Micron Technology (MU.US) stock fell more than 4% before the opening bell, as weak revenue guidance overshadowed better than expected earnings figures.

- Company earned an adjusted $2.59 a share on sales of $8.64 billion. Wall Street expected earnings of $2.43 a share on sales of $8.64 billion. Micron earnings jumped 38% YoY while sales rose 16% YoY.

- Company forecasts smartphone sales to be meaningfully lower than previously expected for the rest of 2022, citing a reduction in consumer demand as rising inflation and recession squeeze consumers and corporate spending.

- “The industry demand environment has weakened,” CEO Sanjay Mehrotra said. This was confirmed by yesterday's U.S. personal spending data, which showed decreasing demand of durable goods, from autos to electronics.

- Micron forecasts that PC sales will fall nearly 10% this year, while smartphone shipments could plunge 6%, therefore the company plans to “moderate” its output growth accordingly.

- For the Q4 Micron forecasts diluted earnings per share in the region between $1.43 and $1.83 on revenue of $6.8B and $7.6B. Analyst forecasts had seen EPS at $2.69, with sales of $9.31B.

- Micron’s warning indicates that the chipmaker market is starting to show weakness after two years where the pandemic boosted sales as many companies and schools moved to work from home models.

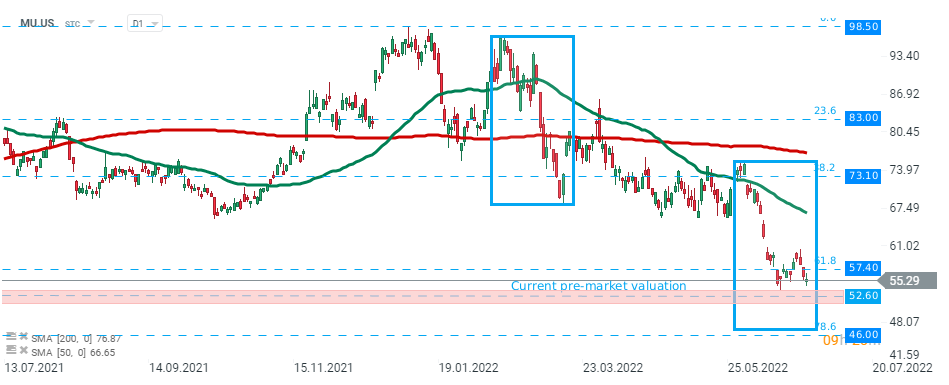

Micron Technology (MU.US) stock fell sharply in premarket and if current sentiment prevails downward move may accelerate towards support zone around $46.00, which is marked with lower limit of the 1:1 structure and 78.6% Fibonacci retracement of the bullish wave started in March 2020. Source: xStation5

Micron Technology (MU.US) stock fell sharply in premarket and if current sentiment prevails downward move may accelerate towards support zone around $46.00, which is marked with lower limit of the 1:1 structure and 78.6% Fibonacci retracement of the bullish wave started in March 2020. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.