Yesterday we were surprised by the publication of high inflation from the United States, where high oil prices and a still-strong consumer are boosting price pressures. Today we face the ECB decision and later PPI inflation from the US, which could potentially put even stronger pressure on the EURUSD pair. What could change today's ECB meeting, and will the bank initiate a series of cuts by G10 central banks?

Low inflation, mixed economic situation

- Eurozone inflation has now fallen to 2.4% y/y (the lowest since 2021), while core inflation continues its strong decline and is now at 2.9% y/y

- Wages, which have so far been a concern for stimulating inflation, have fallen sharply. For Q4 2023, nominal wage growth fell to 3.7% y/y from nearly 6.0% y/y

- The services PMI has rebounded recently and is back above 50 points and stands at 51.5 points, which is in line with the "global" PMI of 51.4 points. On the other hand, the EMU industrial PMI remains low at 46.1 points. The industrial PMI has remained below 50 points for 2 years.

Eurozone inflation is clearly declining, and wages indicate declining demand pressure on prices. Source: Macrobond, XTB

Eurozone inflation is clearly declining, and wages indicate declining demand pressure on prices. Source: Macrobond, XTB

What to expect from the ECB?

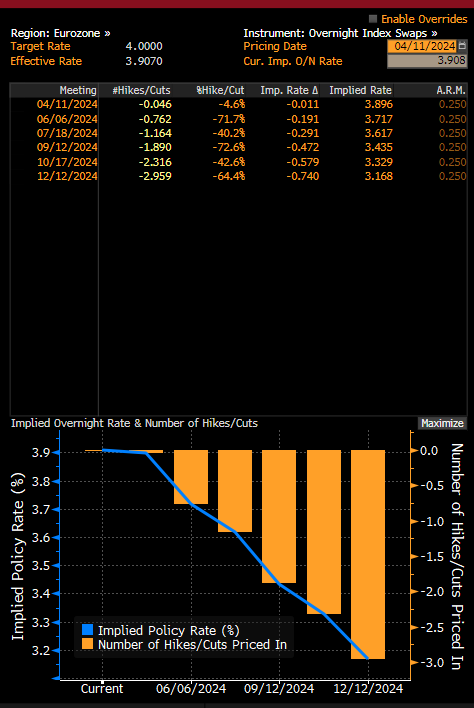

As recently as the end of last year, Christine Lagarde tried to reduce expectations of interest rate cuts, while indicating that by mid-year, bank members should have enough information to decide whether to normalize interest rates. It's also worth mentioning that the ECB is planning an additional balance sheet reduction from mid-year in the form of a reduction in PEPP program reinvestments and to end reinvestments at the end of 2024. This will lead to tighter financial conditions, which could be mitigated by interest rate cuts. There is a good chance that Lagarde today will not try to shy away from a possible cut as early as June. At this point, the probability of this scenario valued by the markets is over 70%. In view of this, there is a good chance of negative pressure on the euro, but at the same time, after a possible cut in June, investors will begin to consider the pace of reductions. If the next cut would not take place until September, there is a chance of a recovery on the EURUSD pair for the summer. An additional factor will be the growing pressure on the appearance of the first US cut, which will most likely take place just in September.

Expectations for interest rate cuts in the Eurozone. Source: Bloomberg

What's next for the EURUSD?

High inflation in the U.S. caused a recovery on the dollar and the pair eventually fell below the 1.0750 level. Although we are seeing a small recovery today, there is a good chance of a return to declines after today's meeting and with a stronger surprise in U.S. PPI inflation.

A rebound of just 0.3% m/m is expected, although oil prices have risen sharply recently. Moreover, we have seen a very strong recent rise in yields in the US and a limited one in Germany. The divergence between yields indicates that the EURUSD pair may still be too high. On the other hand, a possible bottom should take place right around the middle of the year.

The yield spread indicates a continuation of the recent downward movement on EURUSD. Source: Bloomberg Finance LP

Technical analysis

The EURUSD pair enters a clear demand zone on the weekly chart, which is fortified by the 1.0700 level and the 61.8 retracement of the last major upward wave. If the ECB actually hints at possible cuts in June, and PPI inflation surprises with a higher reading, then support could be broken and the next possible targets are around 1.06 and 1.05. Nevertheless, if Lagarde continues to try to delay cuts, then the pair should return above the 50.0 retracement of the last wave near the 1.0800 level.

Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Market wrap: Novo Nordisk jumps more than 7% 🚀

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Economic calendar: Delayed labour market data the key report of the week 🔎

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.