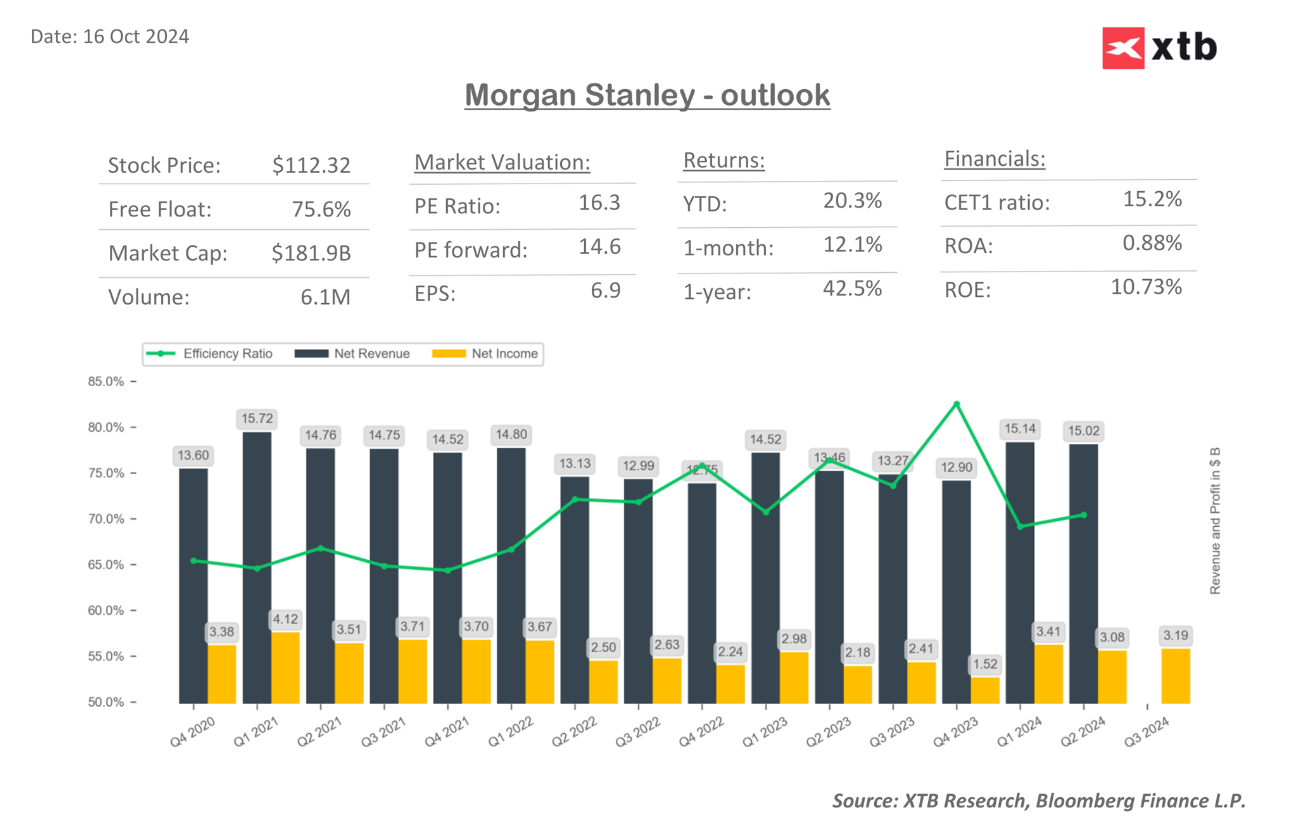

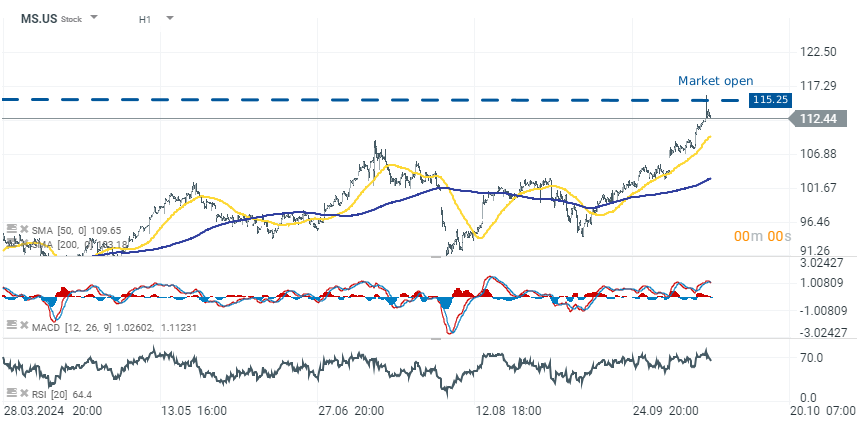

Morgan Stanley gains 2.70% to $115.25 after releasing a better-than-expected Q3 report.

- Earnings per Share (EPS): $1.88, up 32% from $1.42 in Q3 2023.

- Revenue: $15.38 billion, a 16% increase from $13.3 billion in Q3 2023.

- Wealth Management Revenue: $7.27 billion, up 14% year-over-year.

- Investment Banking Revenue: $1.46 billion, a 56% increase from last year.

- Equity Trading Revenue: $3.05 billion, up 21% from $2.52 billion in Q3 2023.

- Fixed Income Revenue: $2 billion, up 3% year-over-year.

- Return on Tangible Common Equity (ROTCE): 17.5%.

Morgan Stanley exceeded analyst expectations for Q3 2024, reporting a 32% rise in profit to $3.2 billion, or $1.88 per share, compared to a $1.58 estimate. Revenue increased by 16% to $15.38 billion, surpassing the $14.41 billion forecast. All key divisions performed well, with Wealth Management revenue up 14% and Investment Banking revenue soaring 56%. Strong trading activity and improved market conditions contributed to robust earnings, and shares rose by 3.8% following the release.

Wealth Management achieved record revenues of $7.3 billion, driven by increased client asset inflows and robust transactional revenues. The firm added $64 billion in net new assets, pushing total client assets to $6 trillion. Institutional Securities reported a 20% year-over-year revenue increase, largely due to strong trading in equities and fixed income.

Investment Management also saw growth, with a 9% increase in revenues to $1.46 billion, driven by higher assets under management (AUM) and positive net flows. CEO Ted Pick highlighted the firm’s capital generation and strong returns with a 17.5% return on tangible common equity (ROTCE) for the quarter.

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.