- Wall Street indices finished yesterday's trading higher, even in spite of a downward revision to US Q3 GDP data

- S&P 500 gained 1.03%, Dow Jones moved 0.87% higher and Nasdaq climbed 1.26%. Small-cap Russell 2000 rallied over 1.7%

-

China's new gaming restrictions rattled Asian markets, sending Hong Kong tech stocks tumbling, including Tencent and NetEase. The Hang Seng Technology Index plunged 4%, and Tencent and NetEase sank 16% and 28%, respectively, marking the largest weekly drop in regional equities in over a month.

- Indices from Asia-Pacific traded mixed today - Nikkei, Kospi and S&P/ASX 200 traded flat, Nifty 50 added 0.6%, while indices from China traded slightly lower

- European index futures point to a flat or slightly lower opening of today's cash session for major blue chips indices from the Old Continent

- Bank of Japan minutes from October 2023 meeting showed that BoJ members agreed there is a need to patiently maintain current easy policy and that yield curve control must be sustained to support wage growth

- Japanese CPI inflation slowed from 3.3% to 2.8% YoY in November, while CPI inflation excluding food slowed from 2.9% to 2.5% YoY (exp. 2.5% YoY). Inflation excluding food and energy slowed from 4.0% to 3.8% YoY

- Australian private sector credit increased 0.4% MoM in November. On an annual basis, private sector credit increased 4.7% YoY. Increase was driven primarily by housing and business credit

- Major cryptocurrencies are trading mixed - Bitcoin gains 0.4%, Ethereum trades 0.6% higher, Ripple drops 0.4% and Dogecoin slumps 1.7%

- Brent gains 0.3%, WTI trades 0.6% higher and NATGAS drops 4% with a bulk of the drop coming from contract rollover

- Precious metals are trading lower today - silver and platinum drop 0.2% while palladium trades 0.9% down. Gold is the outperformer with 0.1% gain at press time

- GBP and USD are the best performing major currencies, while AUD and NZD lag the most

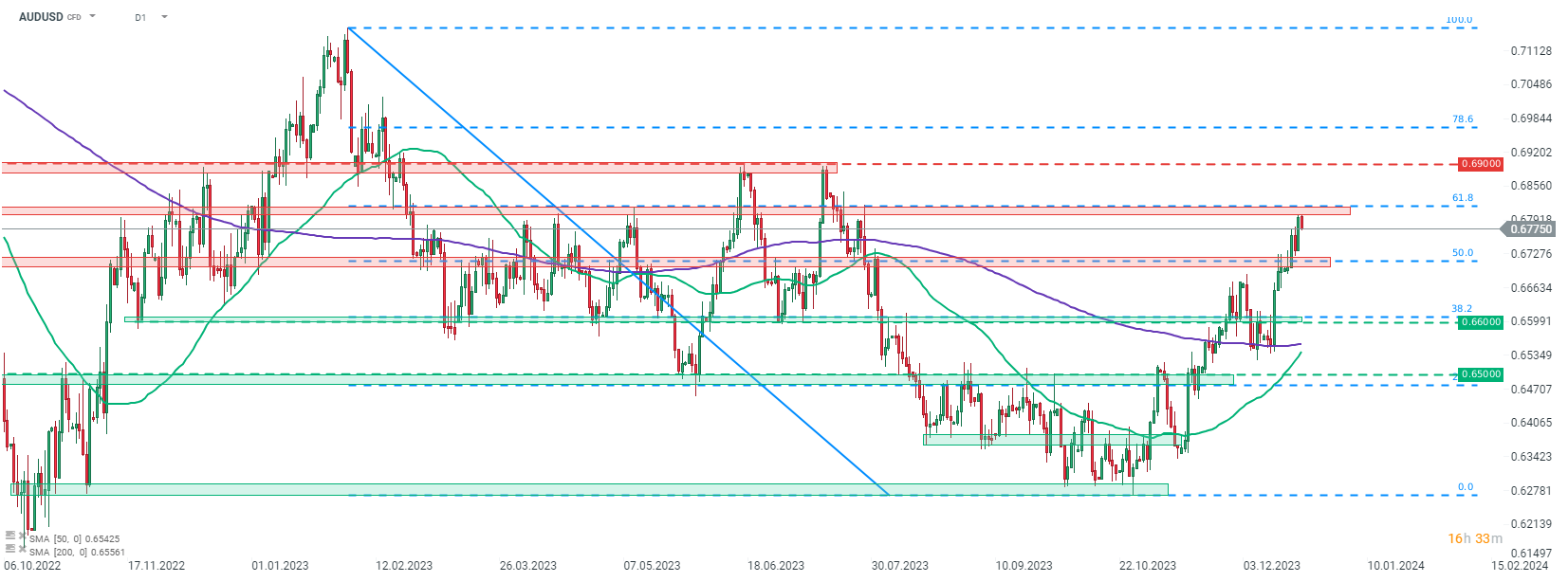

AUDUSD climbed to the highest level since late-July 2023, but bulls failed to break above the resistance zone ranging below 61.8% retracement of the downward move launched at the beginning of February 2023. A small pullback can be spotted today. Source: xStation5

AUDUSD climbed to the highest level since late-July 2023, but bulls failed to break above the resistance zone ranging below 61.8% retracement of the downward move launched at the beginning of February 2023. A small pullback can be spotted today. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.