The CPI report surprised with slightly higher readings than expected. Core inflation rose for the second consecutive month by 0.4% m/m against expectations of 0.3% m/m. For inflation, above all, a further large contribution comes from the rental equivalent side. In overall inflation, fuel prices and transport prices are responsible for the increase. Does today's report change the outlook for interest rates in the US?

The report certainly does not indicate a need for an interest rate cut now. March is ruled out, while the May deadline is clearly moving away. For a May cut, we would need to see data showing a clear reduction in economic activity and very weak labour market data. It still seems that the base case scenario is for a cut in June.

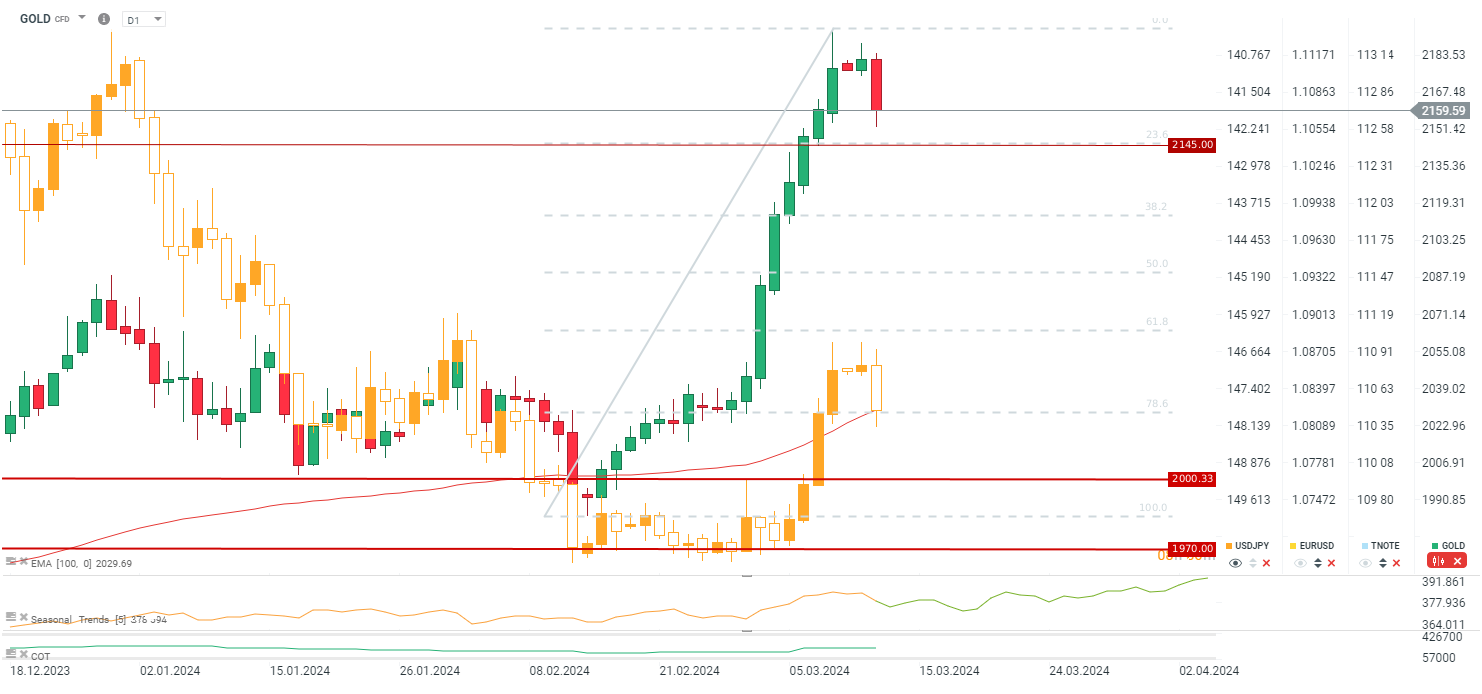

In response, we are seeing a rebound in yield and as trengthening of the dollar with the EURUSD falling around the 1.0900 level. Gold is also losing heavily, above 1% and testing the area of USD 2160 per ounce. The key short-term support is around the level of USD 2145 per ounce.

Source: xStation5

Economic Calendar - All Eyes on NFP (06.03.2026)

Morning Wrap - Oil price is still elevated (07.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Markets attempt to rally on positive news from Iran

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.