-

Wall Street indices slumped yesterday following higher-than-expected CPI reading from the United States. S&P 500 dropped 3.94%, Dow Jones slumped 4.32% and Nasdaq plunged 5.16%. Russell 2000 dropped 3.91%

-

Money market prices in a 35% chance of a 100 basis point rate hike at the FOMC meeting next week. Implied policy rate for year's end sits at 4.18%

-

Indices from Asia-Pacific moved lower following a bloodbath on Wall Street. Nikkei dropped 2.6%, S&P/ASX 200 plunged 2.4% and Kospi declined 1.3%. Indices form China traded up to 2.5% lower

-

DAX futures point to a lower opening of the European cash session today

-

Cryptocurrencies also took a hit following yesterday's US CPI reading. Bitcoin dropped over 9% and revisited $20,000 area

-

EURUSD dropped back below parity levels. USDJPY once again tested 145 handle but has pulled back below 144 since

-

Gold plunged after US CPI reading and has been hovering around $1,700 since

-

US President Biden said he is not concerned with yesterday's CPI report

-

Oil plunged along equities yesterday but has managed to recover some ground on media reports saying United States will start restocking strategic reserves once oil prices drops below $80 per barrel

-

Japanese industrial production increased 0.8% MoM in July (exp. 1.0% MoM). Machinery orders for July jumped 5.3% MoM (exp. -0.8% MoM)

-

API report on US oil inventories pointed to a 6.03 million barrel build (exp. -0.2 mb)

-

GBP and JPY are the best performing major currencies while AUD and USD

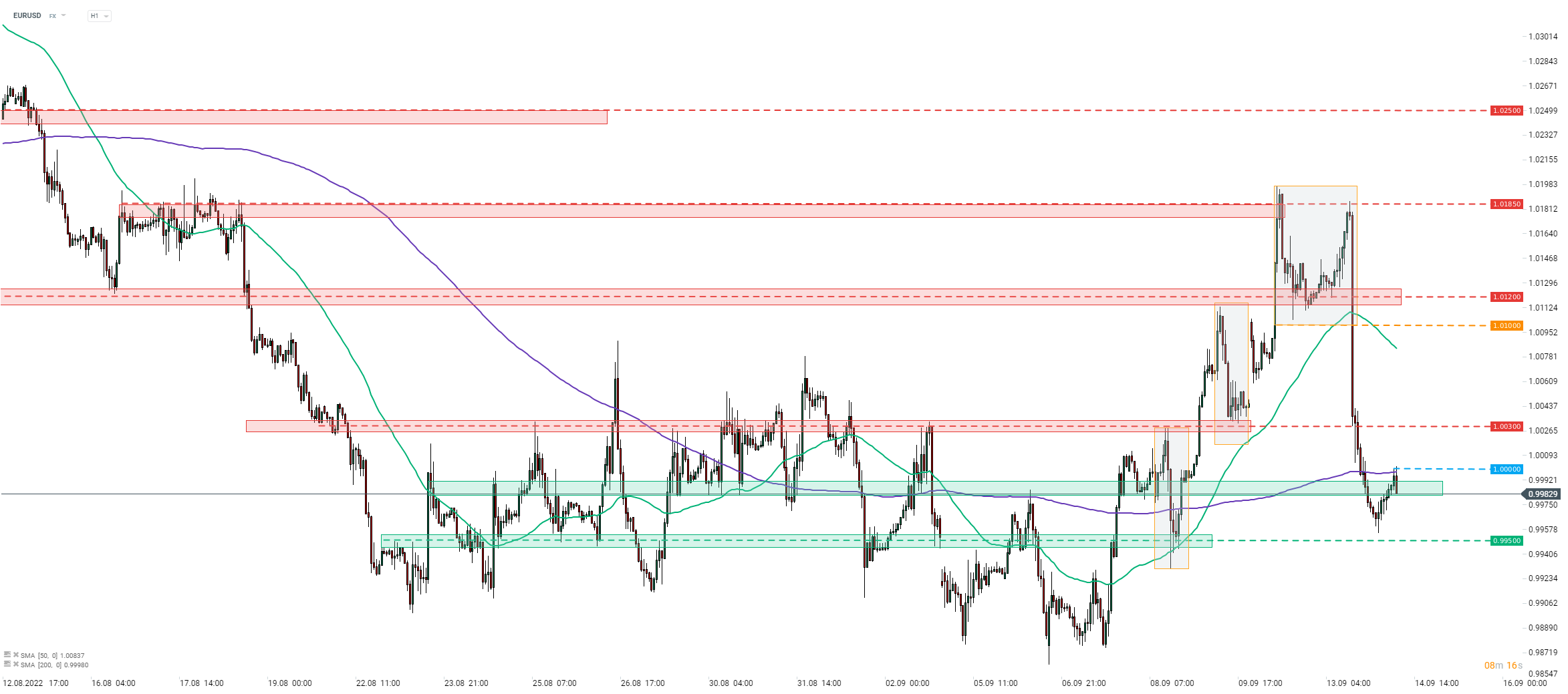

EURUSD slumped following the US CPI release yesterday. The pair broke below the lower limit of the market geometry and continued the move below parity levels. An attempt of breaking above 1.00 handle, marked with 200-hour moving average (purple line), was made this morning but bulls failed to push the pair above. Source: xStation5

EURUSD slumped following the US CPI release yesterday. The pair broke below the lower limit of the market geometry and continued the move below parity levels. An attempt of breaking above 1.00 handle, marked with 200-hour moving average (purple line), was made this morning but bulls failed to push the pair above. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.