Silver has tested the area of $29 per ounce today after gold reached new historic highs above $2,400 per ounce. For precious metals, we are talking about a bull market driven by concerns over the situation in the Middle East. The United States indicated this week that there is a very high probability of a retaliatory attack by Iran against Israel, following an earlier attack on an Iranian diplomatic facility in Damascus, Syria. On the other hand, Iran itself has indicated that it will limit its retaliatory actions against Israel so as not to escalate an overly tense situation.

Silver found its highest since January 2021, when it tested the area around $30 per ounce. It's worth noting that on silver we very often see around $7-8 down and up waves. At the moment, such a range has been filled from the local low in February. On the other hand, in the medium term, seasonality continues to point to increases, while net speculative positions are still far from the extreme overbought of 2016 or 2019. It is also worth mentioning the recent inflows of funds into silver ETFs.

Source: xStation5

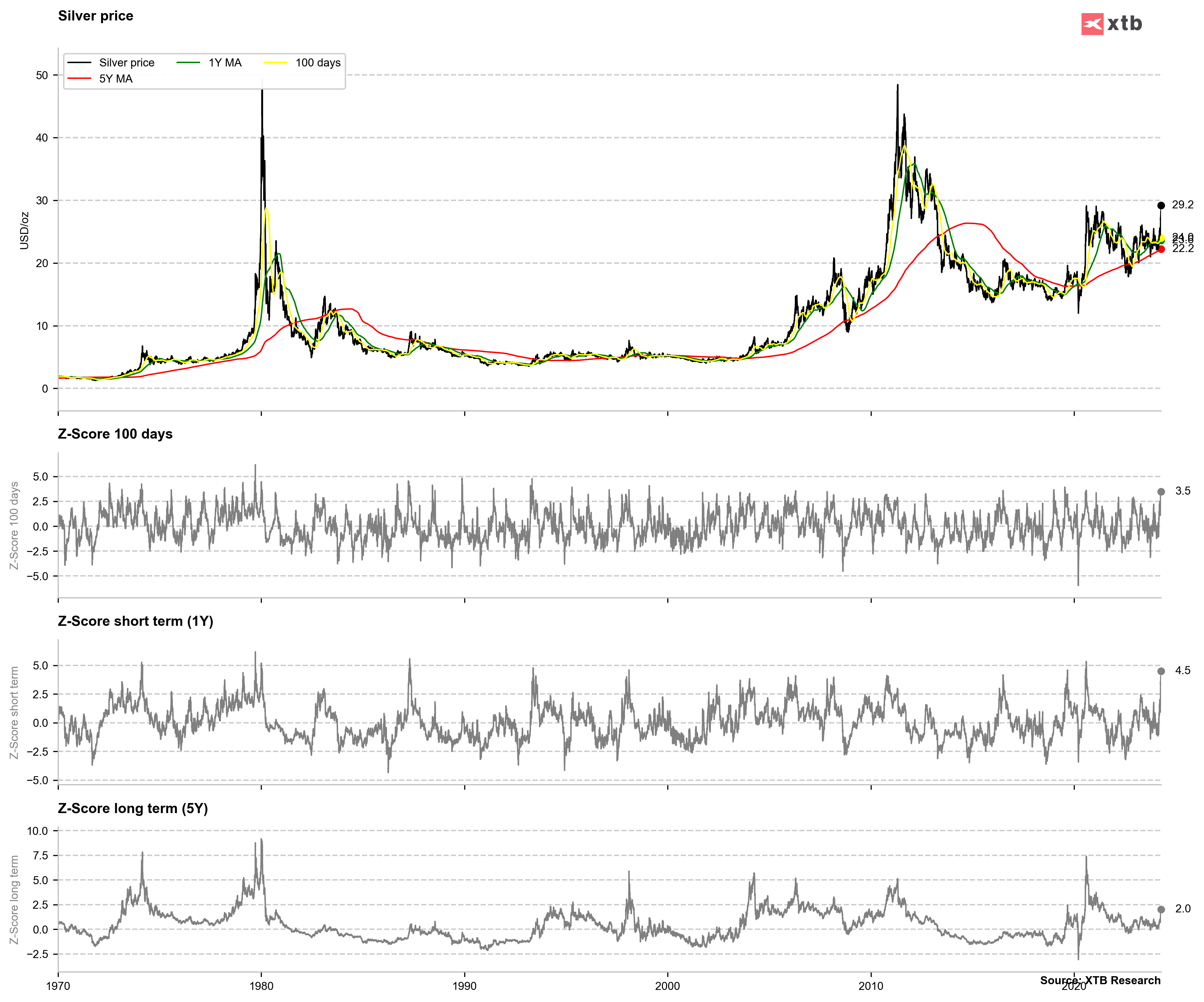

Analyzing the historical situation, it is worth noting that we may be experiencing a short-term overbought condition. We observe a 3.5 times standard deviation from the 100-session average, which seems extremely high, looking at the history of the last 20-25 years. In addition, we observe a 4.5 times standard deviation from the 1-year average, which has generated signals of short-term overboughtness over the past 20 years. At the same time, if we look at the deviation from the 5-year average, here it is far from extreme levels. In view of this, if there is no escalation of the conflict in the Middle East over the weekend, a gap down at the opening on Monday cannot be ruled out, but in the long term, gains are further possible, looking also at the fundamental situation, which suggests one of the largest deficits in the silver market in history.

Source: Bloomberg Finance LP, XTB

Middle East conflict ramps up a gear as energy price spike rips through markets

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.