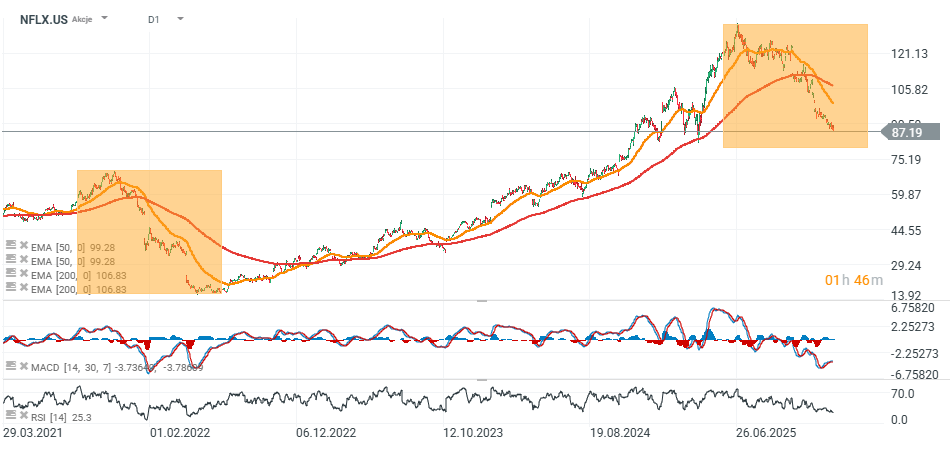

Netflix (NFLX.US) shares are down more than 4% following the Q4 report, extending a pullback that now exceeds 30% from the highs. The company slightly beat sales and net profit forecasts and, although free cash flow came in materially higher, guidance proved to be the key disappointment: a revenue outlook in line with expectations (and therefore underwhelming for a stock priced as a “growth” name), alongside a notably weaker outlook for earnings as well as operating margins, fell short of investor expectations. Despite the Netflix sell-off after earnings, sentiments on Wall Street didn't moved lower, after the very weak trading session, during which Nasdaq 100 slided more than 2%.

- Full-year 2026 revenue guidance landed at the lower end of the consensus range and below USD 51bn, and the company also missed expectations for its average annual operating margin outlook. Netflix is bracing for substantial spending related to its planned content slate and the acquisition of Warner Bros.

- Since the summer of 2022 - when the stock was trading nearly 75% below its then all-time high—the company has added 105 million subscribers and has successfully monetized its larger base through advertising, while the share price has risen more than 6.5x. As a result of this spectacular business turnaround, the market has kept pushing the company’s valuation higher, to the point where even very solid results are no longer enough to sustain the uptrend.

Netflix Q4 Earnings & Guidance

- Earnings per share (EPS): USD 0.56 vs. forecast of USD 0.55 vs. USD 0.43 y/y

- Revenue: $12.05 billion vs. forecast of $11.97 billion

- Free cash flow (FCF): $1.87 billion vs. forecast of $1.46 billion

- Revenue forecast for Q1: $12.16 billion vs. forecast of $12.17 billion

- EPS forecast for Q1: $0.76

- Operating profit forecast for Q1: $3.91 billion vs. forecast of $4.18 billion

- Operating margin forecast for Q1: 32.1% vs. forecast of 34.4%

- 2H 2026: operating profit growth is expected to exceed the growth rate seen in 1H

- 2026: the company expects advertising revenue to approximately double compared to 2025.

- Share buyback: the company will suspend buybacks to finance the planned Warner Bros. transaction.

- Revenue forecast for 2026: USD 50.7-51.7 billion vs. forecast of USD 50.96 billion

- Operating margin forecast for 2026: 31.5% vs. forecast of 32.4%

- Free cash flow (FCF) forecast for 2026: approx. $11 billion vs. forecast of $11.93 billion

Netflix shares (D1 interval)

Source: xStation5

US100 chart (H1 interval)

Source: xStation5

What did Netflix show?

