The U.S. dollar is strengthening against the euro after U.S. inflation showed a lower rate of decline yesterday, and members of the Federal Reserve spoke quite hawkishly, signaling an extended hike cycle. In addition, the leader of the Republicans, McDonell indicated yesterday that the party would not stand in the way of raising the debt limit thus lowering the risk of a US 'default'. A slightly more dovish message from Patrick Harker, head of the Philadelphia Fed, was balanced by hawkish Thomas Williams, head of the New York Fed.

Biden's choice

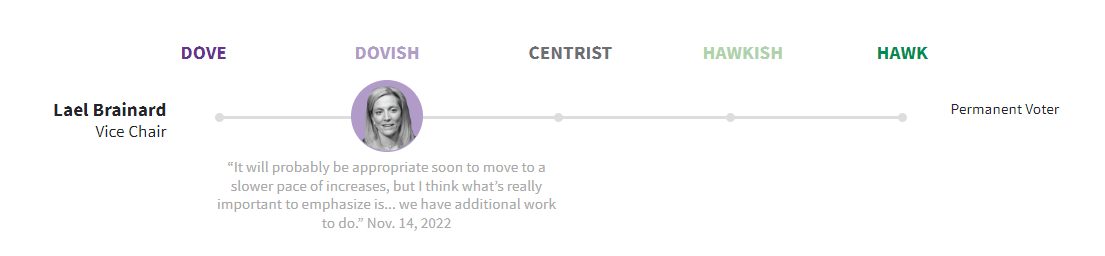

Joe Biden has appointed Jared Bernstein and Lael Brainard to key economic posts. Bernstein, who in the past has leaned toward 'Modern Monetary Theory,' an economic theory that considers near-zero interest rates appropriate, will become the White House's chief economist. Brainard, a Fed deputy governor known for her more dovish stance, will now be the president's chief economic advisor.

In the past, Brainard has emphasized the 'two-sided' risk of rate hikes, and has often focused more on it than on controlling inflation. If nothing changes, we can assume that in view of the slowing economy, Brainard will speak in favor of rate cuts even if inflation does not reach the 2% target. Source: Reuters

Fed Harker

- We need to be cautious about rate hikes during balance sheet reduction but should maintain the path of 25 bps rate hikes;

- The Fed is not yet finished with the hike cycle but is probably close. Deciding in March is not yet a foregone conclusion;

- How much rates will rise above 5% will depend on the data. I see little evidence of a serious slowdown in the labor market but I think unemployment will rise above 4% this year

- The inflation report showed that inflation has stopped falling rapidly. I forecast core inflation around 3.5% this year, 25% next year and 2% in 2025

- I forecast 1% real GDP growth this year before the economy returns to 2% growth in 2024 and 2025. I do not forecast a recession

Fed Williams

- There is a possibility that the Fed will have to raise rates higher than I predict, and inflation will still remain higher;

- I remain confident that the 2% inflation target will be achieved but the struggle to do so may take several years;

- I expect core PCE inflation to be 3% this year. Perhaps the Fed will cut rates in 2024 and 2025 but only if it is prompted by low inflation;

- The main concern is that high inflation is rooted in social expectations. Higher global growth and constrained supply chains are pro-inflationary - supply and demand imbalances drive inflation;

- The Fed may have a long way to go when it comes to controlling price pressures. Lower growth and higher unemployment will result from lower inflation this year. I estimate that unemployment will rise to 4-5%;

- Recent data support the case for additional rate hikes and show improvement in underlying economic strength. Labor market remains exceptionally strong

EURUSD broke the trend line, the pair settled below the 100 and 200 session averages (black and red line) on the H4 interval, signaling a possible further weakening of the European currency against the dollar.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

BREAKING: US100 jumps amid stronger than expected US NFP report

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.