-

Asia-Pacific (APAC) markets traded in a weaker mood today, following the momentum of yesterday's US session. Japan's Nikkei 225 is up by 0.56%, the Hang Seng index is down more than 1.10%, S&P/ASX 200 is trading lower by 0.35% and Korea's KOSPI is lower by 0.40%.

-

Stocks and bonds ticked lower across the region on Thursday due to signals of Chinese weakening and potential Fed interest rate hikes.

-

Japan, Australia, China, and South Korea saw decreasing shares, pushing regional equity market prices to March levels, indicating a significant 2-day drop.

-

Hong Kong's Hang Seng index fell, possibly entering a bear market, Tencent's revenue drop impacted Chinese IT stocks amid gloomy news.

-

China's real estate recession might be worse than official figures. Chinese investors protested outside the office of one of the country’s biggest shadow banks, in a rare show of public outrage after the firm skipped payments on dozens of investment products.

-

Oil prices dropped for a fourth day due to Chinese economy concerns and stricter US monetary policy fears.

-

Morgan Stanley downgrades China's 2023 GDP forecast to 4.7% (from 5%) and 2024 prediction to 4.2% (from 4.5%).

-

Australia's Unemployment Rate reaches 3.7%, slightly exceeding the forecast of 3.6%, with a Participation Rate of 66.7%.

-

China intervenes in FX markets to prevent yuan's decline towards its 2007 low.

-

Japan's Total Trade Balance stands at -78.7B, which is a significant deviation from the forecast of 47.85B. The annual export change indicates a decrease of -0.3%, and imports are lower by -13.5% compared to the previous year. Core Machinery Orders show a decrease of -5.8% year on year, which aligns exactly with the forecasts.

-

RBNZ's Governor Orr anticipates a recession as a minimum outcome, envisions a restrictive approach for 1-2 years, attributing uncertainties to guidance.

-

Cryptocurrencies are experiencing further declines as negative sentiment dominates the market. Bitcoin has fallen below $29,000 and is down by 0.30% today. Altcoins have decreased by 5% or more.

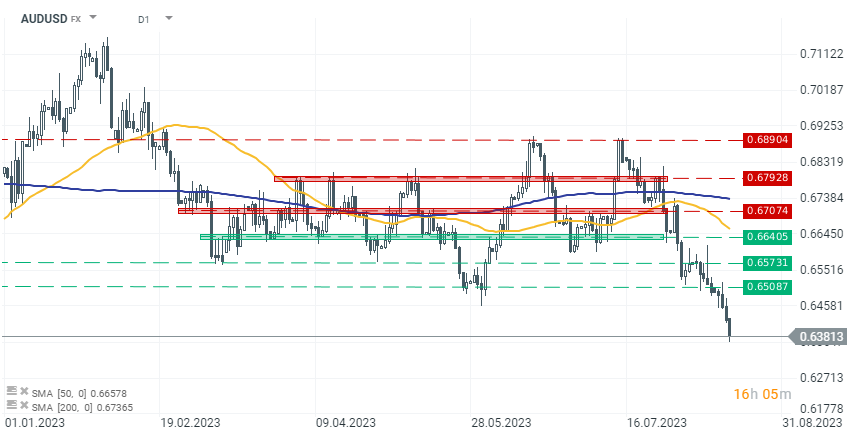

The Australian Dollar deepens its declines after worse-than-expected job market data. The AUDUSD is trading at its lowest level since November 2022.

The Australian Dollar deepens its declines after worse-than-expected job market data. The AUDUSD is trading at its lowest level since November 2022.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.