- Apple reported earnings on Wednesday after market close

- Better-than-expected sales and profits

- Beat driven by solid iPhone sales

- Quarterly dividend increase by 4% to $0.24 per share

- $90 billion in additional buybacks authorized

- Vague guidance for fiscal-Q3 2023

- Stock gains 2.5% in premarket

Apple (AAPL.US), iPhone manufacturer, reported earnings for fiscal-Q2 2023 (calendar Q1 2023) yesterday after the close of the Wall Street session. Results turned out to be better-than-expected, thanks to a beat in iPhone sales. Company has also announced a $90 billion increase in buyback programme as well as increase in quarterly dividend for the eleventh year in a row! Let's take a closer look at how Apple's business performed in the first quarter of 2023.

Apple's fiscal-Q2 2023 results snapshot

Headline results

- Revenue: $94.48 billion vs $92.6 billion expected (-2.5% YoY)

- Products revenue: $73.93 billion vs $71.91 billion expected (-4.6% YoY)

- IPhone revenue: $51.33 billion vs $48.97 billion expected (+1.5% YoY)

- Mac revenue: $7.17 billion vs $7.74 billion expected (-31% YoY)

- IPad revenue: $6.67 billion vs $6.69 billion expected (-13% YoY)

- Wearables, home and accessories: $8.76 billion vs $8.51 billion expected (-0.6% YoY) - Services revenue: $20.91 billion vs $21.11 billion expected (+5.5% YoY)

- EPS: $1.52 vs $1.43 expected (unchanged year-over-year)

- Gross profit: $41.98 billion vs $40.98 billion expected (-1.4% YoY)

- Cash and equivalents: $24.69 billion (-12% YoY)

- Quarterly dividend per share: $0.24 vs $0.24 expected (up from $0.23)

- Up to $90 billion in additional share buybacks authorized

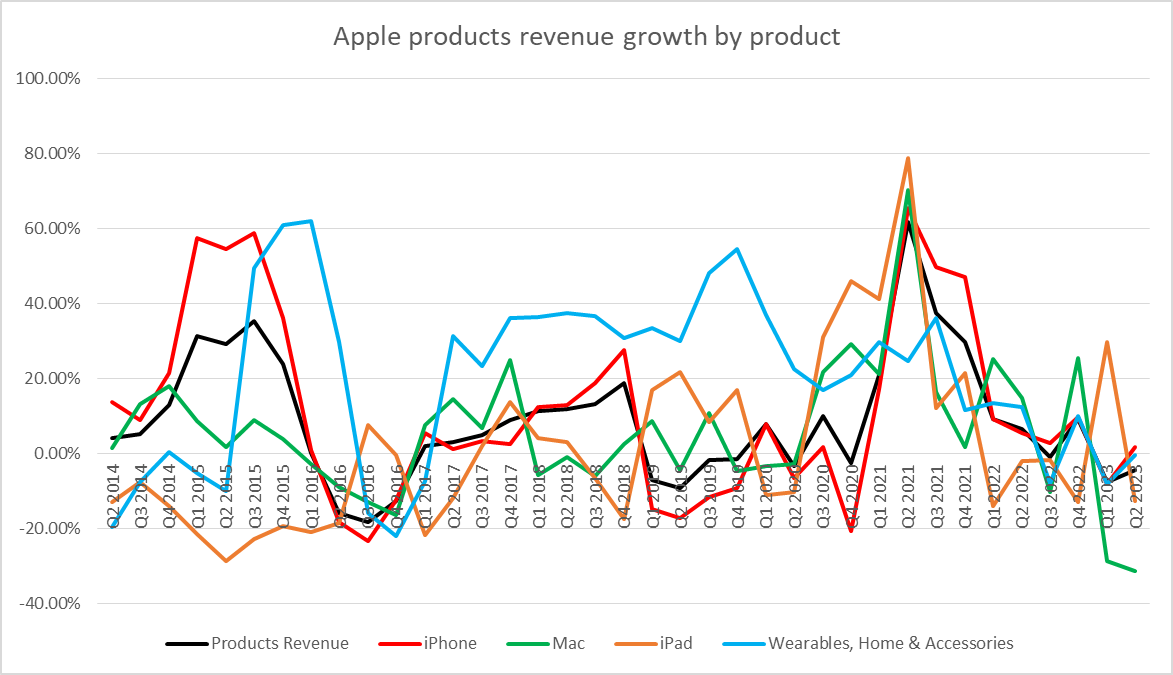

Fiscal-Q2 2023 (calendar Q1 2023) was marked with a rebound in iPhone and Accessories sales growth while iPad sales took a sharp turn lower. Source: Bloomberg, XTB

Sales by geographic region

- Americas: $37.78 billion (-7.6% YoY)

- Europe: $23.95 billion (+2.8% YoY)

- Greater China: $17.81 billion (-2.9% YoY)

- Japan: $7.18 billion (-7% YoY)

- Rest of Asia Pacific: $8.12 billion (+15.3% YoY)

