- Solid Q4 numbers clouded by Q1 outlook

- Operating margins are expected to rise, but not by enough for a shaky market

- Investors do not like the Warner Brothers deal news, yet…

- A high bar for Netflix for 2026

- Netflix execs bet Warner Brothers deal is the future for Netflix

- Solid Q4 numbers clouded by Q1 outlook

- Operating margins are expected to rise, but not by enough for a shaky market

- Investors do not like the Warner Brothers deal news, yet…

- A high bar for Netflix for 2026

- Netflix execs bet Warner Brothers deal is the future for Netflix

Netflix earnings are considered the start of tech earnings season, and they came at a very interesting time for the market, in the middle of a global bout of risk aversion caused by a sell off in Japanese bonds and rising geopolitical angst due to the shifting foreign policy goals of Donald Trump.

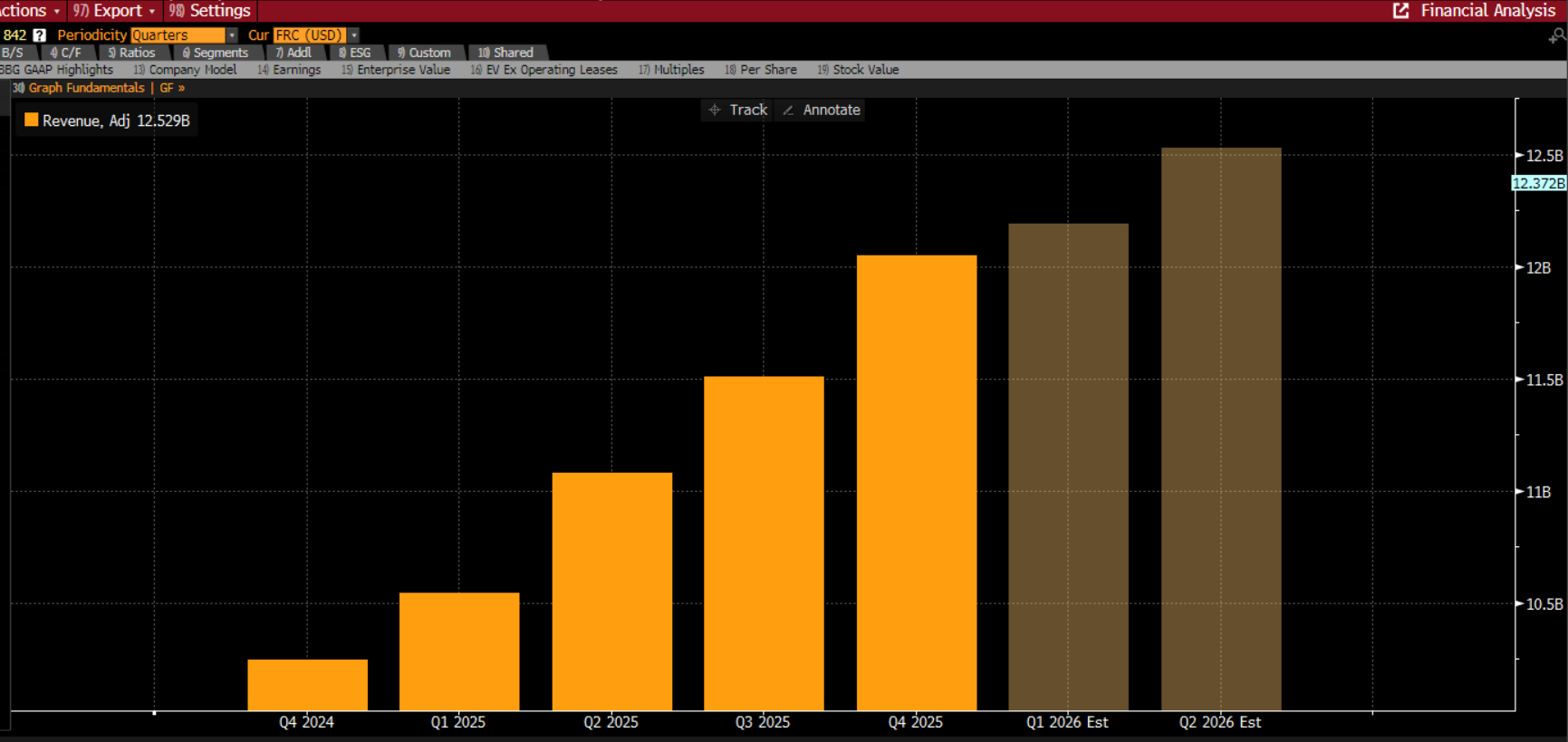

Overall, Netflix’s Q4 numbers were solid. Revenues and net income were above analyst expectations at $12.05bn and $2.55bn respectively. However, the focus was on the 2026 outlook and details about Netflix’s new and revised offer for Warner Brothers. The company may have posted 18% sales growth for Q4, but the outlook for Q1 was lacklustre and the bar was high. Concerns about operating margin strength and rising costs, including costs related to the Warner Brothers deal weighed on the stock in post-market trading on Tuesday, and it fell more than 5%.

The company expects Q1 revenue growth of 15.3%, and full year revenue growth of 13.3% for this year, which is the middle of its range. Even with its $27.75 a share all cash offer for Warner Brothers, Netflix is still predicting an increase in its operating margin to 31.5% for this year, and for free cash flow of $11bn, vs. $10.1bn in 2025. However, the operating margin increase was below expectations, and this could weigh on the stock price, especially when sentiment is shaky.

Advertising revenue is expected to rise sharply and could prove to be a headwind for Netflix. Added to this, the company is expecting to increase its prices this year to protect margins. However, Netflix’s strategy of finding new investment opportunities is expected to weigh on profitability, and earnings per share guidance was well below analyst expectations at $0.76, analysts had expected $0.82.

The company is planning on boosting spending on programming by 10% this year, along with $275mn of extra costs associated with the Warner Brothers deal, and this is causing some angst. The share price is down 25% in the past 6 months, which suggests that the market has not warmed to the deal. However, Netflix executives will not be swayed. They believe that having Warner Brothers’ back catalogue will provide them with a rich source of new content that will drive subscribers and advertisers to the streaming giant in the future.

Netflix’s latest move for Warner Brothers is a strategy for future revenue growth. After a period of slowing new users, this is a catalyst to bring people to the streaming giant. However, this move comes with uncertainty, and markets do not like uncertainty, so Netflix is getting punished. It could be a rough day for Netflix on Wednesday, but by solidifying itself as the world’s largest streaming platform with the Warner Brothers deal, there could be blue skies ahead.

Chart 1: Netflix quarterly revenue and forecasts.

Source: XTB and Bloomberg

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.