The euro is gaining against most currencies, with the EURUSD pair increasing by 0.30% following information that the European Central Bank (ECB) is allegedly preparing to introduce a strategy to manage the excess liquidity in banks, which currently stands at about 3.5 trillion euros. The above strategy is expected to be the main point of the next ECB meeting regarding interest rate decisions, which will take place on October 26 in Athens.

According to several insiders closely associated with the ECB, to whom Reuters reached out, a potential strategy could involve raising the mandatory reserves of banks from the existing 1% of customer deposits to a range of 3-4%. This adjustment aims to help curb inflation, which, despite ten previous rate hikes, consistently exceeds the 2% target, and also to reduce the interest expenses of central and national banks on deposits, which are a loss-inducing factor.

Technical outlook

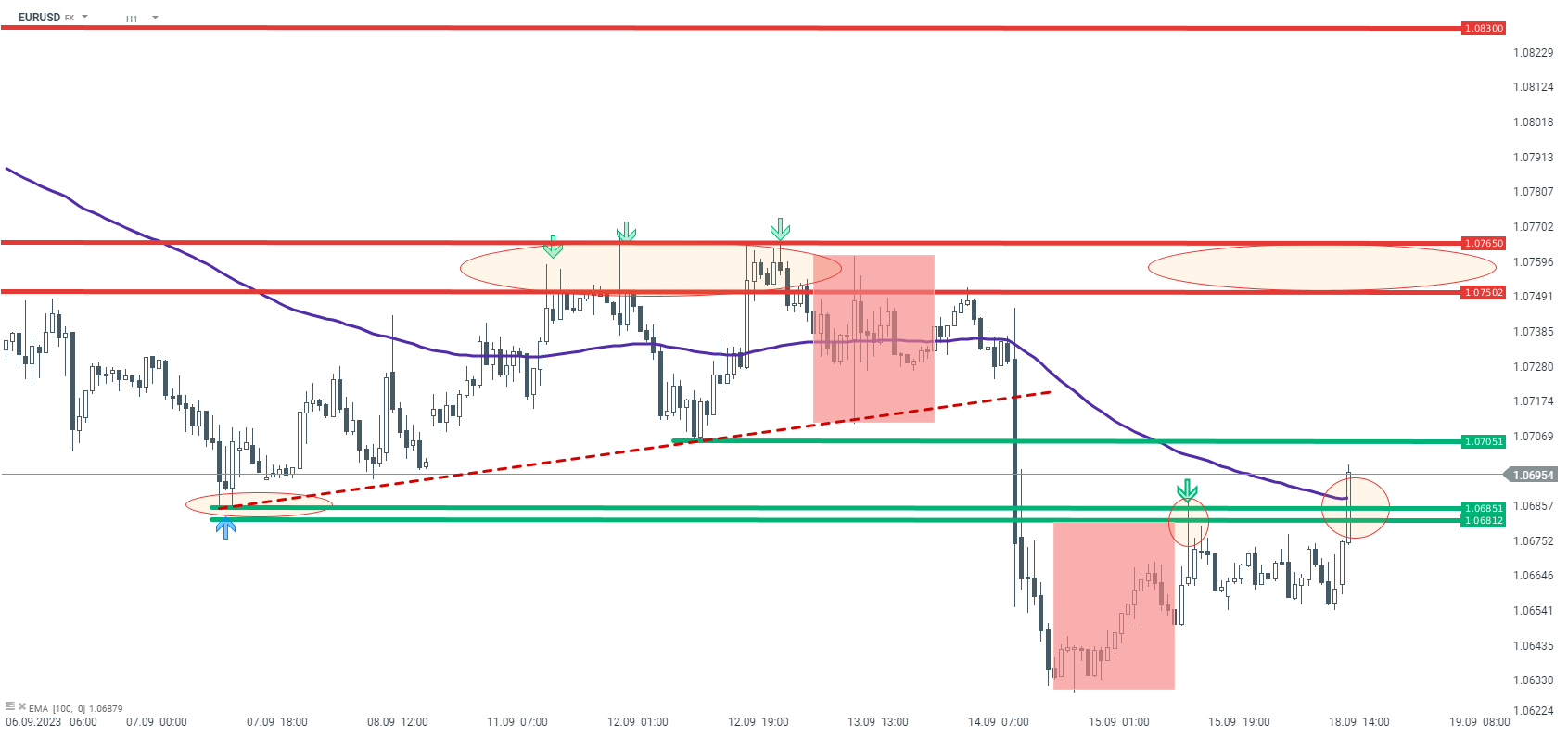

From the perspective of the D1 interval, the sentiment on EURUSD remains bearish. Recently, the rate broke below the key support level at 1.0750, which should now be treated as resistance. This point arises from the breached 1:1 geometry and the trend line. In the event of a continuation of the movement to lower levels, the 1.0630 and 1.0530 levels should be treated as support.

Source: xStation5

As for the H1 interval, we observe an attempt to break the key short-term resistance at 1.0860, resulting from the minimum of September 7 and the 1:1 geometry (red rectangles). In case the upward movement continues, attention should be paid to the resistance at 1.0705, and then the zone 1.0750-1.0760.

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

NFP preview

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.