- Microsoft acquires 27 percent of OpenAI shares valued at 135 billion dollars, securing access to key AI technologies until 2032.

- OpenAI gains greater market independence through the removal of Azure exclusivity for non-API products and the establishment of a non-profit foundation.

- Tomorrow’s Microsoft Q1 2026 report will serve as a critical indicator of AI market dynamics and the effects of the Microsoft-OpenAI collaboration.

- Microsoft acquires 27 percent of OpenAI shares valued at 135 billion dollars, securing access to key AI technologies until 2032.

- OpenAI gains greater market independence through the removal of Azure exclusivity for non-API products and the establishment of a non-profit foundation.

- Tomorrow’s Microsoft Q1 2026 report will serve as a critical indicator of AI market dynamics and the effects of the Microsoft-OpenAI collaboration.

The restructuring of OpenAI and the transfer of 27 percent of its shares to Microsoft, valued at approximately 135 billion dollars, significantly increases the transparency of the company's capital structure and highlights the strategic importance of its collaboration with the Redmond giant. To date, Microsoft has invested 13.75 billion dollars in OpenAI, and now formally gains access to key artificial intelligence technologies, including post-AGI models, until 2032. Excluding consumer hardware from intellectual property rights gives OpenAI a degree of independence, showing that the partnership is long-term in nature but does not fully limit competition in selected areas. Following the announcement, Microsoft shares rose by about two percent.

The removal of Azure exclusivity for non-API products gives OpenAI greater market freedom and the opportunity to work with other providers, such as Oracle, while maintaining API exclusivity on Azure. The creation of the non-profit OpenAI Foundation, holding shares worth 130 billion dollars, allows the company to continue its scientific and social mission, balancing the increasingly commercial nature of its operations.

Within the broader AI ecosystem, companies like Nvidia, AMD, and Oracle also play key roles. Microsoft's investment in OpenAI is not a one-off strategic move but part of a long-term plan to maintain technological dominance. Control over infrastructure, access to breakthrough models, and OpenAI's operational flexibility provide Microsoft with a competitive edge while simultaneously mitigating risks associated with technology monopolization.

