Summary:

- NZ dollar leads the losses in early European trading on Thursday following a dismal reading on business confidence

- Australian private capital expenditure declined in the second quarter sending a warning sign before a GDP reading due next week

- The US does not intend to weaken the buck, according to Steven Mnuchin

Yet more depressed

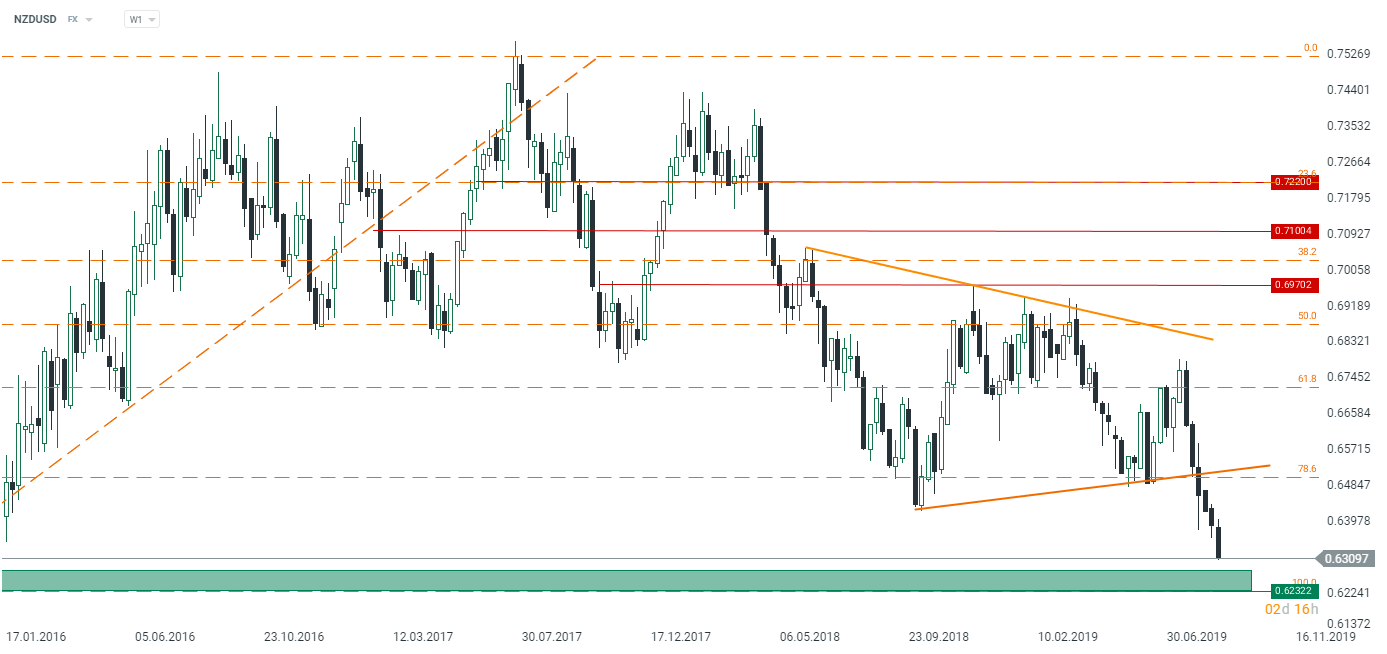

NZ dollar traders have not had a good week so far as the Antipodean currency has fallen quite a lot against the US dollar on the back of either a risk-off environment or dismal domestic macroeconomic prints. The latter played a major role today as the business confidence indicator plunged to -52.3 from -44.3 while the activity outlook gauge lowered to -0.5 from 5, the data for August. These values seem to be pretty depressing taking into account a notable 50 bps rate cut delivered by the Reserve Bank of New Zealand earlier this month. On the other hand, just over a third over responses were given after the RBNZ’s rate reduction, hence some companies could not have expressed their outlook appropriately. Either way, sentiment among businesses there deteriorated noticeably despite still fairly robust commodity prices and positive population growth, as the ANZ noticed (the bank prepares the data). It needs to be underlined that employment intentions fell, while the outlook for profitability plunged to its lowest level since mid-2009. Last but not least, inflation expectations among the corporate sector slid to 1.7% from 1.81% in the previous survey - this could be particularly important point for market participants given the fact that the RBNZ singled out falling expectations as the prime reason for the big rate cut this month. However, a full assessment of easier monetary conditions remains to be seen when the ANZ reveals its indices for September.

The NZDUSD keeps adding to its loss this week, the crucial demand zone lies ahead though. Source: xStation5

The NZDUSD keeps adding to its loss this week, the crucial demand zone lies ahead though. Source: xStation5

Aussie gets a blow

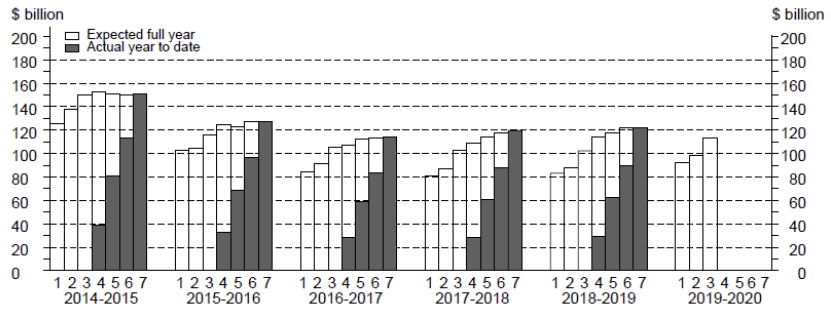

The Australian dollar also got a blow overnight when the private capital expenditure data for the second quarter was released. It showed a 0.5% QoQ decrease, well below the consensus pointing to a 0.4% QoQ increase. The first quarter result was revised up to -1.3% from -1.7%. The details revealed that expenditure on plant and equipment rose 2.5% QoQ while expenditure on buildings and structures fell 3.3% compared to the first three months of the year. It seems to suggest that companies attempted to improve its capacity, which in turn agrees with the elevated level of capacity utilization in the manufacturing sector there. This gloomy reading, in conjunction with yesterday's disappointing construction work done, does not bode well for overall investment in Australia in the second quarter. On the other hand, the third estimate of capital expenditure for the 2019/2020 year came in at 113.4 billion AUD, that is 10.7% higher compared to the third estimate in the previous year and 14.9% higher compared to the second estimate this year. This could be somewhat reassuring in the light of the prospect for investment in the Australian economy.

Private CAPEX disappointed for the second quarter, but the outlook does not look so weak. Source: Forexlive

Private CAPEX disappointed for the second quarter, but the outlook does not look so weak. Source: Forexlive

In the other news:

-

US Treasury Secretary Steven Mnuchin said that the US does not intend to weaken the US dollar for now

-

BoJ’s Suzuki stressed that lowering rates further could risk a deeper slowdown in the Japanese economy once banks start charging fees on deposits

-

Italian President Mattarella will give Conte a mandate to forge a new government, Conte will be supported in his task by the Five Star Movement and the Democratic Party

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.