- Asian stock markets started the week on a positive note: Hang Seng +1.25%, Shanghai Composite +0.75%, ASX 200 +0.41%. Markets in Japan are closed due to a bank holiday. Optimism was fuelled by improved sentiment following Chinese trade data and the PBOC fixing.

- On Wall Street, futures contracts point to declines following the outbreak of tension surrounding the Fed's independence; investors are shifting into defensive mode ahead of the CPI release and earnings season. The retreat from "risk" is also spreading to Europe, where futures are losing ground.

- Exxon found itself at the centre of a political storm after Trump threatened to block investment in Venezuela following criticism of its "uninvestable" market by the company's CEO.

- Jerome Powell disclosed that he had received subpoenas from the Department of Justice, heightening concerns about the Trump administration's interference in monetary policy.

- Federal prosecutors have launched an investigation into Federal Reserve Chairman Jerome Powell. Criticism centres on the costly renovation of the central bank's headquarters in Washington and the White House's general frustration with the pace of interest rate cuts.

- Senator Thom Tillis announced that he would block Fed nominations until the investigation is complete, increasing institutional uncertainty in the US.

- Geopolitical tensions are rising: the US is planning possible action in Iran, and Europe is strengthening NATO's presence in the Arctic following Trump's verbal threats against Greenland.

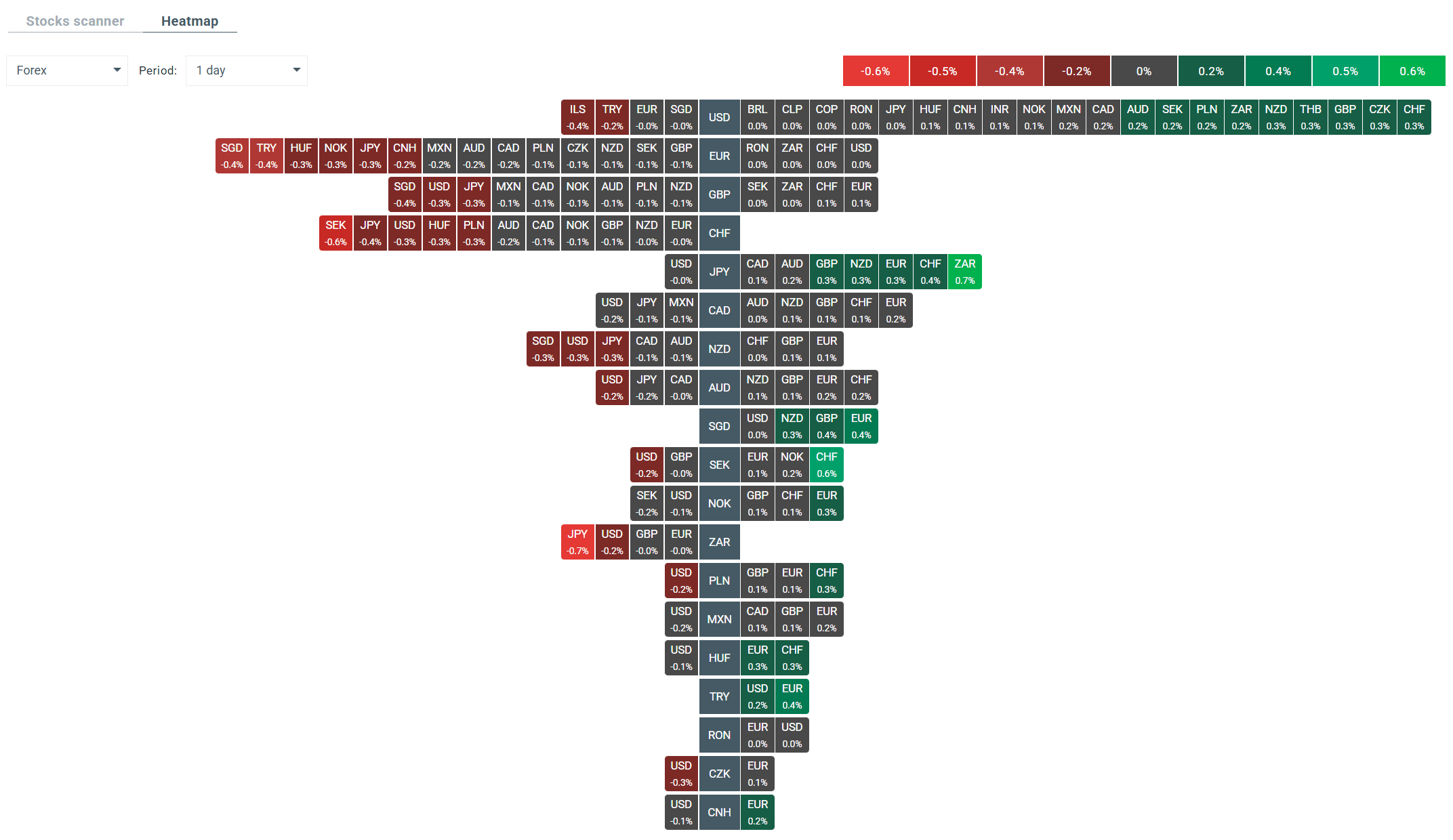

- The US dollar weakened significantly following controversy surrounding the Fed; the USDIDX index fell by approximately 0.2%, and investors increased their positions in gold (+1.4%), silver (+5.6%) and the Swiss franc (USDCHF -0.35%), which are rising sharply today.

- The PBOC set the USD/CNY fixing at 7.0108 against a forecast of 6.9849, signalling a desire to limit the appreciation of the yuan in the face of weak growth and deflation.

- Brent crude oil (OIL) rose in response to unrest in Iran, which could threaten exports of up to 1.9 million barrels per day.

- Silver is leading the gains in precious metals thanks to rising dollar volatility and speculative demand.

- The mood on the crypto market is positive. Bitcoin is currently gaining nearly 1.65% intraday and is trading at close to £92,000, while Ethereum is up 1.59% to £3,158.

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

Daily summary: Markets capitulate under the influence of the Persian Gulf

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.