-

US indices finished yesterday's trading lower as US dollar strengthened following a much better-than-expected housing market data for May

-

S&P 500 and Russell 2000 dropped almost 0.5%, Dow Jones traded 0.7% lower and Nasdaq dropped around 0.2%

-

Indices from Asia-Pacific traded mostly lower today - S&P/ASX 200 dropped 0.4%, Kospi traded 0.8% lower, Nifty 50 traded flat while indices from China traded up to 2% lower. Nikkei was the outperformer with a 0.7% gain

-

DAX futures point to a slightly higher opening of the European cash session today

-

According to US President Biden, China is in position where it desires to resume good relations with the United States

-

BoJ minutes showed that Japanese policymakers still see current monetary policy easing should be maintained and that there was no need to revise yield curve control mechanism

-

Goldman Sachs made upward revision to its stock market forecasts and now expects S&P 500 to reach 4,700 pts mark within the next 12-months

-

Meanwhile, Morgan Stanley is cautious on stock in the second half of 2023, citing fading fiscal support, less liquidity and lower inflation as main concerns

-

Chinese financial media suggest that People's Bank of China may decide on further rate cuts this year

-

ECB Simkus said that he would not be surprised if rates in the euro area were hiked in September

-

ECB Vujcic warned that while Bank will continue to work to bring inflation down, soft landing is not always achievable

-

China extended tax exempts for purchases of New Energy Vehicles (i.e. EVs) until the end of 2025 while taxes in 2026-2027 period will be cut in half

-

Cryptocurrencies trade higher with Bitcoin jumping 2.4%, Dogecoin trading 2.2% higher, Ethereum adding 2% and Ripple moving 1.7% higher

-

Energy commodities attempt to recover from yesterday's losses - oil trades 0.9% higher while US natural gas prices increased 0.2%

-

Precious metals trade mostly lower - silver drops 0.1%, platinum declines 0.3% and gold trades flat

-

NZD and CAD are the best performing major currencies while JPY and CHF lag the most

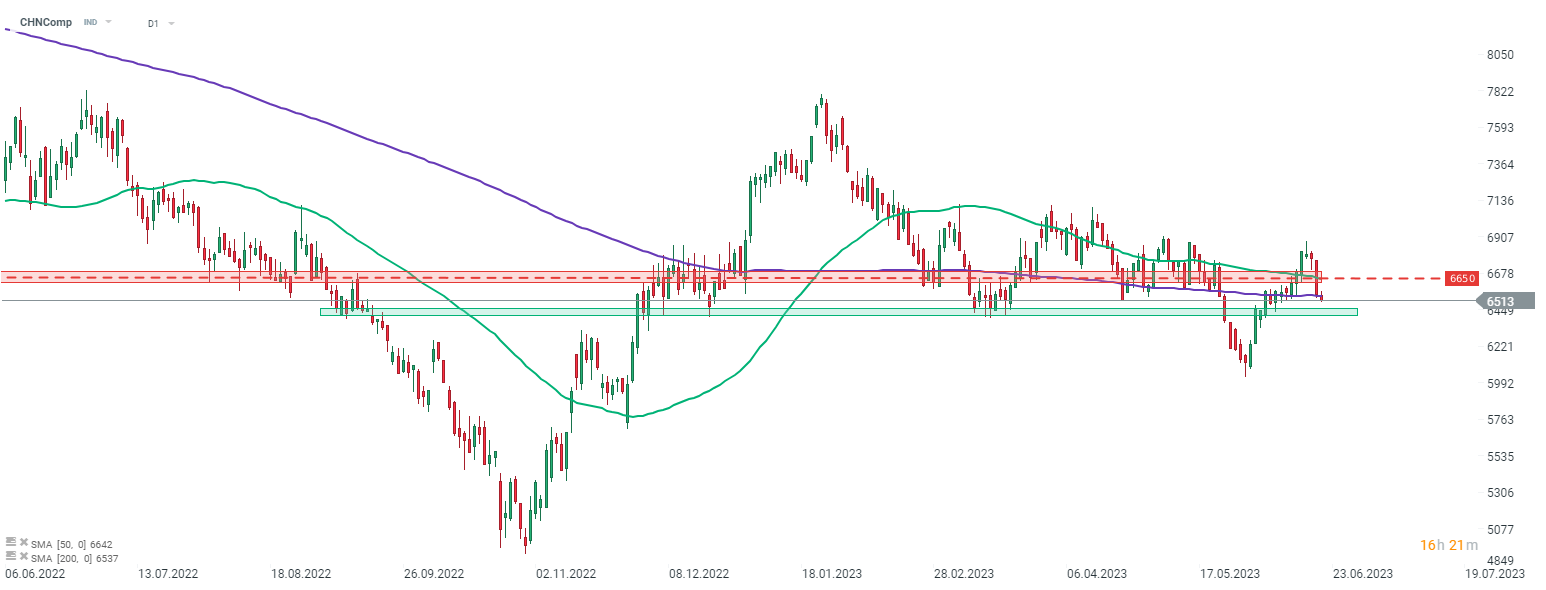

CHNComp is making a break below the 200-session moving average as indices from Asia-Pacific followed US peers lower. Source: xStation5

CHNComp is making a break below the 200-session moving average as indices from Asia-Pacific followed US peers lower. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.