Gold and silver prices are rising sharply today, reaching their highest levels in many years, driven by expectations of imminent interest rate cuts by the Fed, strong demand for ETFs, and growing geopolitical risk. Silver has exceeded $40 per ounce for the first time since 2011, gaining about 40% this year, while gold has approached a record high of over $3,500 per ounce, up 31% since the beginning of the year. Over the past three years, prices for both metals have more than doubled amid ongoing market and political uncertainty. Today alone, SILVER is up 2.2% while GOLD is adding 0.8%.

Expectations regarding interest rate cuts by the Fed

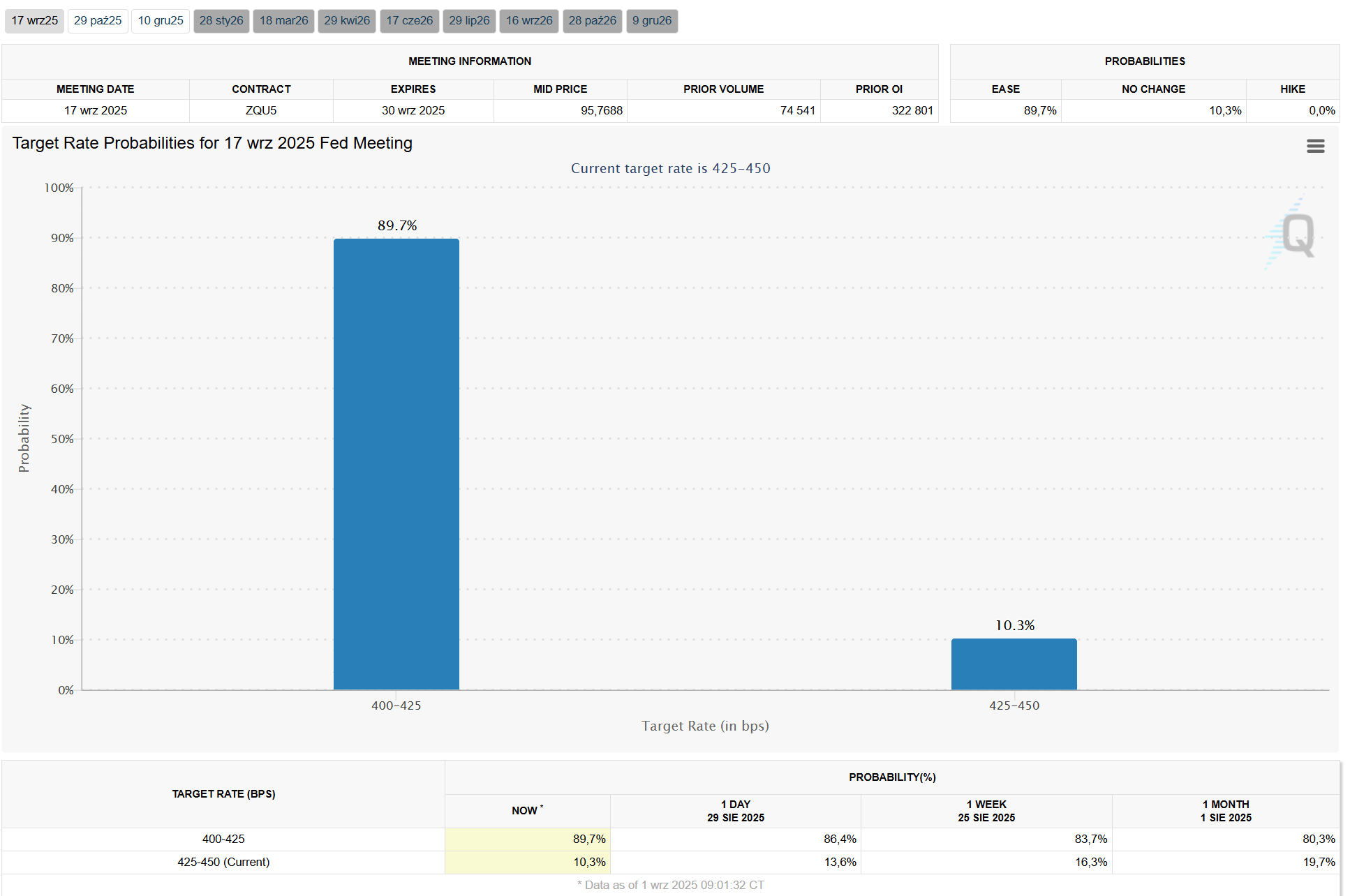

Growing consensus that the Federal Reserve will soon cut interest rates (now a nearly 90% chance) has caused gold and silver prices to rise. Lower interest rates reduce the opportunity cost of holding non-yielding assets such as gold and silver, making them more attractive to investors seeking protection against monetary easing and currency devaluation.

