-

US indices finished yesterday's trading mixed. S&P 500 gained 0.09%, Dow Jones dropped 0.16%, Nasdaq declined 0.11% and Russell 2000 added 0.14%

-

Stocks in Asia traded mostly higher, although the scale of gains was minor. S&P/ASX 200 gained 0.2%, Kospi moved 0.5% higher and indices from China traded up to 0.7% higher. Nikkei lagged and dropped 0.8%

-

DAX futures point to a lower opening of the European cash session

-

Risk-off moods arrived at the markets ahead of the European cash session following reports of tensions in Ukraine increasing

-

Russian media reported that Ukraine government forces have started mortar shelling of Russian-backed rebel groups in Luhansk and Donetsk Oblasts

-

So far reports came from Russian media only and were not confirmed by Ukrainian or Western media

-

Ukraine denied shelling Russian-backed separatists' positions

-

White House said that Russian troop build-up near border with Ukraine continues

-

FOMC minutes showed that Fed sees need for quicker pace of tightening than in 2015

-

Oil prices dropped yesterday in the evening on positive Iran nuclear deal headlines. France said that the deal is just days away

-

Australian employment increased by 12.9k in January (exp. 0k) while the unemployment rate remained unchanged at 4.2% (exp. 4.2%)

-

Japanese exports increased 9.6% YoY in January (exp. 16.5% YoY) while imports were 39.6% YoY higher (exp. 37.0% YoY)

-

Japanese machinery orders increased 3.6% MoM in December (exp. -1.8% MoM)

-

Precious metals gain on increased risk aversion - gold, platinum and palladium trade higher. Silver drops

-

NZD and JPY are the best performing major currencies while EUR and CAD lag the most

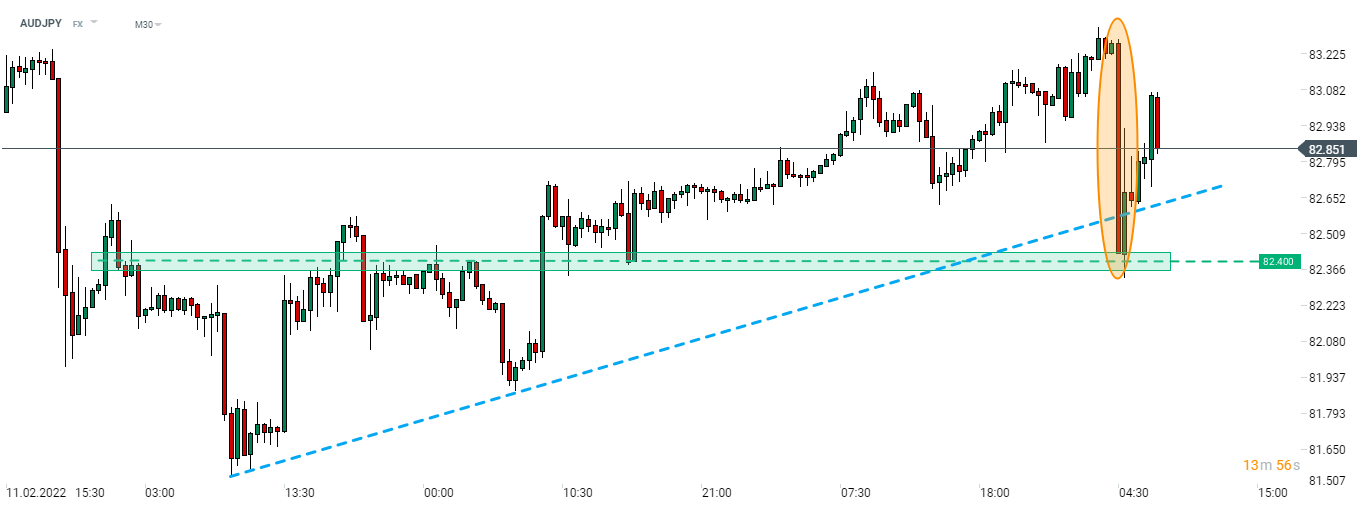

Risk trades took a hit on reports on shooting in eastern part of Ukraine. AUDJPY slumped around 1% on the news (orange circle). While tensions remain, the pair has managed to recover a bulk of losses already. Source: xStation5

Risk trades took a hit on reports on shooting in eastern part of Ukraine. AUDJPY slumped around 1% on the news (orange circle). While tensions remain, the pair has managed to recover a bulk of losses already. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.