-

The Asia-Pacific session proceeded moderately without a clear direction. The Japanese market stood out with gains, where the Nikkei 225 increased by 1.50%, thus achieving a return rate of over 6.60% since the beginning of the month.

-

The MSCI index for Asia and the Pacific is down 0,64% today, while MSCI Asia ex Japan, the index is trading around 0.0%.

-

The biggest losses are seen in Chinese shares, where declines reach 0.10-0.20%. Meanwhile, Kospi and S&P ASX 200 are flat.

-

The yields on 10-year U.S. Treasury bonds fell in the first part of the day to 4.49%, and currently stand at 4.50%.

-

Inflation data in China are around expectations. China's PPI was -2.6% year-on-year versus forecasts of -2.7% year-on-year. Meanwhile, the CPI index in September was at -0.2% against a forecast of -0.1% year-on-year.

-

In the Chinese market, investors continue to sell off in the real estate sector. There are new speculations about saving developers struggling with financial problems.

-

There were speculations that Ping An Insurance Group wants to take a stake in Country Garden Holdings, but a spokesperson denied these reports today. Ping An Insurance Group has sold all its shares in Country Garden Holdings Co and does not plan to take over the developer in difficulty.

-

The European stock market is sending mixed signals ahead of today's session with minimal fluctuations. Futures contracts for U.S. stocks are noting a slight decrease.

-

The dollar is strengthening against various currencies and has approached its annual high against the yen at a rate of 151. Meanwhile, EURUSD is rising and remains above 1.07.

-

Oil prices have dropped to the lowest level in three months but have risen slightly in Asian trading. OIL.WTI is quoted at $75.60.

-

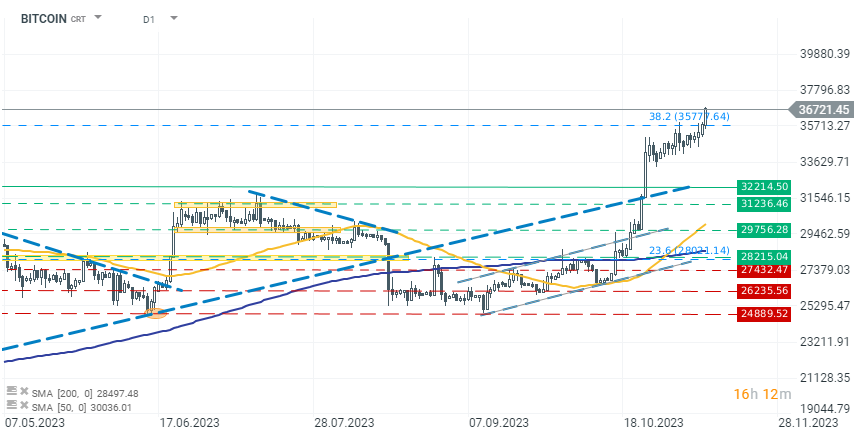

Bitcoin has broken through the resistance at the $36600 level and is gaining 3.20% today. Along with it, the rest of the cryptocurrencies are rising, including altcoins, which in some cases are registering significant increases of 10-20%.

Bitcoin has broken out above $36,000 and is rising to $36,700. The increases in the largest cryptocurrency are driven by speculation of the approaching acceptance of ETFs by the SEC.

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.