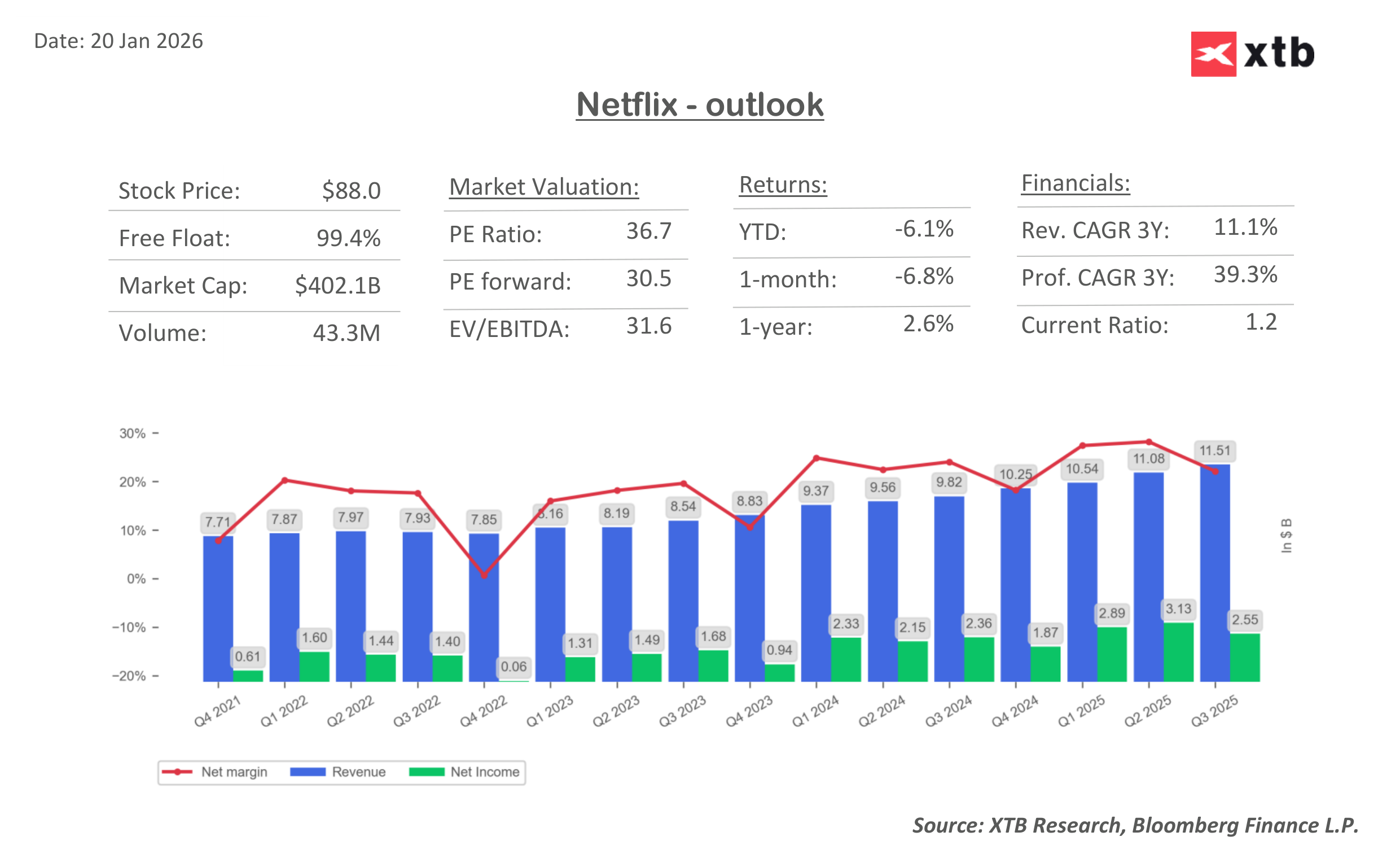

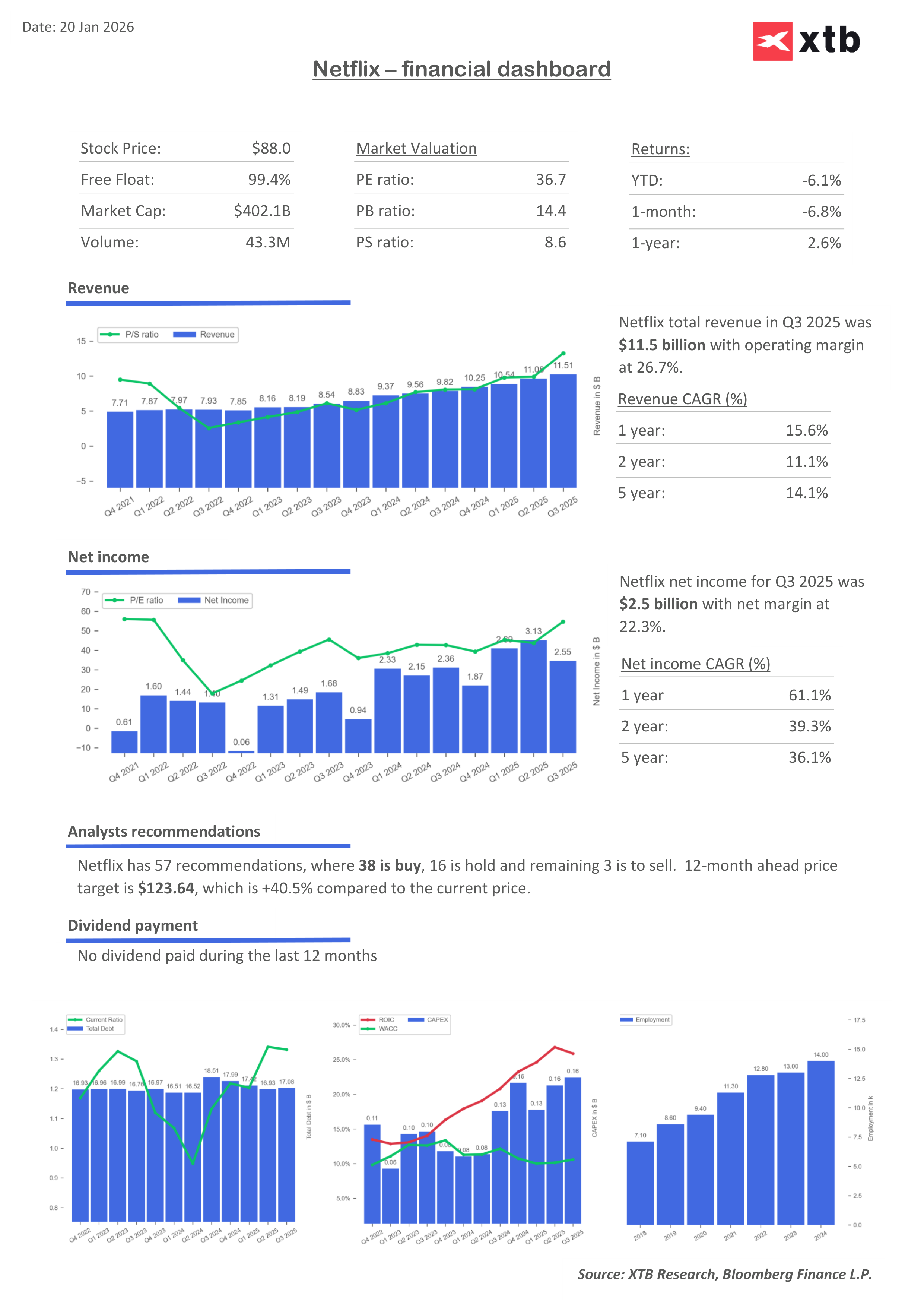

Wall Street is starting to judge the company not on whether it is growing, but on whether it is growing perfectly. The print confirms that Netflix’s business model is still working and that monetization of its customer base remains above average. By the end of 2025, Netflix is estimated to have surpassed 325 million subscribers, implying nearly 8% year-on-year growth.

- Even though the company has been moving away from regularly reporting subscriber figures, it’s hard to ignore that the ecosystem is still expanding. Yet that same scale raises the bar: the bigger Netflix gets, the less room there is for “good” to be good enough. The biggest issue this time? Guidance.

- For the current quarter, Netflix expects EPS of $0.76, below market expectations of roughly $0.82. Revenue is projected at $12.2 billion, essentially in line with consensus. But Netflix is no longer a “regular” stock—at roughly 30x forward 12-month earnings, any outlook that merely meets expectations is read as a lack of upside surprise. And at elevated valuations, no surprise can trade like a negative surprise.

- Netflix also said it will increase content spending by 10% in 2026, after allocating roughly $18 billion to programming in 2025. The message is clear: the fight for viewer time and “share of attention” isn’t easing, and the content investment cycle is turning up again. That’s great for users, but the market is less enthusiastic.

Investors have grown used to Netflix expanding revenue faster than costs and rebuilding margins. This guidance suggests 2026 could be a year when margin improvement slows because the company is deliberately leaning back into heavier investment. At this stage of the cycle, that’s exactly the kind of shift that prompts profit-taking.

Another key overhang is the potential acquisition of Warner Bros. Discovery’s assets—specifically the studio and streaming business. Netflix is explicit: closing the deal would add $275 million of costs this year, on top of the $60 million already incurred. Importantly, the company also signaled it would pause share buybacks to build cash for the transaction.