Why this matters today

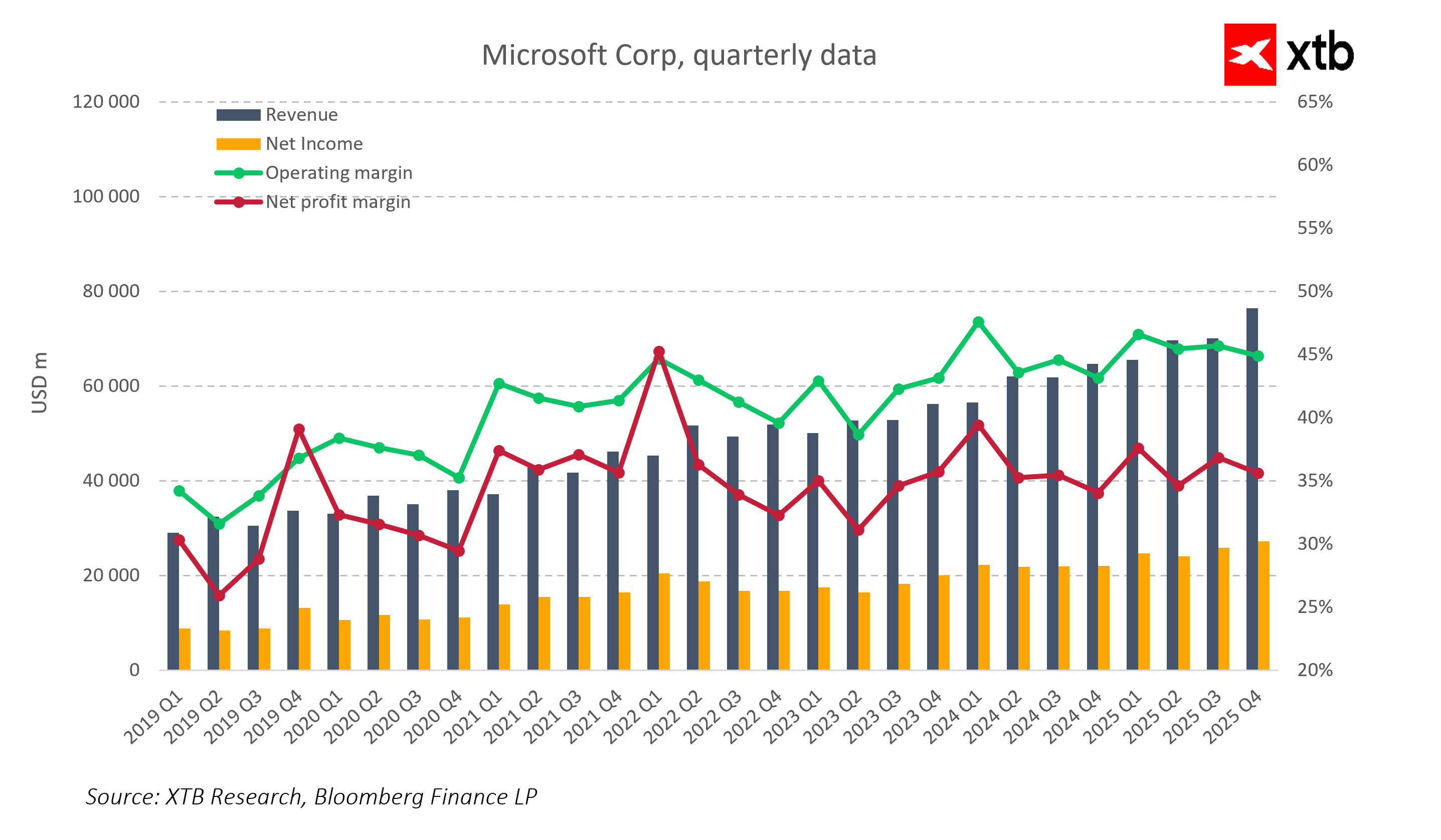

Microsoft is set to release its results for the first quarter of fiscal 2026 tomorrow, which will serve as an important market reference point. Analysts’ consensus forecasts revenue in the range of 74.9 to 75.5 billion dollars and earnings per share around 3.65 dollars, representing year-on-year growth of approximately 10 to 11 percent. The fastest growth is expected in the Intelligent Cloud segment, with Azure projected to increase by 25 to 37 percent. The Productivity and Business Processes segment is expected to grow by 14 percent, while More Personal Computing may see a slight decline, underlining the growing importance of investments in AI and cloud services.

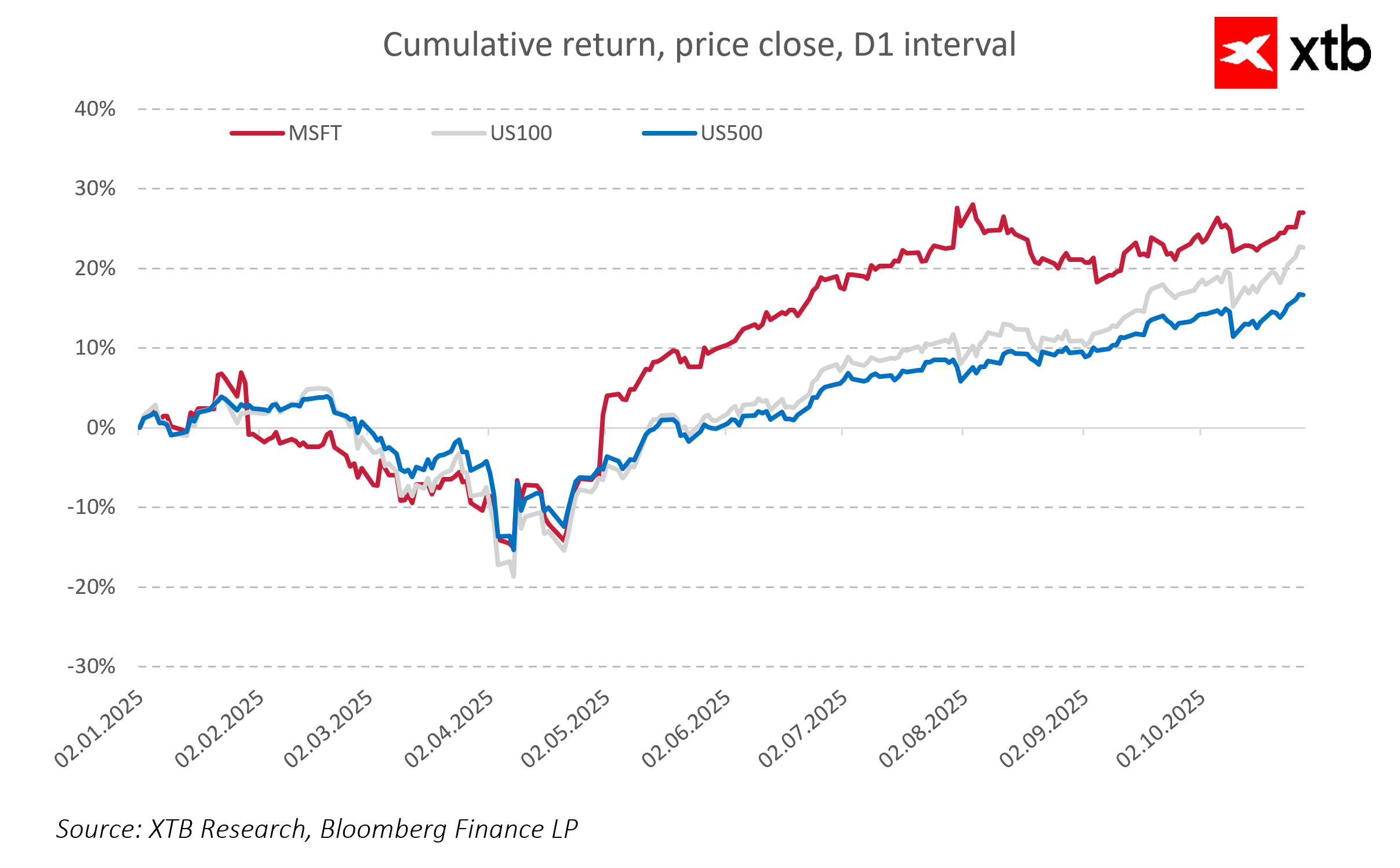

Analysts note that higher capital expenditures could temporarily reduce margins, but in the medium term they support strong growth potential. The average target price for Microsoft shares ranges between 610 and 635 dollars, suggesting the possibility of further upside following the earnings release and a positive market reaction if the company’s leadership in AI and cloud is confirmed.

Implications for investors

The OpenAI restructuring consolidates the strategic partnership with Microsoft while increasing the AI company's operational flexibility. Tomorrow’s report will act as a gauge for AI development pace, real cloud revenue, and Microsoft’s strategy to maintain its competitive edge. The results could significantly shape the dynamics of the technology market in the coming months and influence the valuation of companies heavily invested in AI development.

The combination of long-term strategic partnership, a flexible cooperation model, and the upcoming financial report makes investors closely watch both Microsoft’s results and OpenAI’s next steps, given the growing role of artificial intelligence in the economy and global investment landscape.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.