In the FX market, in addition to the pound reacting to higher-than-expected inflation data from the UK, the New Zealand dollar played a dominant role today, sinking under the strain of today's RBNZ decision and comments from central bankers. A key view throughout the meeting was that rate hikes would no longer be necessary to combat inflation, so the RBNZ was the first of the world's major central banks to halt the rate hike cycle.

New Zealand's central bank raised interest rates by a quarter of a percentage point to 5.5% (as expected). The central bank's forecasts show that the OFR has already peaked, with reductions starting in the third quarter of 2024. Following the news, two-year NZD yields fell by the most in six months.

"The committee is confident that, with interest rates held at restrictive levels for some time, consumer price inflation will return to the target range of 1-3% per annum," the - The RBNZ said. "Inflation is expected to continue to decline from its peak, and with it inflation expectations indicators." Inflation slowed to 6.7% in the first quarter, and the central bank expects it to return to the target range by the third quarter of next year. Today's decision was voted in a 5-2 structure (5 members in favour of a hike; 2 in favour of maintaining rates). The commentary following the decision added that the Committee is confident. that the hike cycle has captured inflationary pressures.

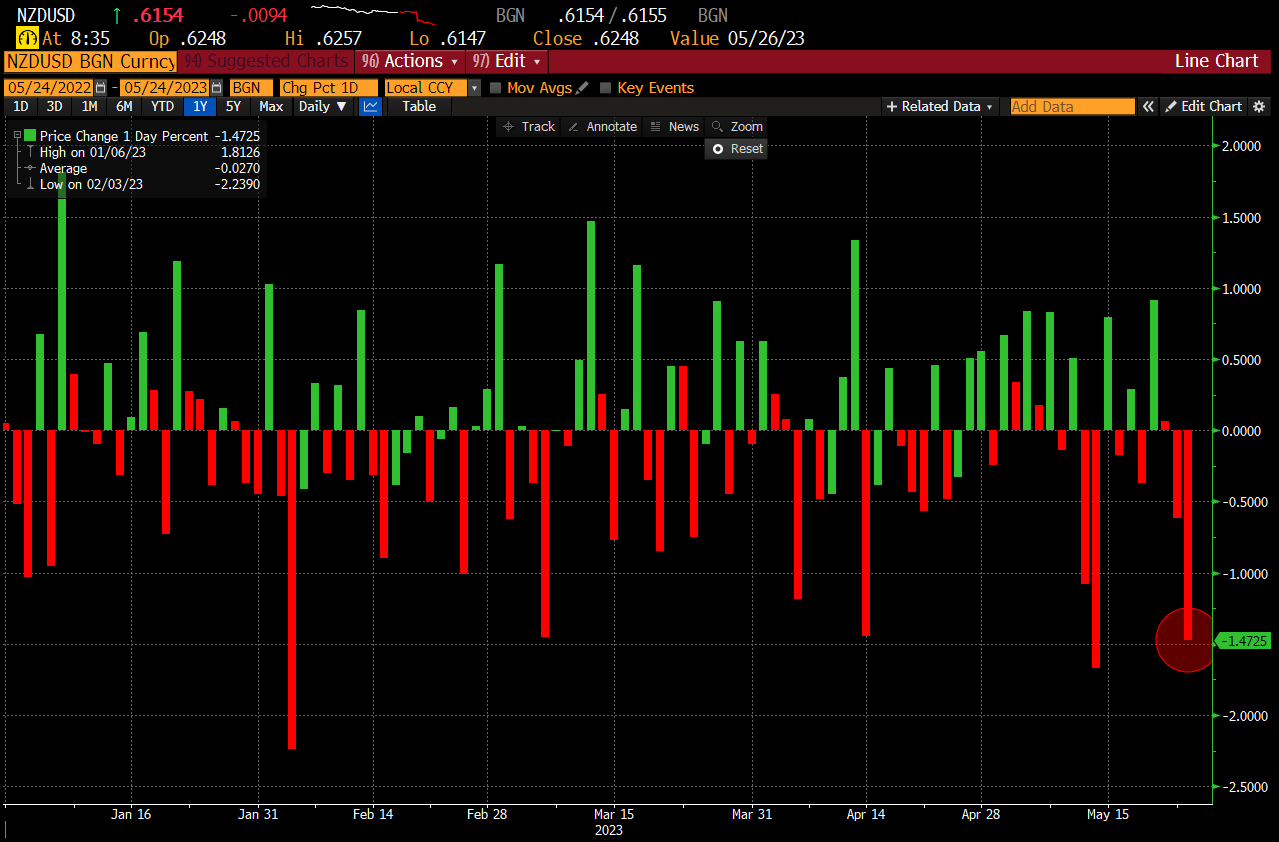

The magnitude of today's sell-off is huge, nevertheless declines of similar magnitude have already been recorded in this one. Source: Bloomberg

The magnitude of today's sell-off is huge, nevertheless declines of similar magnitude have already been recorded in this one. Source: Bloomberg The NZDUSD pair is currently losing more than 1.7% amid news of the end of New Zealand's rate hike cycle. The pair is currently testing support set by the March and April 2023 minima, which is further reinforced by the 50-day exponential moving average (blue curve). Source: xStation5

The NZDUSD pair is currently losing more than 1.7% amid news of the end of New Zealand's rate hike cycle. The pair is currently testing support set by the March and April 2023 minima, which is further reinforced by the 50-day exponential moving average (blue curve). Source: xStation5

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.