That kind of signal always lands heavily on Wall Street. When buybacks disappear, the market immediately asks: will the balance sheet become tighter? Will the ROI on the acquisition be high enough? Strategically, Netflix wants Warner Bros. in order to:

-

secure one of the largest and strongest film/TV libraries in the world,

-

use the IP for new formats and sequels,

-

expand adjacent businesses such as consumer products and gaming.

This isn’t a “two-year” purchase—it’s a “decade” purchase. But markets typically don’t like paying upfront for vision until they see hard numbers in the model.

Netflix is entering a phase where “a good quarter is the minimum.” The company has recently raised prices, scaled its ad business, and stopped treating subscriptions as the only growth engine. Netflix remains an outstanding company—yet sentiment is shifting around its valuation.

The next few months will come down to three things:

-

Can Netflix sustain ad momentum? The company expects advertising revenue could double in 2026 (from roughly $1.5 billion in 2025). If that path holds, some margin concerns may fade over time.

-

Will higher content spend translate into higher engagement? Netflix has already seen that spending doesn’t always convert proportionally into viewership—engagement growth in the second half of the year was marginal. This will be a hard test of the strategy.

-

Warner Bros. synergies: the market will want a clear, quantified synergy story—not just a strategic narrative.

Netflix valuation multiples

Source: XTB Research, Bloomberg Finance L.P.

Source: XTB Research, Bloomberg Finance L.P.

Market wrap: European and US stocks try to rebound rebound 📈

Trump’s plan for Strait of Hormuz fails to stop gains in oil price, as investors pause European sell off

Paramount Skydance shares under pressure after S&P warning

Broadcom as the Last of the Big Tech. What Can Markets Expect from the Earnings?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.