Gold, as well as other precious metals, are trading higher today. GOLD trades 0.6% higher on the day while SILVER rallies 1.6% and PALLADIUM surges 2.1%. Platinum is a laggard within the group with a 0.9% drop at press time.

While current gains are quite decent, it should be said that precious metals have pulled back from daily highs. GOLD traded as high as $2,078 per ounce during an overnight flash crash on WTI market, reaching the highest level on the record. However, those gains were quickly erased and gold traded in a rather wide range of $2,030-2,060 later on. There is a number of reasons behind solid performance of precious metals with main ones being:

- US banking turmoil - a flight-for-safety can be spotted on the markets as problems of US regional banks have been reignited

- PacWest Bancorp and Western Alliance are rumored to be next in-line to collapse after SVB, First Signature and First Republic

- FOMC strongly hinted that rate hike cycle in the United States may be in for a pause after yesterday's 25 basis point hike

- European Central Bank delivered a 25 bp rate hike today and ruled out that it is about to pause. However, wording of the statement was change and no longer strongly hints at need of additional rate hikes

- US dollar is on the back foot with USD index (USDIDX) dropping more than 1% over the past two days

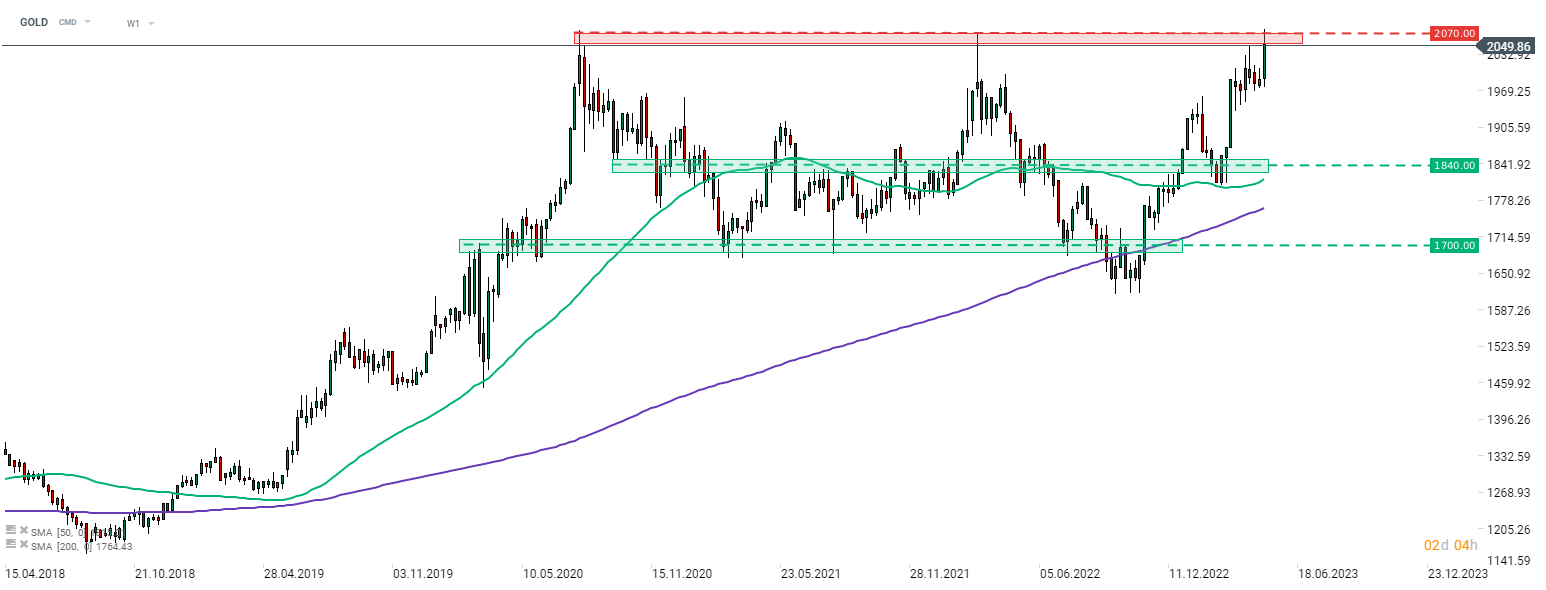

Taking a look at GOLD at W1 interval, we can see that price tested an all-time high area above $2,070 mark and even briefly managed to trade above August 2020 highs. However, looking at a lower time frame (H1), we can see that a double top has been painted in the $2,059 area. Neckline of the pattern can be found in the $2,032 area and should we see a break below it, textbook range of a downside breakout points to a possible drop to as low as $2,005 per ounce. Nevertheless, should more worrying news from US banking sector surface, gold could benefit from safe haven bids and once again looks towards $2,070 area.

GOLD at W1 interval. Source: xStation5

GOLD at W1 interval. Source: xStation5

GOLD at H1 interval. Source: xStation5

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.