-

Asian indices launched a new week higher. Nikkei gained 0.7%, S&P/ASX 200 added 0.3% while indices from China traded 0.4-1.5% higher. Kospi was a laggard, dropping over 1% today

-

DAX futures point to a higher opening of the European cash session today

-

Chinese GDP growth reached 1.6% QoQ (exp. 1.1% QoQ) and 4% YoY (exp. 3.6% YoY)

-

Chinese retail sales increased 1.7% YoY in December (exp. 3.7% YoY), industrial production was 4.3% YoY higher (exp. 3.6% YoY) while urban investments were 4.9% YoY higher (exp. 4.8% YoY)

-

People's Bank of China lowered 1-year medium term lending facility and 7-day reverse repo rate by 10 bps

-

First cases of Omicron infection were detected in Beijing, China just 3 weeks ahead of Winter Olympics

-

Goldman Sachs expects US GDP growth to reach 3.4% in 2022, down from 5-6% in 2021

-

ECB Schnabel said that premature rate hike may halt economic recovery

-

According to data from BitPay, share of Bitcoin in cryptocurrency payments dropped from 92% in 2020 to around 65% in 2021

-

USD and CAD are the best performing major currencies while JPY and CHF lag the most

-

Precious metals trade a touch higher in spite of USD strengthening. Brent and WTI trade around 0.5% higher each

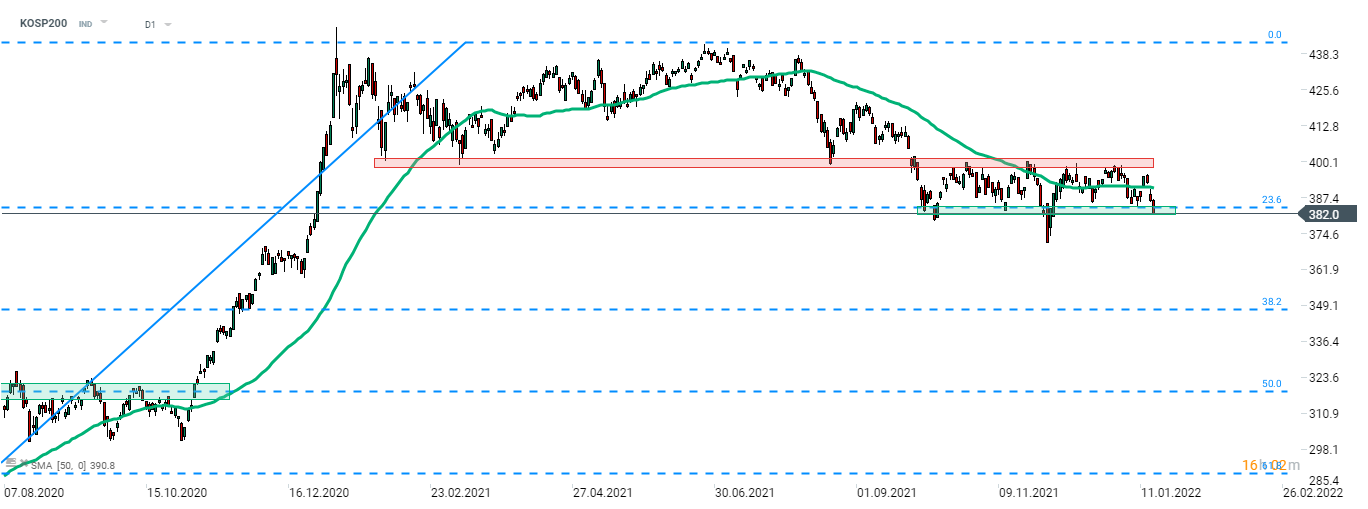

KOSPI (KOSP200) has been top laggard among Asian indices today. The index dropped over 1% and is threatening to break below the support zone at 23.6% retracement of post-pandemic recovery that serves as the lower limit of the current trading range (382 area). Source: xStation5

KOSPI (KOSP200) has been top laggard among Asian indices today. The index dropped over 1% and is threatening to break below the support zone at 23.6% retracement of post-pandemic recovery that serves as the lower limit of the current trading range (382 area). Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.