The previous meeting of the Federal Reserve led to a significant strengthening of the dollar. This was related to the new Fed macroeconomic projections, in particular interest rate expectations. The dot chart showed that the median for 2023 assumes two interest rate hikes. Despite such a change, the position of the main representatives of the Fed, and above all Jerome Powell, remains unchanged - the Fed is not preparing for a quick change of monetary policy.

Does high inflation change the situation?

Of course, new inflation data have appeared since the last decision. CPI inflation is significantly above 5.0%, while core inflation is at the level of 4.5% - the highest in 30 years. The last time such high inflation was recorded in the US, interest rates were much higher! Now, however, the situation is completely different. The main goal of the Fed is to improve the situation in the labor market, in fact to restore the situation before the pandemic. Interestingly, the newly opened jobs (JOLTS report) still show a record number of available jobs - over 9 million.

Powell should theoretically explain the Fed's current stance on high inflation, but he already did so during the last Congressional hearing. In view of his recent statements, we should not expect a change.

Coronavirus and growing disagreement among Fed members

The recent rising number of coronavirus cases across the world and in the US justifies a dovish monetary stance. It will be hard for a strong dovish move, such as in the case of the ECB, but emphasizing the need for dovish policy may be enough to weaken the dollar.

On the other hand, we have an increasing divergence of opinion among Fed members, as shown by the previous dot chart. This time the forecasts will not be published, so only the minutes of today's meeting will show whether we are dealing with a lack of consensus. Of course, any signals from Powell that the discussion about reduction of the QE program is looming should be positive for the dollar.

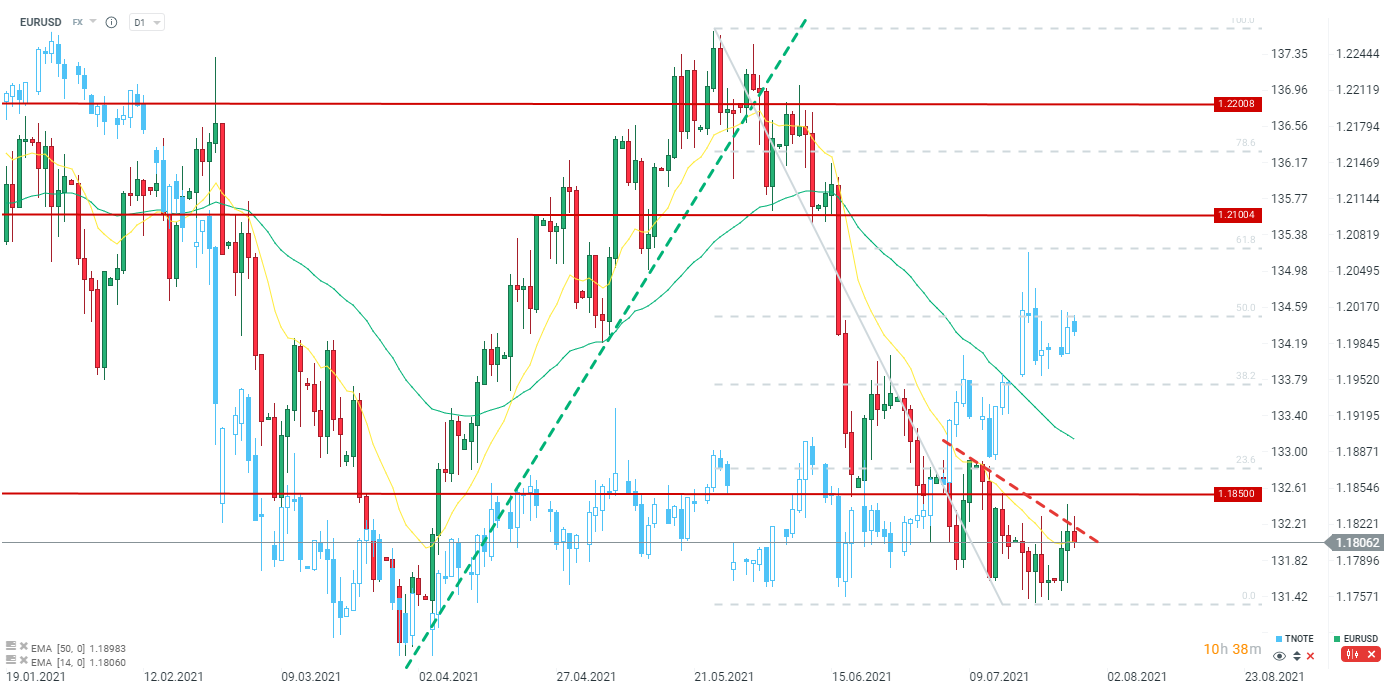

EURUSD has been testing the downward trend line since yesterday. Potential break higher may signal the end of the downward trend, especially that since the beginning of July we have seen a decline in the dollar's appreciation rate (which coincides with a decline in yields - rising TNOTE). On the other hand, if there are any signals indicating a reduction in the pace of asset purchases, then the downward movement may accelerate towards the 1.1700 level which acts as the nearest medium-term support. Source: xStation5

EURUSD has been testing the downward trend line since yesterday. Potential break higher may signal the end of the downward trend, especially that since the beginning of July we have seen a decline in the dollar's appreciation rate (which coincides with a decline in yields - rising TNOTE). On the other hand, if there are any signals indicating a reduction in the pace of asset purchases, then the downward movement may accelerate towards the 1.1700 level which acts as the nearest medium-term support. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.