-

US indices finished yesterday's trading mixed with major Wall Street indices experiencing rather small moves. S&P 500 added 0.07%, Dow Jones moved 0.12% higher and Nasdaq dropped 0.11%. Small-cap Russell 2000 was an outlier and plunged 1.48%

-

Indices from Asia-Pacific traded mixed today. Nikkei gained 0.3%, S&P/ASX 200 moved 0.5% higher, Nifty 50 added 0.7%, Kospi traded flat and indices from China traded 0.7-1.8% lower

-

DAX futures point to a flat opening of the European cash session

-

Wall Street Journal reports that around two-thirds of local CHinese governments are at risk of breaching unofficial debt limits, with debt exceeding 120% of previous year's income. According to WSJ, this creates risk of delay in investments and lower spending

-

Amos Hochstein, US energy envoy, said that price caps on Russian oil are working well, with Russian crude trading at prices even lower than caps

-

Reserve Bank of Australia delivered a 25 basis point rate hike, in-line with expectations. Main interest rate increased to 3.60% - the highest level since May 2012

-

RBA said that it is trying to bring inflation back to 2-3% range and keep economy on its track but route to soft landing remains limited

-

Statement no longer said that further rates hikes will be needed over the coming months and instead noted that further tightening is likely to be required

-

However, AUD dipped following the release as wording of the statement changed to less hawkish

-

Chinese exports dropped 6.8% YoY in February (exp. -9.4% YoY) while imports were 10.2% YoY lower (exp. -5.5% YoY)

-

Australian exports increased 1.0% MoM while imports were 5.0% MoM higher in January. Trade balance came in at $A11.69 billion (exp. A$12.35 billion)

-

Citigroup expects ECB to deliver 50 bp rate hikes in May and March, pushing deposit rate to around 4%

-

Nomura increase its ECB peak rate forecast from 3.50 to 4.25%

-

Oil is trading flat while US natural gas prices pull back. Precious metals are trading flat

-

CHF and NZD are the best performing major currencies while AUD and CAD lag the most

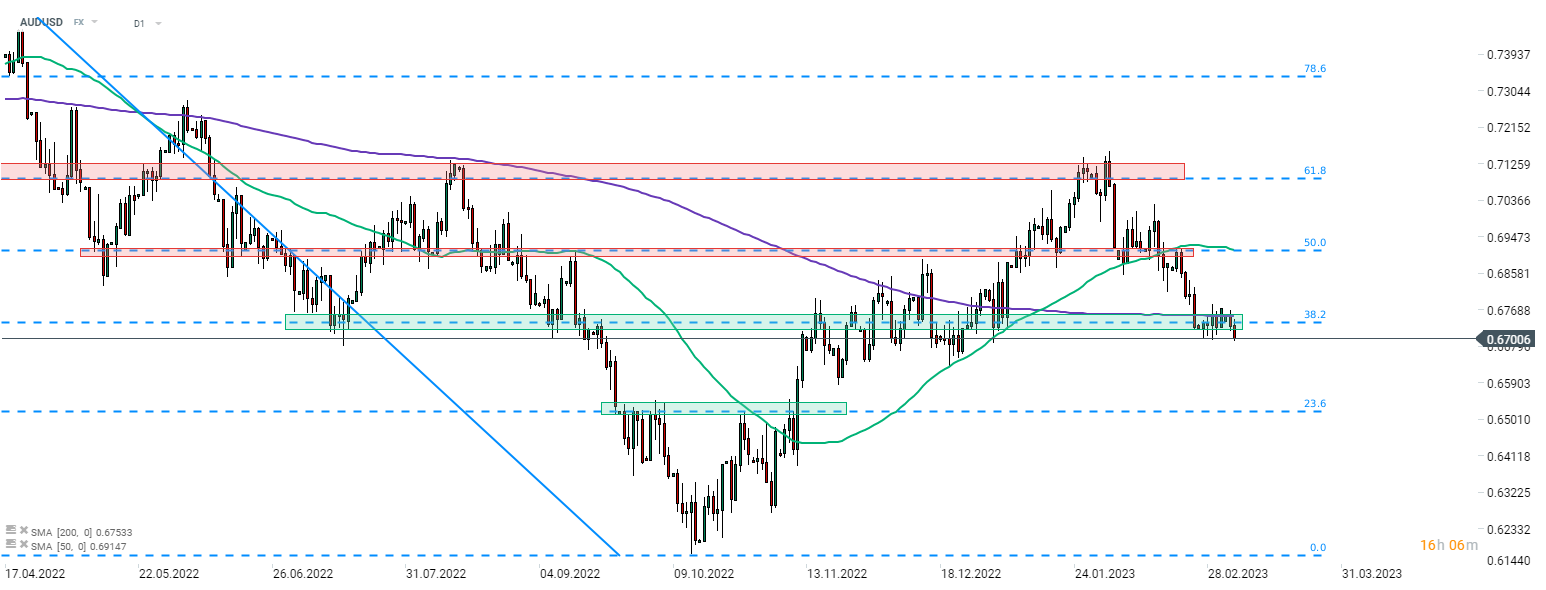

AUDUSD is pulling back as today's RBA statement was seen as less hawkish than the last time. The pair is attempting to make a break below the support zone marked with 200-session moving average (purple line) and a 38.2% retracement of the downward move launched in April-2022. Source: xStation5

AUDUSD is pulling back as today's RBA statement was seen as less hawkish than the last time. The pair is attempting to make a break below the support zone marked with 200-session moving average (purple line) and a 38.2% retracement of the downward move launched in April-2022. Source: xStation5

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.