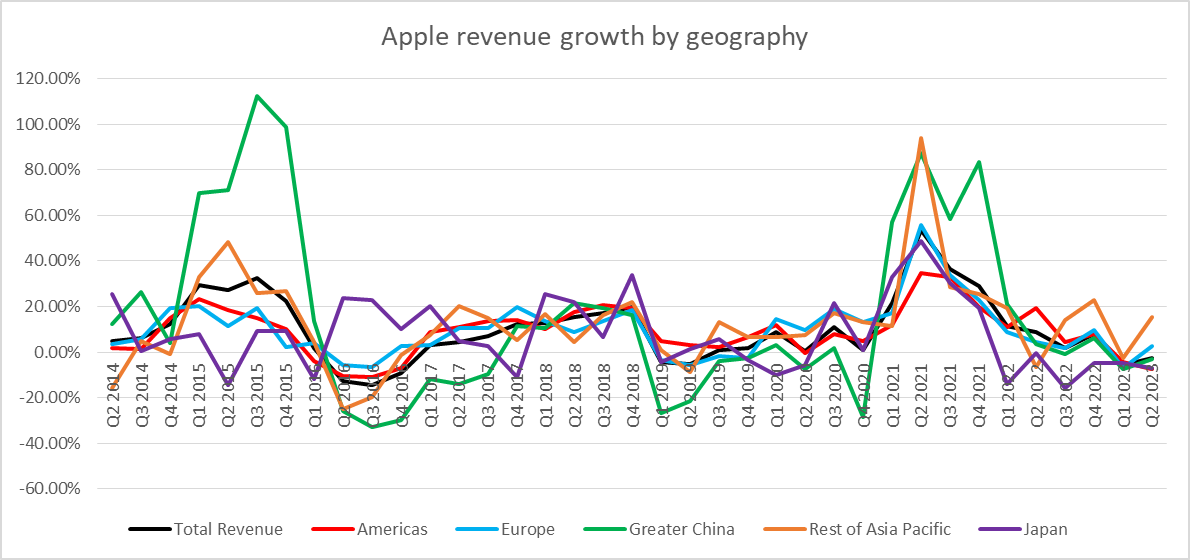

While sales growth rates in Apple's major region have improved in fiscal-Q2 2023, the company reported positive growth rates in Europe and Rest of Asia-Pacific only. Source: Bloomberg, XTB

While sales growth rates in Apple's major region have improved in fiscal-Q2 2023, the company reported positive growth rates in Europe and Rest of Asia-Pacific only. Source: Bloomberg, XTB

Apple delivers strong results driven by iPhone sales

Apple reported better-than-expected results for fiscal-Q2 2023. As one can see in the snapshot above, the company managed to report a much smaller drop in total revenue than expected. This beat was driven by stronger product sales, especially an unexpected 1.5% YoY increase in iPhone sales. However, it was not as unexpected as it may seem as some analysts pointed out that iPhone sales may beat after Foxconn, Apple's top assembler, reported record revenue for the quarter. Strong beat in iPhone sales was enough to offset disappointing Mac and services sales, and allowed Apple to report beat in total revenue. Services revenue missed expectations but has still come at a new record high.

As far as geography is concerned, 'Rest of Asia Pacific' segment has outperformed with a 15.3% YoY sales growth. While this segment is relatively small, it is watched closely as it includes countries like Indonesia, India or Philippines, which are emerging as potential new top drivers for companies business. Record sales were also reported in emerging markets outside of Asia-Pacific, like for example Mexico or United Arab Emirates. A key takeaway from Apple's Q2 earnings release is that while the macroeconomic situation around the globe deteriorates, consumer spending on electronics continues to hold quite firm. Company has also become more efficient as cost of sales dropped by 3.3% YoY in the quarter while overall revenue drop was at 2.5% YoY.

Apple continues to share profits generously

Apart from solid fiscal-Q2 2023 earnings, Apple has also announced that it will increase its quarterly dividend for the eleventh year in a row. Quarterly payout will increase from $0.23 to $0.24 per share, translating into a dividend yield of less than 1%. While this does not seem like much, one should remember that this is not the only way in which Apple shares profits with investors. Apple said in earnings releases that its Board authorized an increase of up to $90 billion in a buyback programme. Company said that it has returned a total of $23 billion to shareholders during the quarter, in the form of buybacks and deposits, and it intends to continue growing these distributions as it continues to be confident in the value of its stock.

Continuation of fiscal-Q2 trends expected in fiscal-Q3

As far as guidance is concerned, Apple refrained from providing specific financial projections for the fiscal-Q3 2023 (April-June 2023 period). However, Luca Maestri, Apple's CFO, said on an earnings call with analysts that continuation of trends seen in fiscal-Q2 2023 should be expected in fiscal-Q3 2023 unless macroeconomic outlook worsens significantly. Services revenue is expected to grow at a similar pace as in fiscal-Q2. Gross margin in fiscal-Q3 2023 is expected at 44.0-44.5%, more or less in line with fiscal-Q2 2023.

A look at the chart

Apple (AAPL.US) trades around 2.5% higher in premarket today following release of better-than-expected earnings. One may wonder why the stock gains 'just' 2.5% after announcing massive increase in buybacks. However, a $90 billion increase in buybacks was expected and therefore already priced in ahead of the release.

Taking a look at the chart at D1 interval, we can see that the stock dropped below the $168 support zone yesterday and tested an earlier-broken downward trendline. Bulls managed to defend this technical support but failed to break back above the aforementioned $168 zone. However, stocks is set to launch today's cash trading above it and just a touch below $170 mark. In case we see a move above recent highs, the next level to watch for buyers would be $175 area marked with local highs from 2022.

Source: xStation5

Source: xStation5

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance

Disaster for Volvo shares. Is this the end of an iconic brand?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.