Summary:

-

Single currency and stock markets slide lower

-

Latest industry surveys from the bloc disappoint

-

Deutsche Bank swoons as earnings miss

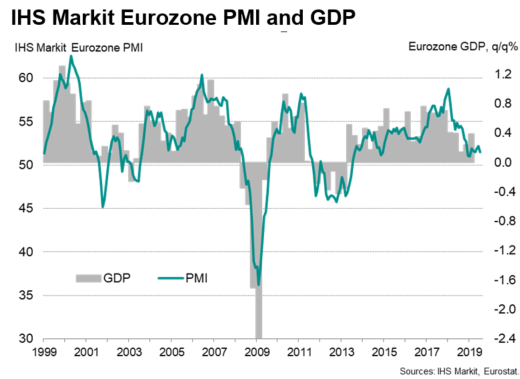

There’s been more bad economic data from the Eurozone this morning with a series of industry surveys from across the bloc setting alarm bells ringing. The PMI readings are seen as a leading indicator of economic health and with a composite from across the EU showing the weakest pace of expansion in 3 months and only 4 worse readings in the past 6 years it is abundantly clear that activity is in danger of grinding to a halt.

The latest round of PMIs from the Eurozone have disappointed and point to a slowdown not only in the bloc, but also the global economy. Source: IHS Markit, Eurostat

Overall the manufacturing figures make for far worse reading than their service sector equivalents, and unfortunately the weakest data came from the bloc’s biggest economy as the German PMI fell to its lowest level since 2012 at 43.1. Furthermore, given Germany’s position as a large exporter in this field its manufacturing figures can be viewed as a bellwether on the global economy and this suggests that the slowdown is not a phenomenon confined to the bloc. Looking back at previous iterations of this release makes for pretty grim reading with 12 of the past 15 months coming in below consensus forecasts in a sign that it is consistently underperforming expectations.

Unsurprisingly the Euro has dropped on this news, with the single currency falling to a 2-month low against the US dollar shortly after the release. The $1.11 handle has provided a floor on a couple of occasions in recent months but if the market falls below this level then you have to go back more than 2 years to May 2017 to find a lower exchange rate. Source: xStation

Will the ECB cut rates tomorrow?

Those looking for a potential catalyst for a break may not have to wait too long with the ECB set to announce the outcome of their latest policy decision in just a little over 24 hours time. At present the markets are pricing in just under a 50% chance of a 10 basis point cut to the deposit rate tomorrow and this latest set of dire data will only serve to heighten the chances that president Draghi and the Governing Council deliver one.

The efficacy of the cut itself is questionable to say the least but while it is largely a symbolic gesture if it occurs it could well be seen as a sign of things to come and the first tangible steps along the path to a resumption of the Asset Purchase Programme (AKA QE) in the not too distant future.

Deutsche Bank hit with double whammy

There’s more bad news from Germany this morning with Deutsche Bank shares taking a swoon lower and dropping more than 5% after two negative developments in a short space of time. It is no secret that the German lender has been struggling for some time now and the latest trading update showed the bank post its largest quarterly loss since the depths of the financial crisis in 2008. The loss itself is entirely due to the impact of the firm choosing to realise almost half of its 3-year €7.4B bill in the quarter, with the €3.4B hit meaning a total loss of €3.1B. However, even taking this into account net income in the 3-month period to June and adjusted pre-tax profits both missed analysts forecasts.

Before these results were announced an arguably even more damaging piece of news hit the wires with reports indicating that Deutsche helped Jeffrey Epstein manage his fortune. Epstein was denied bail last week pending trial on charges of trafficking under age girls for sex. The possibility that the bank was complicit in this alleged crime threatens to do serious reputational damage and raises major questions relating to the firm’s KYC policies and procedures. The timing of this revelation could hardly be worse for Deutsche and the stock dropped back below the €7 mark on the open in response.

Shares in Deutsche Bank had fallen by more than 5% shortly after the open this morning but have since bounced a little. The market is just about clinging to the uptrend that has been in place in the past couple of months - defined by the 8/21 EMAs and a rising trendline. Daily lows of 6.70 could be seen as key support to watch going forward. Source: xStation

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.