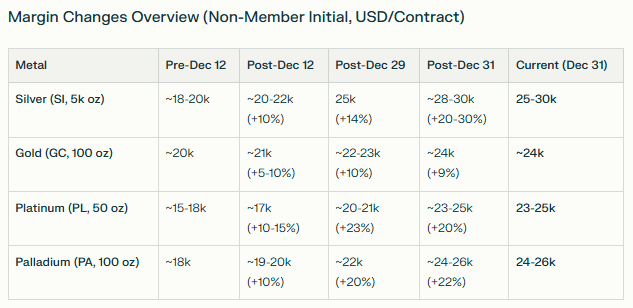

Following Friday’s close, the exchange announced a hike in both initial and maintenance margins for precious metals on its COMEX division. This has prompted a significant retreat across the sector, despite an earlier dramatic surge in silver prices beyond $80, driven by the announcement of Chinese export restrictions. Citing persistent volatility, the CME has signaled a further increase effective after today’s closing bell.

The following initial margin requirements have been compiled using AI tools, aggregating data from sources including the CME, Bloomberg, Yahoo Finance, and AIInvest. The table reflects initial margins; maintenance requirements typically stand at approximately 80-90% of these levels. The numbers may differ from the actual ones.

While speculative positioning on futures exchanges has not yet reached extreme levels, the current hikes may compel commercial investors to reduce their market exposure. However, a more sustained price correction would likely require action from long-term investors, such as profit-taking within exchange-traded funds (ETFs).

On Tuesday, silver and palladium ETFs reduced their bullion holdings, while gold and platinum funds increased their exposure. Since the start of the year, gold volumes in ETFs have risen by 19%, silver by 20%, platinum by 2%, and palladium by 50%. The current value of gold held in these funds stands at nearly $430bn, with silver at $65bn, platinum at $7bn, and palladium at almost $2bn.

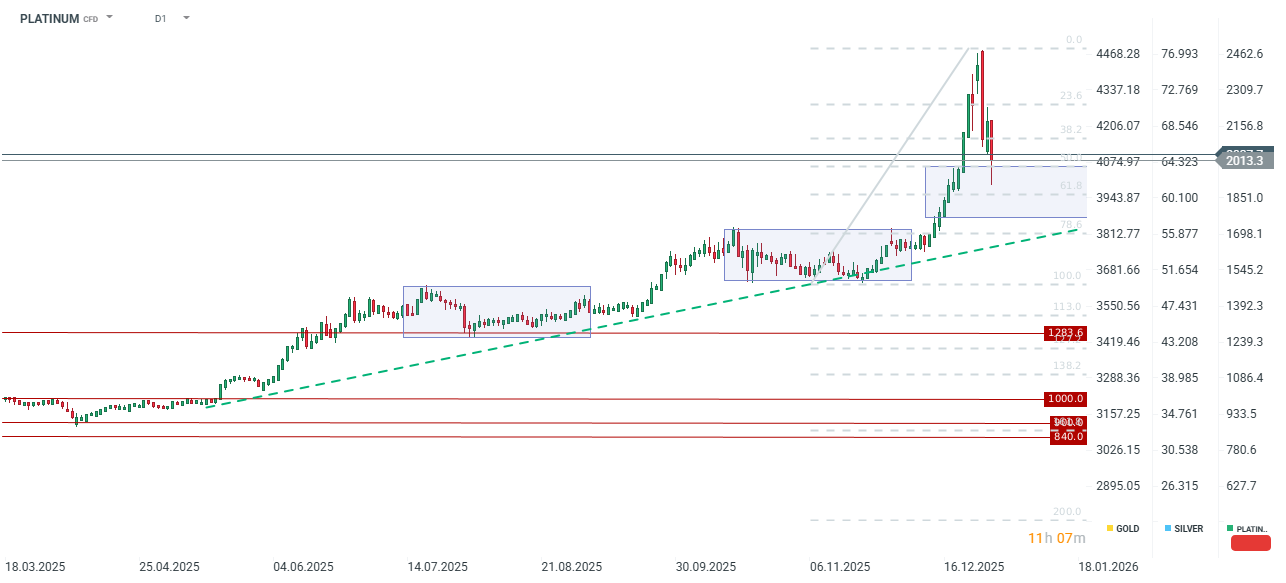

Platinum has retreated by more than 7% today, testing the $2,000 level after a rebound yesterday saw prices touch $2,200 per ounce. The metal is currently testing the 50.0% Fibonacci retracement level. Should this support be breached, the next significant technical floor lies near $1,700, coinciding with the 78.6% retracement of the most recent upward wave and the prevailing bullish trendline.

Navigating Middle East uncertainty and tariff risks

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.