- US indices booked another session of solid gains. S&P 500 gained 0.69%, Dow Jones moved 0.78% higher, Nasdaq added 0.75% and Russell 2000 jumped 1.07%

- Upbeat moods prevail on Asia markets. Nikkei gained 1.77% while S&P/ASX 200 added 1.17%. Liquidity was limited due to Chinese Lunar New Year

- DAX futures point to a slightly higher opening of the European cash session today

- RBA's Lowe: End of bond purchase program does not mean a cash rate rise is imminent. We're prepared to be patient, don't need to move in lockstep with others. Rise in inflation does not require an immediate response

- New Zealand unemployment rate dropped to 3.2% in Q4 (exp. 3.4%)

- API data showed unexpected draw in oil inventories

- Alphabet Inc (GOOGL.US) stock surged more than 9% in premarket following upbeat quarterly results. EPS: $30.69 vs $27.34 expected. Revenue: $75.33 billion vs $72.17 billion expected. Its board approved plans for a 20-for-1 stock split

- PayPal (PYPL.US) stock plunged nearly 18% in premarket after the company reported mixed Q4 results and provided weak guidance for the next quarter. Earnings per share: $1.11 per share vs. $1.12 per share expected. Revenue: $6.92 billion vs. $6.87 billion expected

- Cryptocurrencies are trading slightly lower today. Bitcoin fell to $38,400 while Ethereum trades above $2,700

- Precious metals trade mixed while oil advances

- AUD and CHF are the best performing major currencies while JPY and CAD lag the most

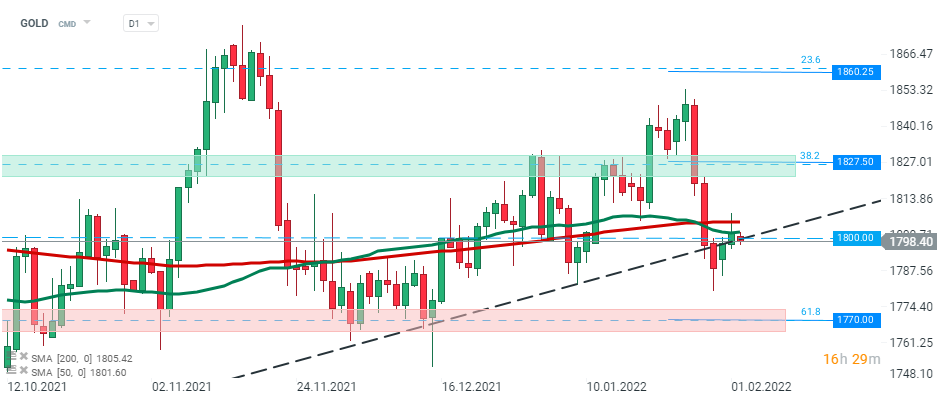

GOLD once again broke below psychological support at $1800. Source: xStation5

GOLD once again broke below psychological support at $1800. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.