US labor market data came in poorly. Despite expectations for a reading of around 75,000, the change in employment was ultimately 22,000. The July data was slightly revised upwards, but the net two-month change was already negative. This indicates that the labor market is in increasingly poor condition. The unemployment rate rose as expected to 4.3% year-on-year, while wage dynamics slowed to 3.7% year-on-year.

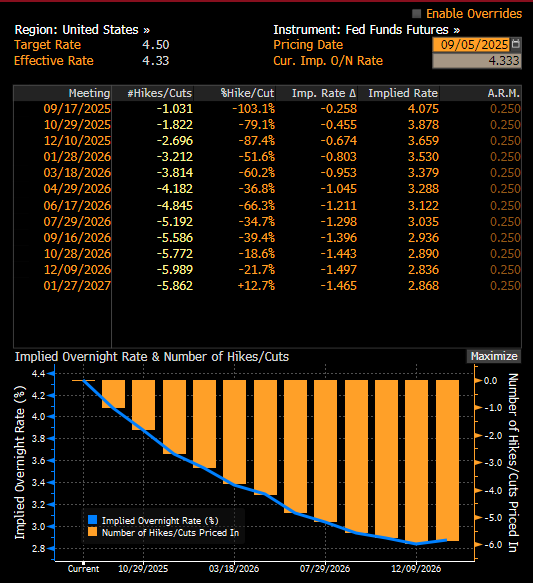

This data clearly suggests that the Fed must cut interest rates at its September meeting. Even if August inflation surprises with a higher reading, it is important to remember that the Fed has a dual mandate: price stability and maximum employment. In his last speech, Jerome Powell indicated that the labor market has clearly weakened, which determines a possible adjustment to monetary policy. Nevertheless, the current data may suggest that the Fed is already late with cuts and that a significant economic slowdown could occur, necessitating a deeper cut. A September rate cut is currently priced in at 100%.

September cut is almost certain and the market is pricing nearly 3 cuts this year. Source: Bloomberg Finance LP

Lower interest rates and increased risk of a slowdown or recession are good news for gold, which is a safe-haven asset. Gold is up around 1% today, testing the area of $3,580 per ounce. The $3,600 level is reinforced by the 127.2 Fibonacci retracement of the last major downward wave. Support for gold in the event of a correction is at $3,500 and $3,430 per ounce.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.