Since the beginning of November, gold has been moving in a strong upward trend. Last week there was a breakthrough of a key resistance zone, but after the weekend we are seeing an attempted correction. Is this a temporary pause or perhaps the end of the strong uptrend on this precious metal?

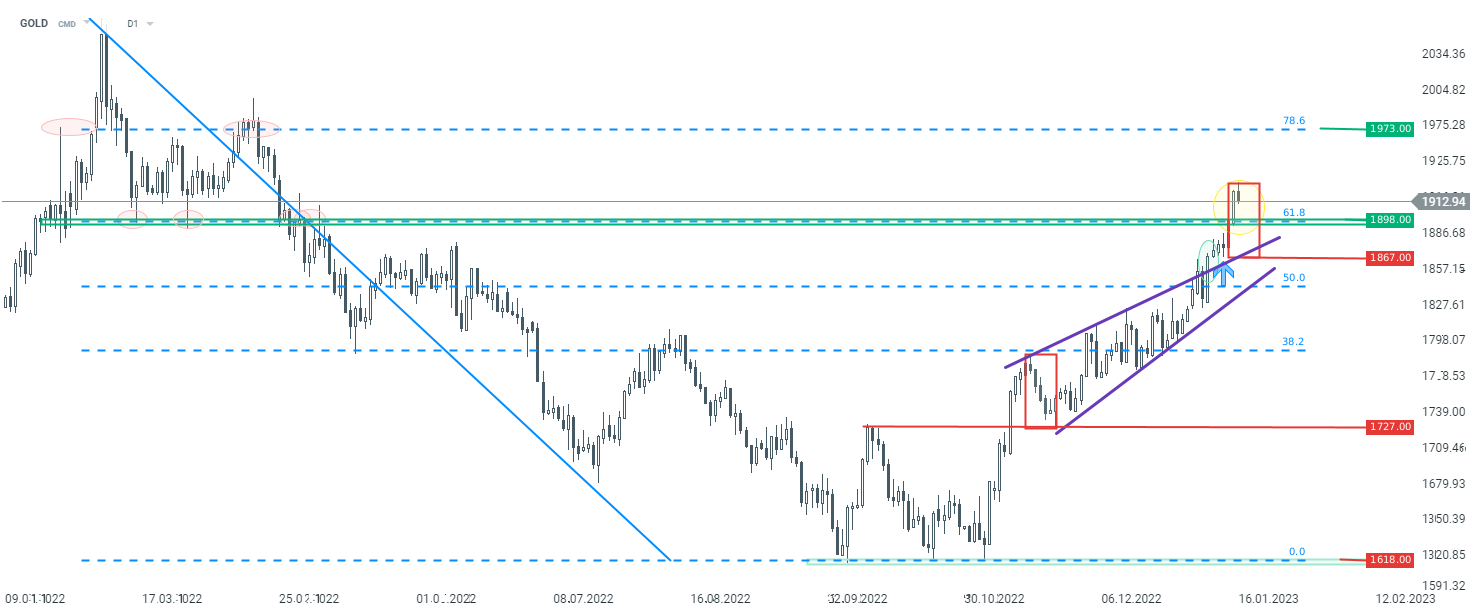

Looking at the daily chart, for the time being, there are no signals coming from technical analysis that could speak of a change in sentiment. On Friday, the price broke through with momentum above the key resistance zone in the $1898 area, which resulted from previous price reactions and the 61.8% Fibonacci retracement, determined by the entire downward wave, counting from the peaks of March 2022. The price's persistence above support at $1898 thus confirms that sentiment remains bullish. As long as the price remains above, an attack on the next resistance is not ruled out, which falls at the next Fibonacci retracement - 78.6% - $1973.

GOLD interval D1. Source: xStation5

GOLD interval D1. Source: xStation5

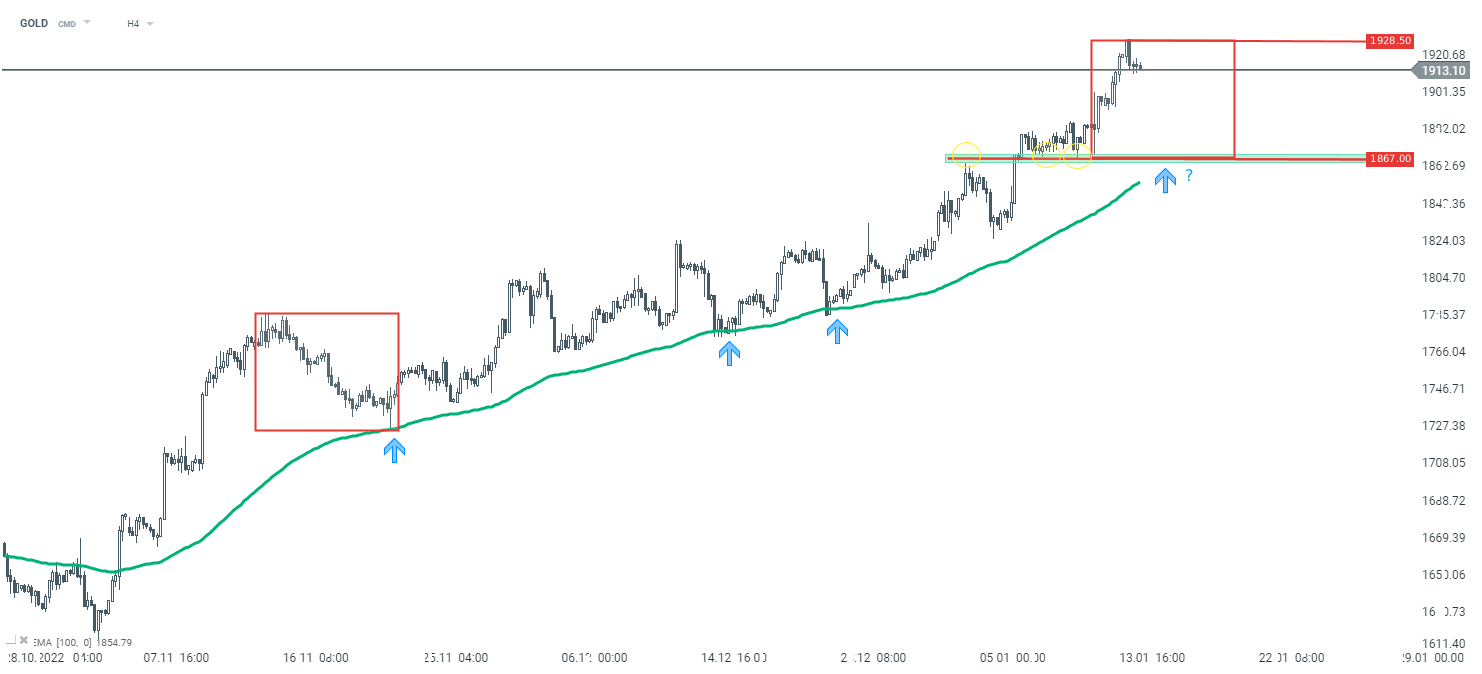

As for the lower time frame - H4, the dominance of buyers is also evident. The recent upward movement was made virtually without major corrections. Currently, in case of a deepening of the downward correction, we should pay attention to the support in the area of $1867, where the lower limit of the 1:1 system is located, confirmed by the average of the EMA 100, which has also acted as support in the past. As long as the price does not fall below, the base scenario is further northward movement. Only the negation of the 1:1 system and the average can change the balance of power on the chart.

GOLD interval H4. Source: xStation5

GOLD interval H4. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.