Meta Platforms' stock has been the biggest disappointment of all US technology companies this year, enjoying a capitalization of more than $1 trillion in 2021. Meta has performed surprisingly poorly and is in the gray end of the S&P500 index ranking 5th from the bottom in terms of % annual change in capitalization, from which it has evaporated this year ... nearly 60%:

- Investors are unsure whether the Metaverse trend announced by Zuckerberg in the fall of 2021 will pay off for the company. In some interviews, Zuckerberg has suggested that the Metaverse is an unavoidable path for the company's growth, one that must be taken even at the cost of massive capital expenditures and slowing revenues. Positive references to the Metaverse have been made in the past by the world's largest asset management fund, BlackRock, among others, describing the implementation of digital worlds as only a matter of time in its analytical report 'Step into the Metaverse';

- In Q2, the division responsible for the Metaverse i.e. Reality Labs generated $452 million in revenue and lost $2.8 billion. The division accounted for only 1.5% of the company's total revenue but enjoys the largest amount of funding. According to Zuckerberg, Metaverse products will not have a key impact on the company's business until early in the next decade;

- Oculus VR headsets, which are currently the primary virtual reality tool, enjoy great user reviews and dominate the global VR market. At the same time, their high price and still small number of developed games may prove to be a problem in an environment of rising inflation and a decelerating economy. A positive sign, however, is that the Met already has technology that can transport users into a virtual world that is increasingly realistic. For Zuckerberg, however, this is still not enough; the company dreams of enabling the full sensory experience in virtual worlds, making them even more immersive;

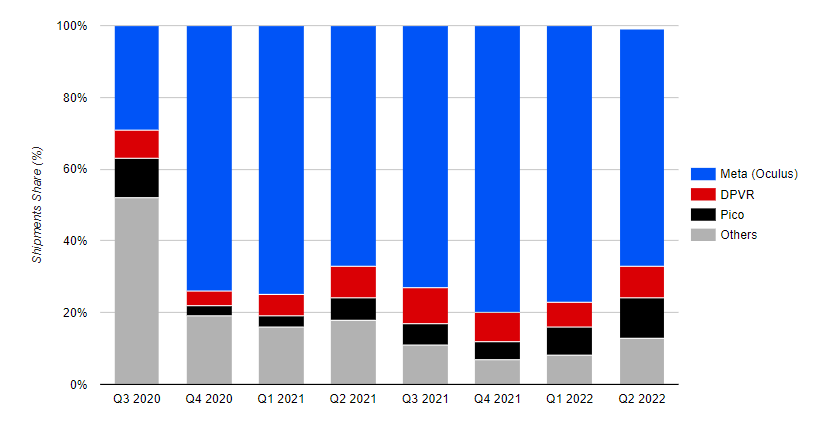

Meta Platforms' share of the global virtual reality headset market has been increasing since 2020; in Q2 2022, Oculus accounted for roughly 70% of the global VR headset market. Source: CounterPoint Research

Meta Platforms' share of the global virtual reality headset market has been increasing since 2020; in Q2 2022, Oculus accounted for roughly 70% of the global VR headset market. Source: CounterPoint Research

- At the beginning of 2019, the company suffered reputational damage due to the 'Cambridge Analytic' privacy scandal, Facebook was also harmed by the conclusions of former employee Frances Haugen according to which the company had knowledge of the harmful effects of apps on users, including children, but decided not to change anything. Some US senators compared the company's activities to 'Big Tobacco' concerns. Also riding the wave of negative sentiment was the Metaverse trend pushed by Zuckerberg, which some critics say is another step in the wrong direction for society. The name change was one of the marketing elements of the company, which wants to free itself from its at times controversial past'. So far, Facebook has shown that it can 'prove' a product in spite of analysts' predictions and criticism, and people continue to use the company's services more and more. Since the beginning of 2020, another 300 million users have joined Facebook, with another 400 million joining Instagram. The nearly 3 billion people concentrated in Meta's apps still represent a powerful base for potential revenue;

- The company's IPO in 2012 was painful for investors after Wall Street became skeptical of Facebook's plans to move the PC experience to the world of mobile phones. The app business, however, turned out to be a hit, and by the end of 2013 investors had already begun buying the company's shares in large numbers. Does the same await Metaverse and the transfer of the world from mobile apps to virtual reality? If Zuckerberg and his team succeed in implementing the Metaverse concept and building a business model, the current stock price could turn out to be the 'bargain of the decade' however, the massive number of unknowns still narrows the field of view of investors, and maintaining an unprofitable business can be especially painful during high interest rates. Recall, however, the cover of Barron's financial magazine in 2012, whose headline read "Facebook is worth $15." Less than four years later, the stock market valued Facebook at $130 per share. And today we're back to those levels.

Meta Platforms (META.US) shares, D1 interval. The chart illustrates a massive sell-off in the company's shares, which can safely be considered the biggest in its history to date. The stock has slipped to levels below the March 2020 panic, erasing all the gains of the 2020 - 2021 period. At the same time, however, the number of people using Meta's main apps, Facebook and Instagram, has increased. The first worrying sign of an impending sell-off was the intersection of the averages of the so-called 'death cross', which occurred in late 2021 and early 2022. The stock is losing nearly 70% from historic highs. Fundamental indicators have cooled dramatically, the C/Z is less than 12 with a C/WK of less than 3. Source: xStation5

Meta Platforms (META.US) shares, D1 interval. The chart illustrates a massive sell-off in the company's shares, which can safely be considered the biggest in its history to date. The stock has slipped to levels below the March 2020 panic, erasing all the gains of the 2020 - 2021 period. At the same time, however, the number of people using Meta's main apps, Facebook and Instagram, has increased. The first worrying sign of an impending sell-off was the intersection of the averages of the so-called 'death cross', which occurred in late 2021 and early 2022. The stock is losing nearly 70% from historic highs. Fundamental indicators have cooled dramatically, the C/Z is less than 12 with a C/WK of less than 3. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

Brent tops $90 per barrel

RyanAir shares under pressure amid Middle East conflict 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.