A combination of 'risk appetite' sentiments fueled by hope around a 'helpful Fed' and banking sector problems has put downward pressure on the US dollar and a rally on EURUSD. Following the bankruptcy of three US banks Silvergate, Signature, Silicon Valley Bank (now we now that,First Republic Bank also joined this trio) the Federal Reserve, the Treasury Secretary and the National Economic Council reached an agreement with banking regulators. The institutions decided to help depositors through liquidity programs and created an instrument so that banks would not have to realize losses on bonds to cover payouts. Indexes and cryptocurrencies reacted with a dynamic rally to the regulators' effort to provide more details before markets opened in Asia to prevent panic and stop a potential domino effect.

Index futures ignored news of Signature Bank's collapse, and declines in the eurodollar took their toll. EURUSD gains were supported by today's comments from Goldman Sachs, which does not expect the Fed to keep rates unchanged at its upcoming March 22 meeting. According to analysts, the regulators' decisions will increase liquidity in the banking sector and improve depositor confidence. At the same time, Goldman reiterated expectations for a 25bp hike in May June and July, still sees the final rate in the 5.25 - 5.5% range

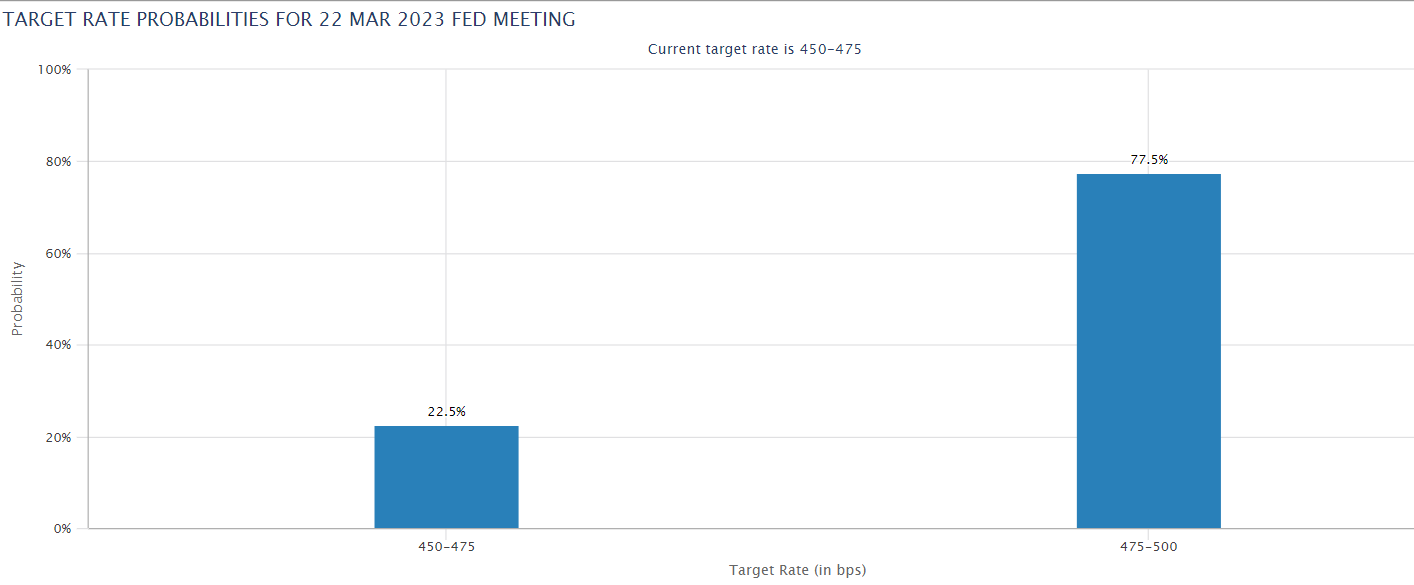

The market has sharply reduced expectations for the amount of a Fed rate hike on March 22. It now sees a 22,5% chance of no hike and a 77,5% chance of a 25 bp hike. Before to the banks' collapses, a narrative of 50 bp prevailed. Source: CME, FedWatch

