Summary:

-

Euro slides well below 1.15 this morning as stop orders have been finally cracked

-

European financial watchdog has become concerned about the exposure of some European banks in Turkey in the light of the lira’s runaway slump

-

Japanese GDP beats estimates, but there is no inflationary pressure on horizon

-

Turkish lira deepens its rout being up more than 3% against the USD this morning

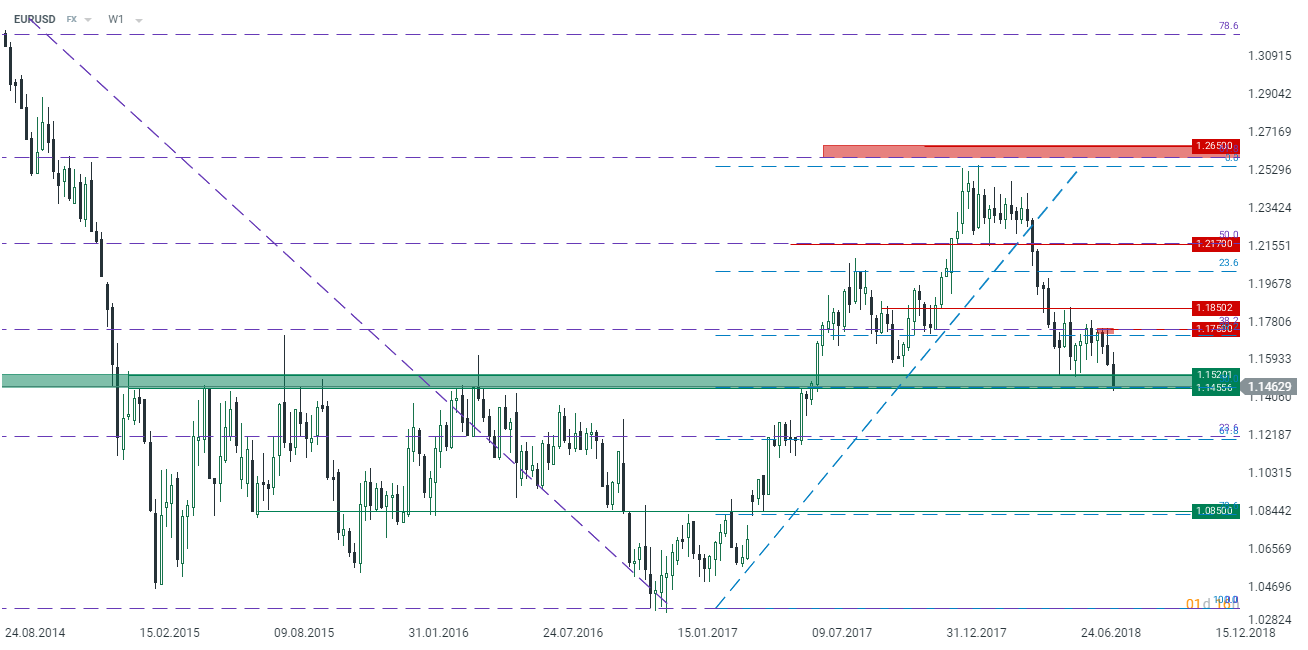

The euro slid below 1.1450 this morning fuelled by cracking stop loss orders placed nearby 1.15. Notice that the pair has been trying to break through this level already several times, hence the area has weakened from a technical point of view. The move came on the heels of the Eurozone’s chief financial watchdog comments. It said that it has become concerned about the exposure of some European banks in Turkey in the wake of the lira’s sharp decline - mainly UniCredit, BBVA and BNP Paribas. There is no doubt that a sharp decline seen in the morning could be overreacted and some corrective moves might be expected to come when European traders enter the marker. However, the weekly close could be outstandingly important and if the pair manages to stay below 1.1500 to the end of the day, it could bode well for bears meaning that a deeper pullback could be in the offing. Having the US dollar strengthening so quickly one cannot rule out some remarks from the US President Donald Trump therefore everyone needs to follow him on Twitter as his comments might bring a short-lived relief to the greenback. As of 6:37 am BST the US dollar is index is trading above 96 climbing its highest level since July 2017. It is worth noting this the morning USD rally could be viewed as an inflow to safe haven assets as the US 10Y yield has fallen more than 2 basis points approaching 2.90%.

The EURUSD is breaking down its crucial support placed in the vicinity of 1.1450. The weekly close could be critical for the pair in the upcoming weeks. Source: xStation5

The EURUSD is breaking down its crucial support placed in the vicinity of 1.1450. The weekly close could be critical for the pair in the upcoming weeks. Source: xStation5

The stronger greenback and an influx to safe haven assets only deteriorated moods surrounding the Turkish lira as it almost touched 5.75 against the US dollar this morning. As of 6:43 am BST the lira os trading 3.1% at 5.7279 per dollar. Keep in mind that we were offered some comments from the Turkish finance minister that he will outline the vision of a ‘new economy’ on Friday nevertheless it is highly uncertain whether his remarks might bring even temporary relief to the TRY. In this respect one may conclude that the Turkish creditworthiness has been undercut as the USD 5Y CDS, giving insurance against a possible Turkish default, climbed above 370 basis points this morning reaching the highest level since March 2009.

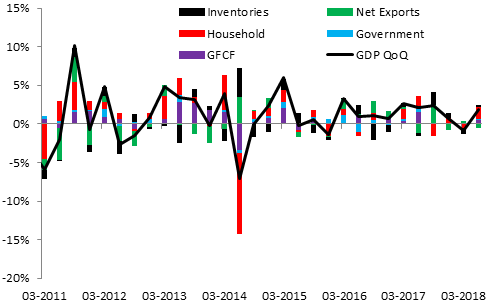

Setting the US dollar and Turkish lira story aside one cannot omit Japanese GDP for the second quarter which produced decent 1.9% growth in annual terms. In quarterly terms the Japanese expanded 0.5% beating the consensus at 0.3% and recovering from a 0.2% contraction registered during the first three months. According to the preliminary data growth was mainly driven by private consumption as consumer spending increased 0.7% QoQ smashing the median estimate at 0.2%. Business spending grew 1.3% QoQ easily exceeding expectations placed at 0.6% bringing the growing CAPEX for the seventh consecutive quarter. Notice that the better data could embolden the Bank of Japan to keep preparing the economy for more contractionary monetary policy translating into the stronger JPY. Nonetheless, it could not be the case in the nearest future as GDP delator, the broadest inflation gauge, increased just 0.1% staying far below the BoJ's desirable level. The Japanese currency was gaining about 0.3% prior to the sudden rally on the greenback. As of 6:57 am BST it is trading 0.1% higher.

The Japan's economy recovered after the weakish first quarter fuelled both by consumer and business spending. Source: Macrobond, XTB Research

The Japan's economy recovered after the weakish first quarter fuelled both by consumer and business spending. Source: Macrobond, XTB Research

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.