Precious metals are gaining, supported by the US consumer price inflation reading, which came in line with forecasts, while the y/y growth rate of core CPI indicated 3.2% y/y vs. 3.3% forecasts. The data, while essentially mixed provided markets with considerable relief and lifted valuations of assets negatively correlated with the dollar. Yields on 10-year bonds fall to 4.66%, while the USDIDX dollar index loses 0.5%. In the wake of rising market demand for bullion, GOLD gains nearly 0.5% and SILVER gains nearly 1.8% to around $30.5 per ounce.

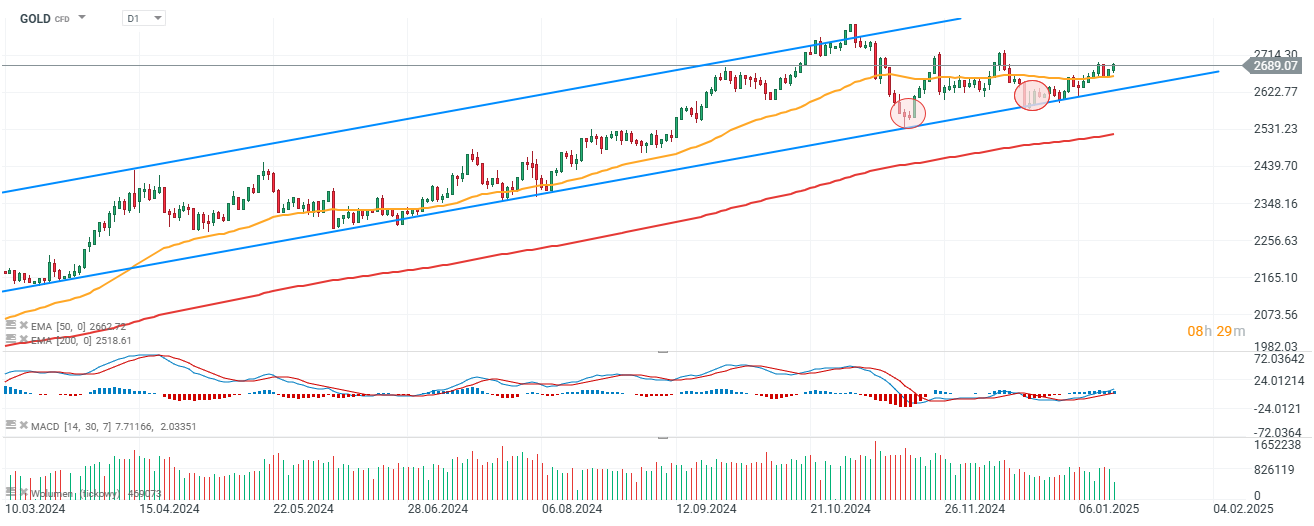

GOLD (D1 interval)

Gold maintains an upward trend and has recently respected the lower limit of the uptrend structure twice; while drawing a potentially bullish formation of two increasingly higher lows. Historical peaks are located at the level of $2,800 per ounce.

Source: xStation5

SILVER (D1 interval)

Silver has held support in the form of the EMA200 (red line) and is returning to growth, preparing for a test of the EMA50 and EMA100; both averages run around $30.7 per ounce.

Source: xStation5

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌

The Week Ahead

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.