- The FOMC decided to increase interest rates by 75bps yesterday, above initial expectations. The main rate is in the range of 1.5-1.75%

- The Fed message was rather hawkish – president Powell stressed the importance of ensuring price stability. The Fed sees the economy as being strong (unlikely to refrain from tightening due to worries of possible slowdown at this point)

- Risk assets rallied in an immediate reaction to the meeting, similar to the 50bp hike in May. S&P500 gained 1.46%, Dow 1% and Nasdaq as much as 2.5% on Thursday

- However, just like in May, this reaction fizzled overnight with futures now pointing lower. DE30 seems to be set up for a lower opening after rallying overnight

- While markets have largely moved past the Ukrainian war, it still rages and the Ukrainian side reports Russian assaults from 9 directions. The focus in on resulting food crisis (major corn and wheat supplies are at risk).

- The ECB held an extraordinary meeting yesterday and started working on measures to address market fragmentation. Markets read this as possible watering down of expected tightening – this helped European stocks and incidentally helped defend 20000/1000 levels on Bitcoin and Ethereum

- In Asia Hong Kong raised rates by 75bp to 2% while Shanghai reopening seems to be taking longer than expected

- Very mixed data prints:

- Japanese May trade close to expectations (exports +15.8% y/y, imports +48.9% y/y)

- Awful GDP Q1 report on GDP -0.2% q/q vs +0.6% expected!

- +60.6k jobs in Australia (+25k expected) but unemployment rate stays at 3.9% (3.8% expected)

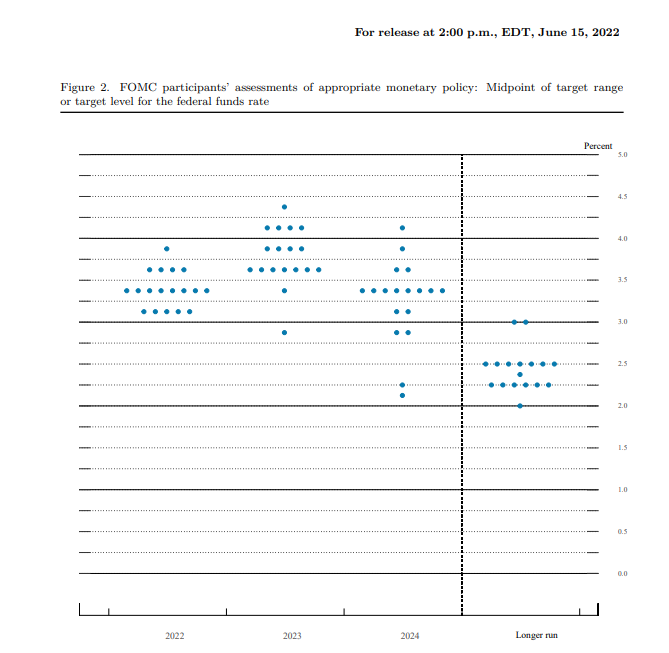

After hiking by 75 bp, the Fed communicates 175 bp moves over the next 4 meetings this year. Source: federalreserve.gov

After hiking by 75 bp, the Fed communicates 175 bp moves over the next 4 meetings this year. Source: federalreserve.gov

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.