The market has sharply reduced expectations for the amount of a Fed rate hike on March 22. It now sees a 22,5% chance of no hike and a 77,5% chance of a 25 bp hike. Before to the banks' collapses, a narrative of 50 bp prevailed. Source: CME, FedWatch

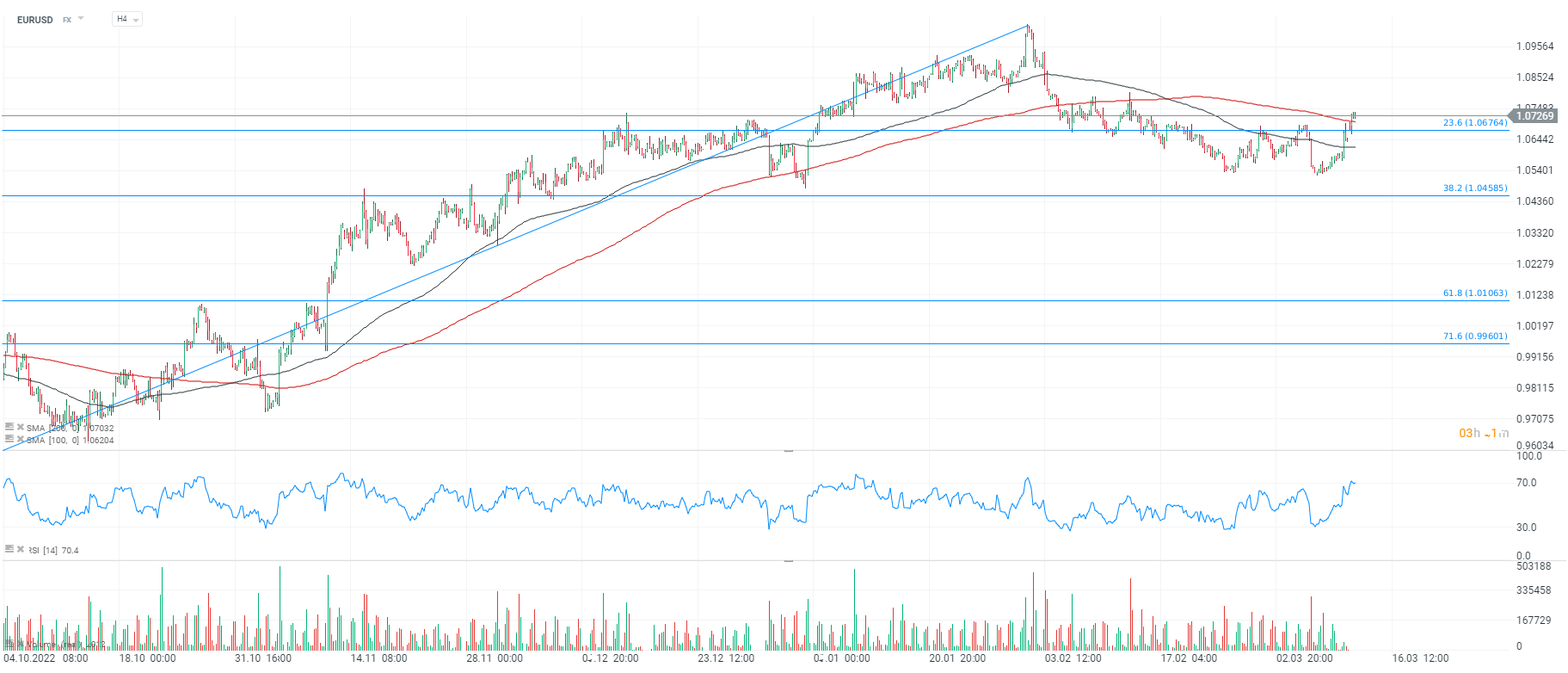

EURUSD chart, H4 interval. The dollar has weakened mightily since March 8, the EURUSD exchange rate returned above 1.07. The market reacted positively to the Fed's support. The price climbed above the 23.6 abolition of the upward wave started in September 2022 and the 200-session average SMA200 (red line). Looking at the volume candles, that the dollar's prolonged weakness is supported by considerable volume signaling the markets' hopes for the end of the Federal Reserve's rate hike cycle while maintaining a hawkish stance at the ECB, which has started raising rates of late. Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.