Lockdowns in China and the Russia-Ukraine war remain the key downward risks of coffee demand. A recent report forecasts that the demand for coffee will decline by 25% and 50% in Russia and Ukraine respectively. Moreover, it predicts a shift from the recorded deficit of 5.1 million bags in the 2021/22 season to a surplus of 1.7 million bags in 2022/23. The expected surge in supply has driven prices down in the beginning of this new week. Eased concerns over frost in Brazil have also curbed coffee price gains. Investors were concerned that the below-average temperatures will result in intense crop damage.

Let's see if the Ichimoku analysis confirms these bearish fundamentals.

Ichimoku analysis :

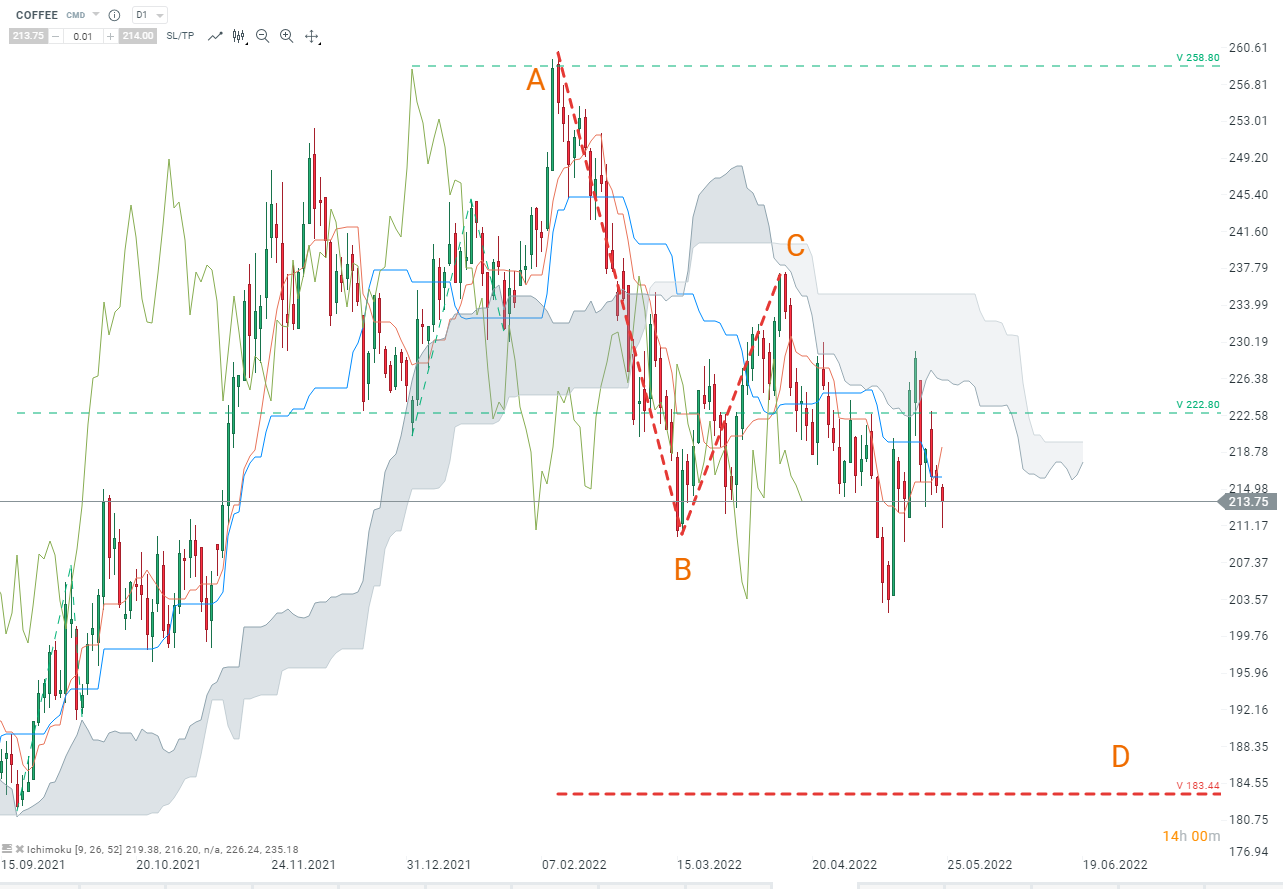

As can be seen, the Ichimoku daily cloud has acted as resistance to every attempt at a bullish recovery. The highs and lows are getting lower and lower, confirming the ongoing downtrend. Moreover, a further break of the support at 210 (point B), could lead to an acceleration of the decline towards the Hosoda V projection at 183.50.

