Summary:

-

New highs for GBP pairs

-

GBPUSD > $1.31. EURGBP < 0.8450

-

FTSE failing to join in bounce in indices

With just a week to go until the general election it seems that the financial markets are placing their bets on a Conservative majority with the pound extending its push higher. Sterling has hit another 7-month high against the US dollar and you have to go back to May 2017 to find a better GBP/EUR rate. It is quite clear that the markets are looking favourably on the prospects of a Conservative majority, which due to the promise of delivering Brexit will lift some uncertainty at least for the next couple of months. While there has been a slight narrowing in the lead enjoyed by the Conservatives over Labour, at present it’s looking like there won’t be a repeat of the 2017 election where a disastrous Conservative campaign and an inspired Labour one saw a stark change in popular opinion and ultimately delivered a hung parliament.

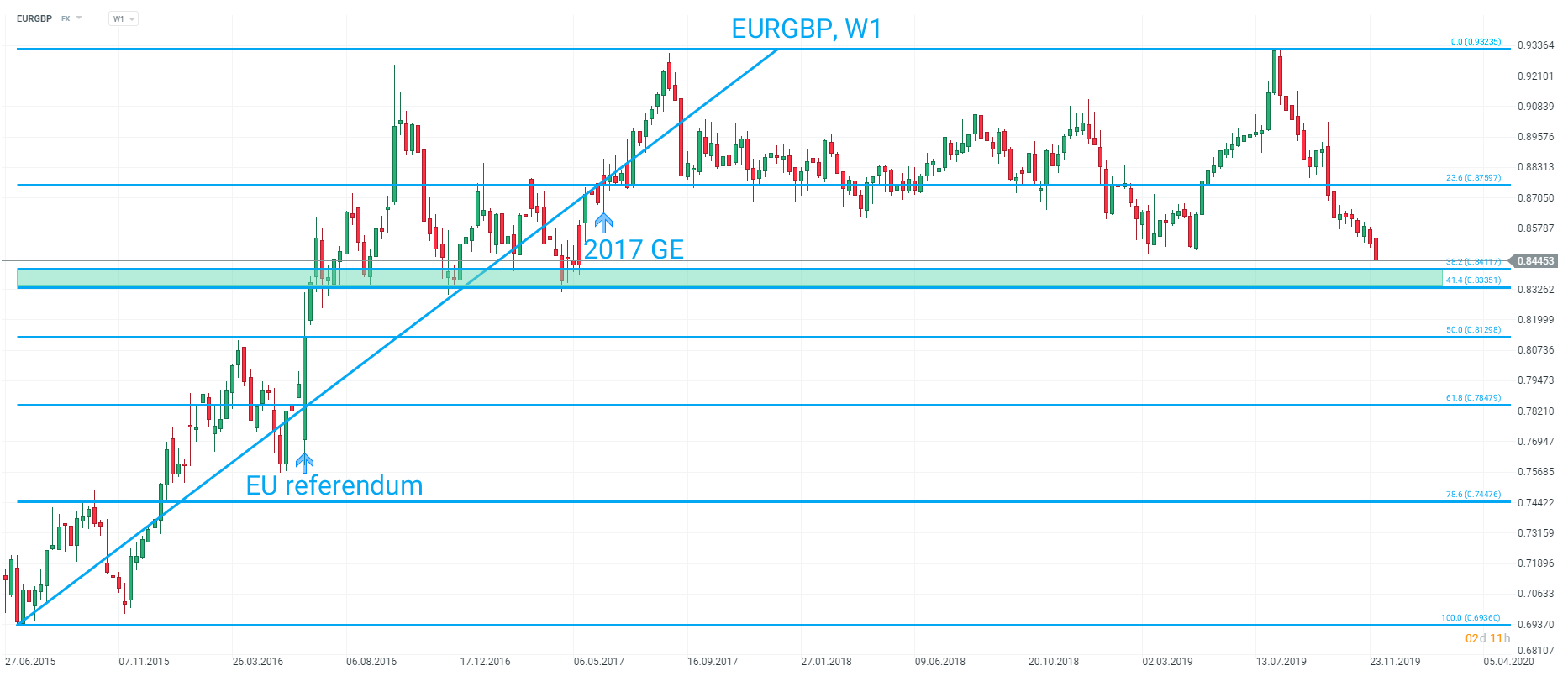

EURGBP has fallen to its lowest level in 2 ½ years this morning with price approaching a potentially key region. The 38.2-41.4% fib retracement comes into play from 0.8335-0.8412 and could be seen as pivotal going forward. Source: xStation

Frontrunning the election?

