $16.6 (previous: $13.05 - $13.55), estimate: 13.71 $

In pre-market trading, the company is gaining more than 12%. Source: xStation

In pre-market trading, the company is gaining more than 12%. Source: xStation

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.