Oil giants Chevron (CVX.US) and Exxon Mobil (XOM.US) today presented excellent reports for the third quarter of the year. The results exceeded analysts' already very optimistic expectations. The stocks of both companies gained nearly 3% in pre-opening trade and are pushing to historic highs:

Exxon Mobil

Revenues: $112.07 billion vs. $102.96 billion forecasts

Adjusted earnings per share (EPS): $4.45 vs. $3.89 forecasts

Net income: $19.6 billion vs. $6.7 billion in Q3 2021

Cash flow (cash flow): $27.1 billion

Costs: $86.6 billion (up 35% y/y)

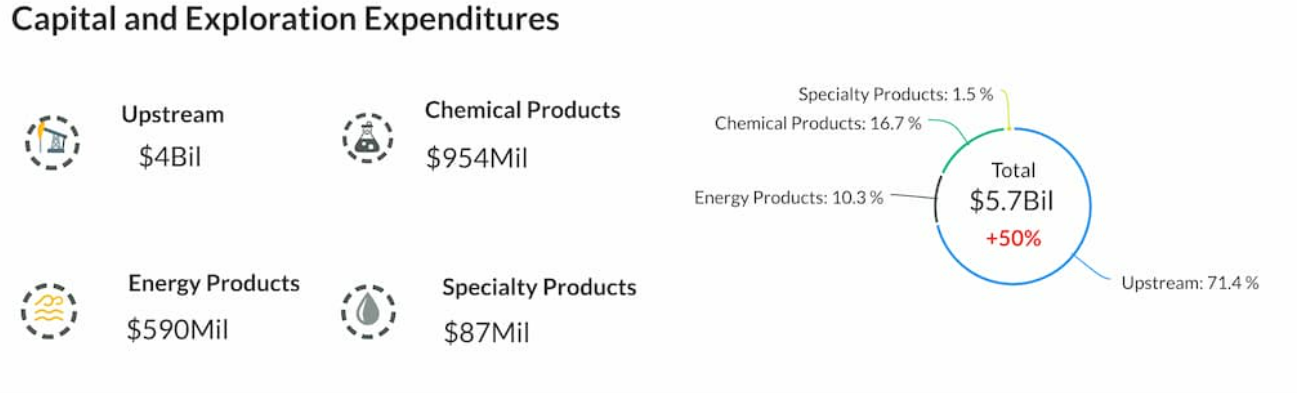

The company increased revenue from upstream (exploration and production) and downstream (production and supply) operations. Source: ExxonMobil

- The company's shareholders will receive a dividend of $0.91 per share on December 9, in the fourth quarter of FY 2022

Chevron

Revenues: $66.64 vs. $61.44 forecasts

Adjusted earnings per share (EPS): $5.56 vs. $4.94 forecasts

Net income: $11.2 billion vs. $11.6 billion in Q2

Downstream revenue: $2.53 billion vs. $1.95 billion forecasts

Upstream revenue: $9.31 billion vs. $8.13 billion forecasts

EPS year-over-year: $5.78 vs. $3.19 in Q3 2021

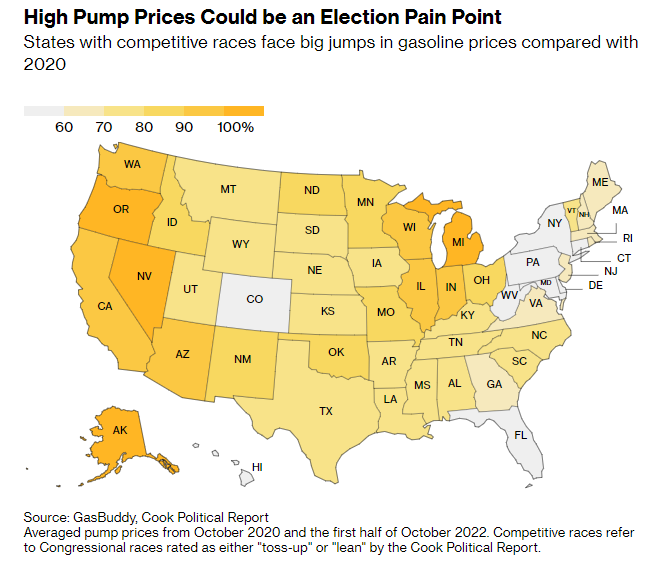

Cash flow: $15.3 billion The average increase in gasoline prices is a major concern for Democrats ahead of the midterms elections for Congress. In the first half of October this year, the scale of the increase exceeded 70% in most US states compared to October 2020. Gasoline became most expensive in the states of Michigan, Oregon and Nevada. Source: GasBuddy, Cook Political Report

The average increase in gasoline prices is a major concern for Democrats ahead of the midterms elections for Congress. In the first half of October this year, the scale of the increase exceeded 70% in most US states compared to October 2020. Gasoline became most expensive in the states of Michigan, Oregon and Nevada. Source: GasBuddy, Cook Political Report ExxonMobil (XOM.US) and Chevron (CVX.US) stock charts, W1 interval. Oil company stocks are highly correlated with oil prices. Higher GDP readings in the economies 'dismiss' to some extent the still lively fears around a global recession. The vision of an economic slowdown is limiting the growth of oil prices. Nevertheless, 'black gold' is already trading near $100, the latest DoE report indicated higher oil reserves and a surprising decline in gasoline and distillate stocks. OPEC+ production cuts may 'help' oil overcome the $100 resistance. The RSI relative strength index indicates levels at 64 points. These levels are far from the RSI's historical peaks, although both companies are trading at ATH. Source: xStation5

ExxonMobil (XOM.US) and Chevron (CVX.US) stock charts, W1 interval. Oil company stocks are highly correlated with oil prices. Higher GDP readings in the economies 'dismiss' to some extent the still lively fears around a global recession. The vision of an economic slowdown is limiting the growth of oil prices. Nevertheless, 'black gold' is already trading near $100, the latest DoE report indicated higher oil reserves and a surprising decline in gasoline and distillate stocks. OPEC+ production cuts may 'help' oil overcome the $100 resistance. The RSI relative strength index indicates levels at 64 points. These levels are far from the RSI's historical peaks, although both companies are trading at ATH. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.