With this being the 4th big public vote in the past 5 years and the 3rd general election, it’s worth looking at previous ballots and the market reaction in the run-up to the vote. Markets are inherently forward looking and while there’s been clear reaction once the outcome to the previous events was known, there was also significant movement ahead of the vote itself. In 2015 the GBP/USD rate gained almost 6% in the 3 weeks before the vote, but more recently the final week has seen some clear moves as investors look to position themselves for the outcome.

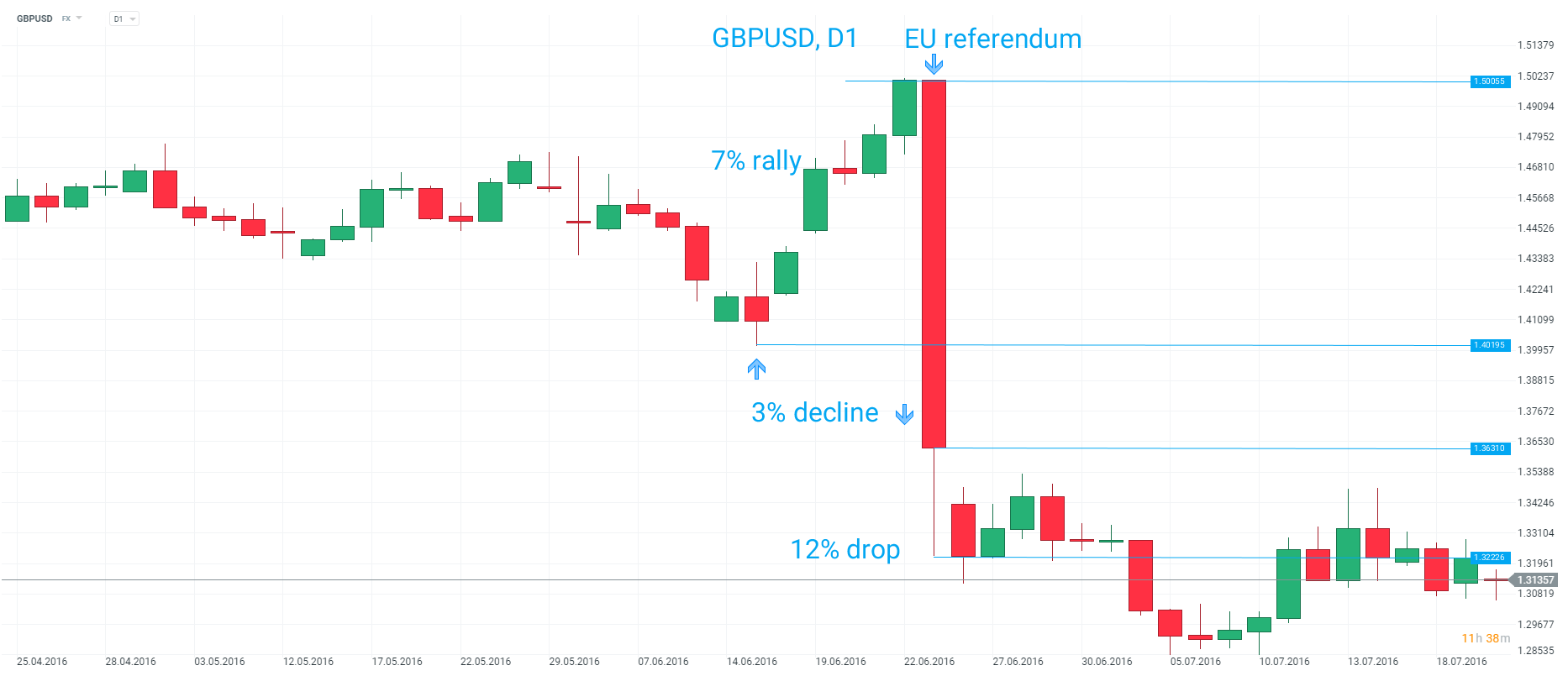

The GBP/USD rate made an often forgotten strong push higher into the 2016 referendum, exacerbating the subsequent decline when the leave victory was announced. Source: xStation

The best example of this was the EU referendum, where it is often forgotten that there was a strong push higher in the pound ahead of the vote. In the 6 days before the result was known (so including polling day) rallied over 7% from low to high as investors rushed to bet on a victory for remain. This exacerbated the downside shock when the surprise result was confirmed, and even though the sell-off was large and dramatic on the following day (June 24th) price was only 3% lower than where it was a week before.