Source: CME

Political and geopolitical tensions

Uncertainty about the independence of the Federal Reserve, exemplified by President Trump's attempts to dismiss Fed board member Lisa Cook, has heightened concerns in global markets. A federal court recently ruled that most of the tariffs imposed during the Trump era are unlawful, but left existing tariffs in place pending further proceedings, leaving trade policy in limbo and further reinforcing defensive market strategies. Furthermore, the addition of silver to the US list of critical minerals increases its strategic importance, raising the prospect of future policy-driven price volatility.

Precious metals on the rise

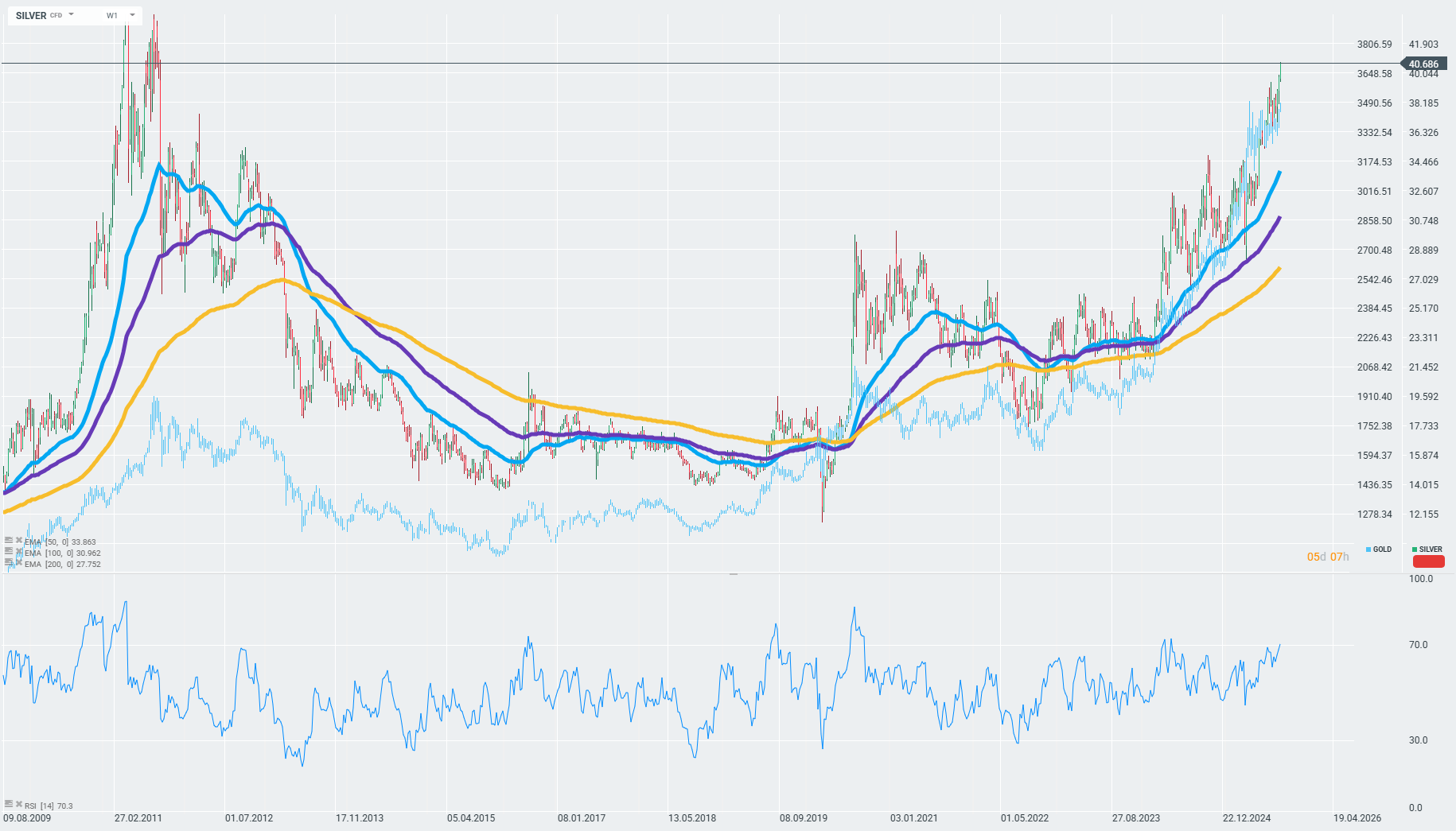

Both gold and silver have broken through key resistance levels ($3,450 for gold, $40 for silver), triggering a surge in demand and reinforcing the upward trend. Overall, the precious metals sector is experiencing a unique combination of favorable factors, rarely seen in such a synchronized form, resulting in record high prices, sustained demand for ETFs (since the beginning of the year, gold stocks in ETFs have increased by 12%, while for silver it is 13%) and structural changes in investors' approach to risk and hedging. Technically, both commodities are maintaining their long-term upward trends.

GOLD is approaching its historic highs, while SILVER is trading near its 2011 highs. Source: xStation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.