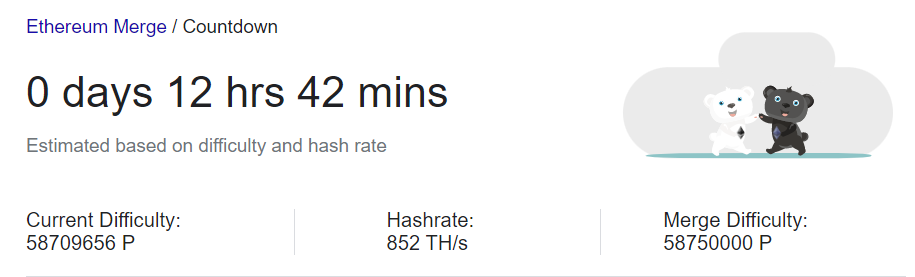

Google made the 'Ethereum Merge' tracker available two days ago. The transformation will take place at a difficulty of TTD 58750000 i.e. in about 12.5 hours. Taking into account the time of publication of the analysis (18:30), the Merge will take place around 6:30, September 15. Source: Google

Google made the 'Ethereum Merge' tracker available two days ago. The transformation will take place at a difficulty of TTD 58750000 i.e. in about 12.5 hours. Taking into account the time of publication of the analysis (18:30), the Merge will take place around 6:30, September 15. Source: Google

The second largest cryptocurrency, Ethereum is preparing for an event that analysts believe is the most important of the year for the cryptocurrency sector:

- Merge itself will not cause immediate consequences for users of the Ethereum blockchain;

- Thanks to the transformation, the network will reduce its eletrical energy consumption by up to 99.95%. Currently, annual consumption is comparable to New Zealand;

- The definitive change of consensus from Proof of Work to Proof of Stake will take place thanks to the so-called difficulty bomb, which will make ETH mining unprofitable for so-called 'miners', who will be replaced by so-called validators;

- The deflationary model will be made possible by freezing the supply of miners and updating EIP-1559 (the so-called London hard fork), which burns ETH tokens in an amount equal to network transaction fees;

- According to some analysts, the Ethereum Merge will cause a wave of institutional interest in Ethereum and may be associated with a new 'DeFi spring', i.e. a renewed interest in decentralized applications and services built on Ethereum;

In future updates, developers will address the reduction of network 'gas fees' and network scalability.

So far, EIP-1559 has burned more than $4.1 billion worth of ETH since the London hard fork i.e. since the summer of 2021. Source: watchtheburn The chart shows two curves of Ether's daily supply since August 2021. The current state is marked in orange, which includes ETH in both the Proof of Work and Proof of Stake blockchain and the EIP1559 protocol. With the exception of literally a couple of days, ETH supply has proven to be inflationary oscillating between 11,800 and 14,300 since July this year. The simulated state with an active Beacon chain and EIP1559, on the other hand, is represented in blue. The on-chain simulation confirms that if Merge is properly implemented Ethereum along with the EIP 1559 proto-chain will reach deflationary. The speed at which deflationary is achieved may support stronger demand for Ether, as the increase in gas fees in the current form of the network will result in an increase in the number of Ether burned. Source: Glassnode

The chart shows two curves of Ether's daily supply since August 2021. The current state is marked in orange, which includes ETH in both the Proof of Work and Proof of Stake blockchain and the EIP1559 protocol. With the exception of literally a couple of days, ETH supply has proven to be inflationary oscillating between 11,800 and 14,300 since July this year. The simulated state with an active Beacon chain and EIP1559, on the other hand, is represented in blue. The on-chain simulation confirms that if Merge is properly implemented Ethereum along with the EIP 1559 proto-chain will reach deflationary. The speed at which deflationary is achieved may support stronger demand for Ether, as the increase in gas fees in the current form of the network will result in an increase in the number of Ether burned. Source: Glassnode

Etheruem chart, H4 interval. Sentiment around Ethereum deteriorated after yesterday's negative inflation reading in the US. Currently, the price of the token is experiencing moderate declines, however, an entry in the area below $1580 could herald a drop to as low as $1300, which would coincide with the 61.8 Fibonacci retracement. A re-entry below the key 200-session average, which runs at $1680, also looks worrisome. Despite Ethereum's successful tests, there is a slight possibility of a technical error during 'The Merge', which would sharply lower the cryptocurrency market sentiment and trigger a liquidation wave. With risk aversion returning, some investors may want to sell tokens in case of an unexpected error. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.