It’s also worth noting that the GBP/USD market gained in 5 of the 6 days before the 2017 vote, and while the rally was only around 1.5% it was noteworthy for its persistent nature.

FTSE continues to lag

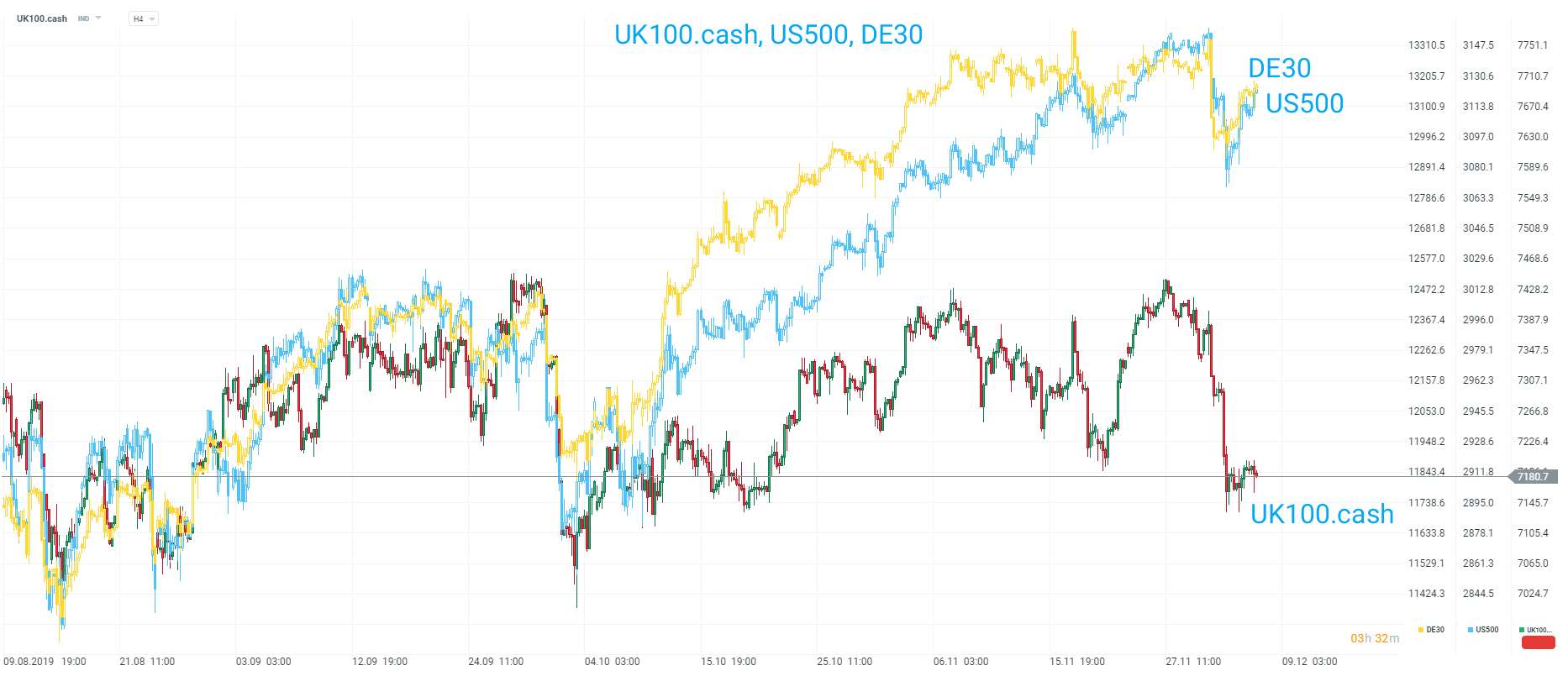

Global stocks are looking to regain their footing after a rocky start to the week with European bourses recouping some of their losses and US futures pointing to an open above Tuesday’s highs. However, as has been a constant theme in recent months the leading UK benchmark continues to lag with the FTSE 100 pretty much flat on the day. The further appreciation of the pound is providing a headwind for UK blue-chips and the FTSE remains not far from its lowest level in 6 weeks.

Stocks in the UK continue to lag behind their peers with the rising pound capping an attempted recovery in the FTSE. Source: xStation

Stocks in the UK continue to lag behind their peers with the rising pound capping an attempted recovery in the FTSE. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.