- US indices traded higher yesterday - S&P 500 gained 0.42%, Dow Jones added 0.43% and Nasdaq jumped 0.54%. Small-cap Russell 2000 gained over 1%

- Indices from Asia-Pacific traded higher today - Nikkei gained 1.1%, S&P/ASX 200 traded 0.8% higher, Kospi gained 0.4% and Nifty 50 advanced 0.7%

- Indices from China traded 0.2-2.0% higher today

- DAX futures point to a higher opening of the European cash session today

- Financial markets are slowly emerging from Christmas lull, but trading ranges on the FX market remain narrow

- AUD and GBP are the best performing G10 currencies, while JPY and USD lag the most

- Precious metals trade mixed - gold drops 0.1%, silver trades 0.2% lower, platinum gains 0.2% and palladium surges 2%

- Major cryptocurrencies trade slightly higher - Bitcoin and Dogecoin gain 0.2%, while Ethereum trades 0.1% higher. Ripple drops 0.2%

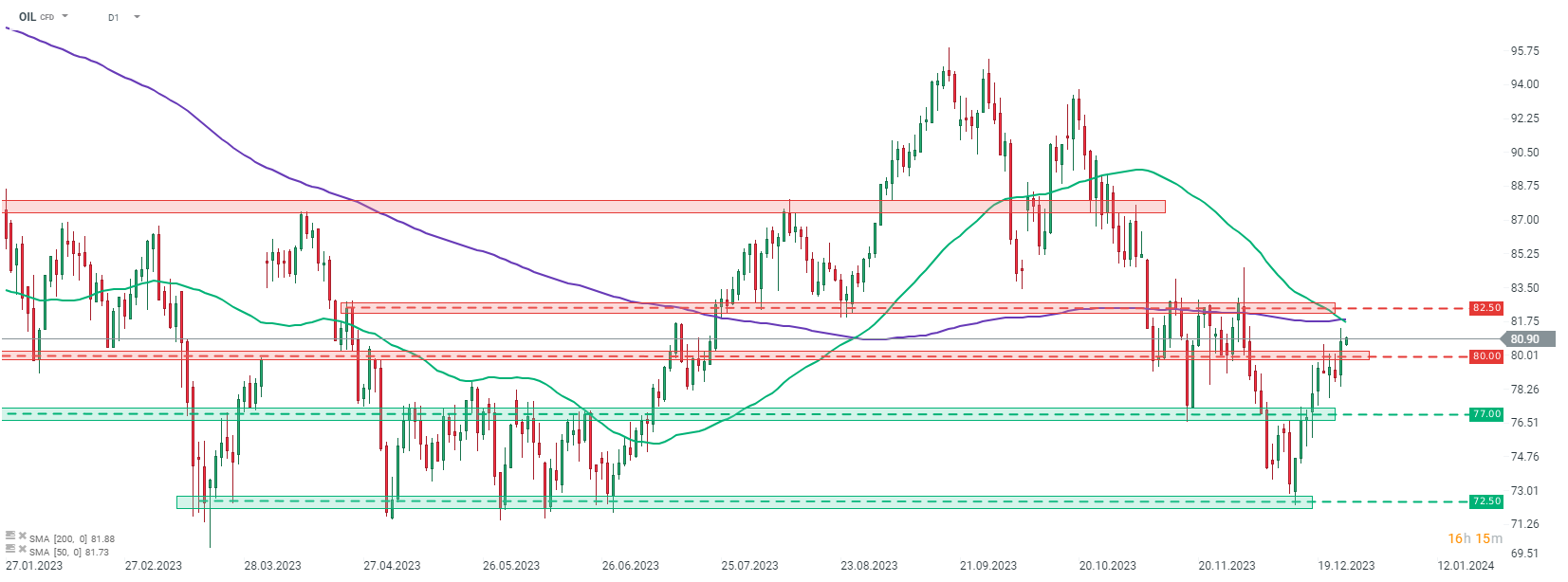

- Oil is trading slightly higher as the situation in the Middle East remains tense. Brent is trading 0.3% higher and approaches $81 area

- United States launched strikes on targets in Iraq in retaliation for a drone attack by an Iranian-linked armed group. Yemen-based Houthi rebels continue to attack commercial ships in the Red Sea

- Chinese industrial profits were 29.5% YoY higher in November, up from 2.7% YoY in October

- Goldman Sachs expects US PCE core inflation to drop to around 2% by US spring

- Summary of Opinions from Bank of Japan December meeting showed that BoJ members still have concerns and are in no hurry to pivot policy

Oil continues to gain amid rising tensions in the Middle East and more frequent Houthi attacks on ship in the Red Sea. Brent (OIL) trades near monthly highs and approaches $81 area. Source: xStation5

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

The Week Ahead

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.