Therefore, if the psychological level at 200 is breached, there is a good chance that coffee prices will confirm the aforementioned Hosoda projection.

COFFEE, D1 interval, Source : xStation5

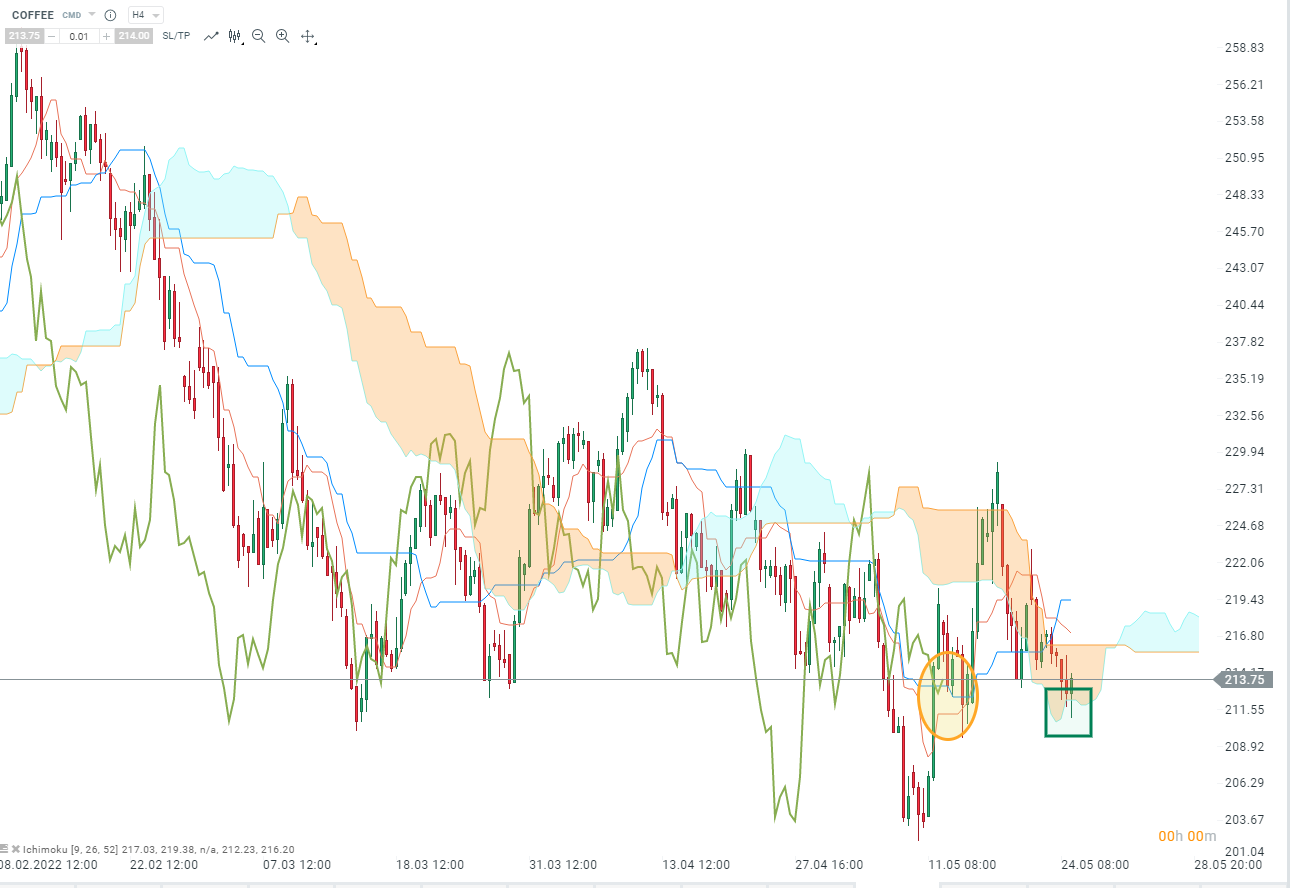

When we take a look at the H4 chart, we can see that coffee prices are about to give a sell signal. Indeed, prices are about to break out from the bottom of the cloud (green box) and this sell signal could be validated by the lagging span, which is also about to cross a last obstacle (yellow ellipse). If this signal occurs and is validated by the lagging span, the bearish scenario we discussed above would be the base scenario.

On the other hand, if the bulls regain control of the market and prices manage to break out of the top of the cloud at 216.25, they will have to tackle the resistance at 220.

COFFEE, h4 interval, Source : xStation5

COFFEE, h4 interval, Source : xStation5

Reda Aboutika, XTB France

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

Three markets to watch next week (09.02.2026)

Market update: recovery takes hold, but investors remain on edge

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.