-

US indices managed to recover from early declines and finished yesterday's trading higher. S&P 500 gained 0.10%, Dow Jones moved 0.28% higher and Russell 2000 added 0.54%. Nasdaq finished flat

-

Situation on the markets have calmed a bit since yesterday's BoJ pivot. However, Nikkei remains under pressure with a 0.7% drop while USDJPY holds near the 132.00 mark. Yield on 2-year Japanese bonds climbed into positive territory for the first time since 2015

-

Indices from Asia-Pacific traded mixed. Apart from Nikkei, Kospi also traded lower. S&P/ASX 200 and Nifty 50 gained while indices from China traded mixed

-

DAX futures point to a higher opening of the European cash session

-

International Monetary Fund said that decision to expand YCC band by BoJ was a sensible one given uncertainty around inflation outlook

-

Goldman Sachs sees the possibility of Bank of Japan hiking rates out of negative territory as the next move. ING said that risks remain skewed to the downside for USDJPY. MUFG does not rule out a quick pullback of USDJPY below 120.00 mark

-

White House confirmed earlier media reports that Ukrainian President Zelensky is heading to the United States for in-person talks with US President Biden today. Biden is expected to announce supply of Patriot air-defense systems to Ukraine

-

New Zealand credit card spending dropped 2.6% in November

-

API report pointed to a 3.07 million barrel draw in US oil inventories (exp. -0.2 mb)

-

Cryptocurrencies are trading lower today - Bitcoin drops 0.2%, Ethereum trades 0.3% lower while Dogecoin declines 2.5%

-

Brent and WTI trade around 0.5% higher while US natural gas prices jump over 2.5%

-

Precious metals pull back amid USD strengthening - gold drops 0.2%, silver trades 0.7% lower and platinum declines 0.4%

-

USD and CAD are the best performing major currencies while NZD and JPY lag the most

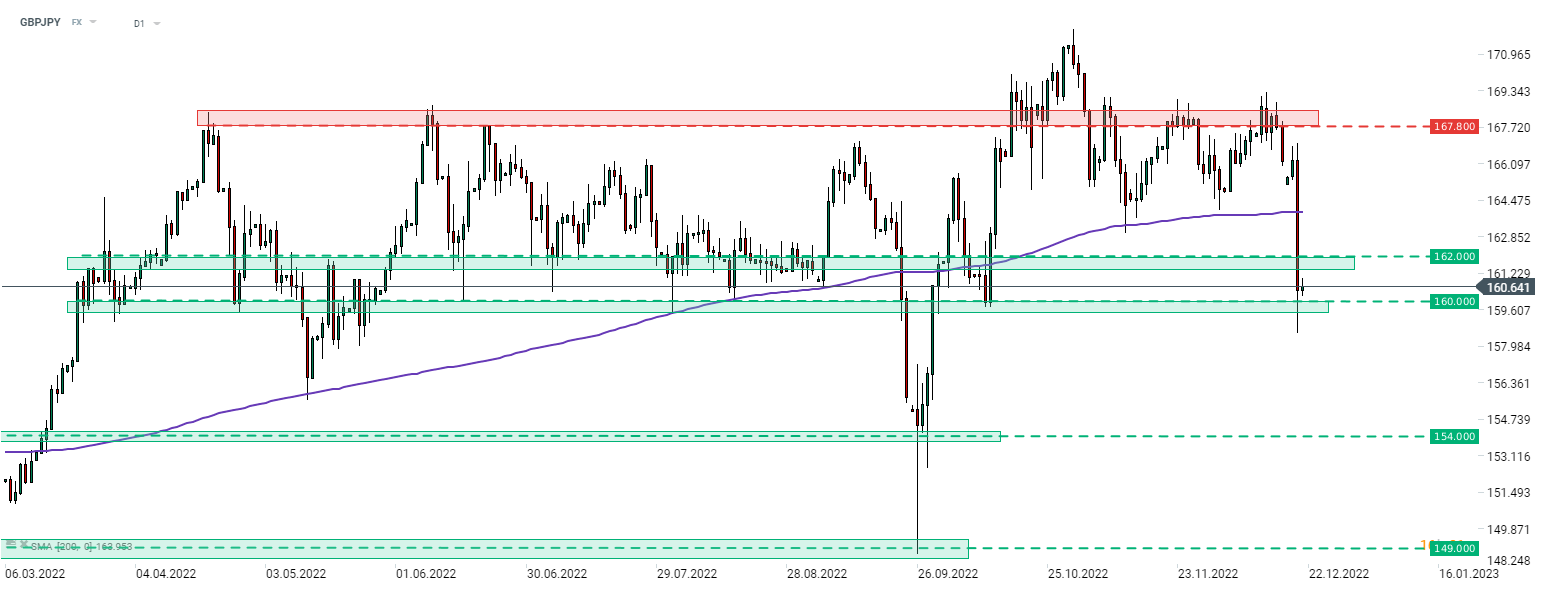

GBPJPY plunged below the lower limit of the short-term trading range after BoJ decision yesterday and continued to drop later on. Pair even traded below 160.00 mark briefly but managed to regain some ground and climb back above this support. Source: xStation5

GBPJPY plunged below the lower limit of the short-term trading range after BoJ decision yesterday and continued to drop later on. Pair even traded below 160.00 mark briefly but managed to regain some ground and climb back above this support. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.