The AI software company C3.ai (AI.US) is one of the biggest beneficiaries of interest in the artificial intelligence. And, as its stock market ticker itself indicates, one of the few companies offering direct exposure to artificial intelligence-based products development. Analysts at DA Davidson described its technology as groundbreaking and compared it to early Microsoft disruptive products. The company has business agreements with technology gignats like Amazon Web Services and Google Cloud, with which it identified more than 350 new business applications in Q4 2022.

The bullish momentum for the company has waned somewhat recently in the face of the AI regulation issues raised in the global debate and the report of the company's shorting fund Kerrisdale Capital, which created the right environment for a dynamic correction. Positive momentum may begin to blow back on the company's stock price again. A general increase in risk appetite, the impending Fed hike cycle, and growing interest in the AI industry could ensure that it attracts new customers and achieves profitability.

What does C3.ai actually do?

The company not only provides its software but also uniquely allows companies to build their own digital products based on AI algorithms. Its flagship product 'Suite' enables estimating the probability of rare events, helps fight fraud, hacking attacks and optimizes supply chains. In addition to Amazon (AWS) and Alphabet (Google Cloud), the company's software customers include such giants as Shell and Baker Hughes, and the U.S. Department of Defense, along with the U.S. Air Force, which only confirms the strength and quality of its products.

Fundamentals

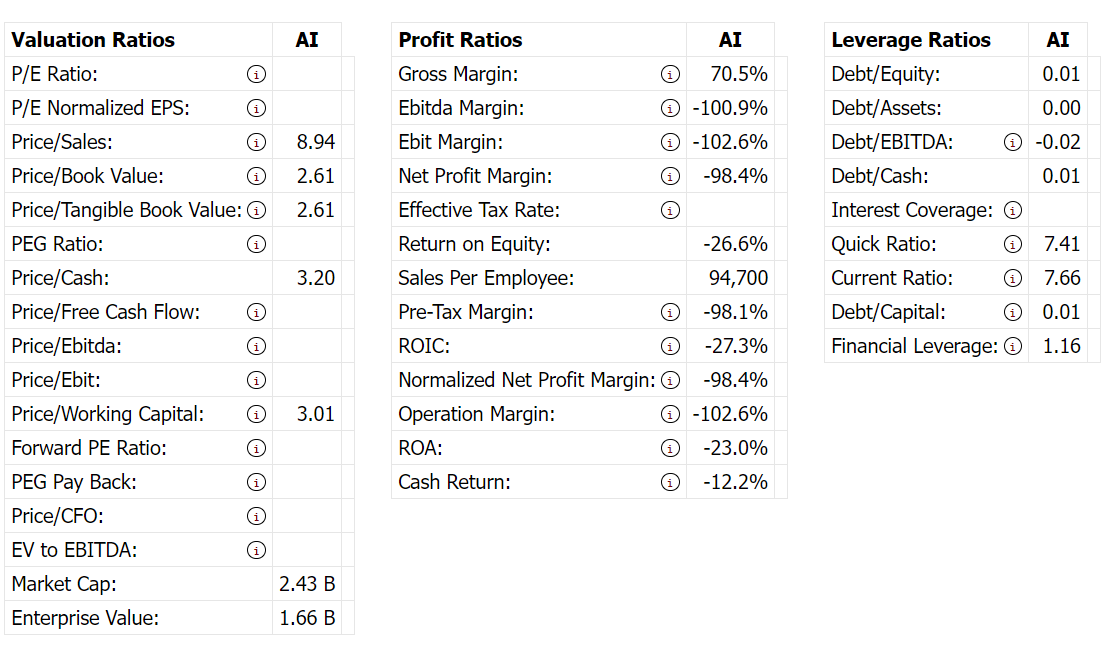

On the fundamental side, a couple of things are thrown up first and foremost. The company is still not profitable and is burning cash. However, its debt is close to zero, its leverage ratio is low, and its 70% Gross Margin means it is able to reinvest 70 cents of every dollar it earns. Its price-to-sales ratio is around 9, its price-to-book-value ratio is 2.7, and the company had 704 employees in 2022 and had not started layoffs. What's more, we can see about 70 new job openings on the company main page, and this year's employee reviews on Glassdoor are mostly very good. Those metrics can indicate that the company is still growing and is a matter of time as will achieve positive cash flows.

Fundamental indicators of the company C3.ai. Source: MarketChameleon

Fundamental indicators of the company C3.ai. Source: MarketChameleon

The most important year ahead?

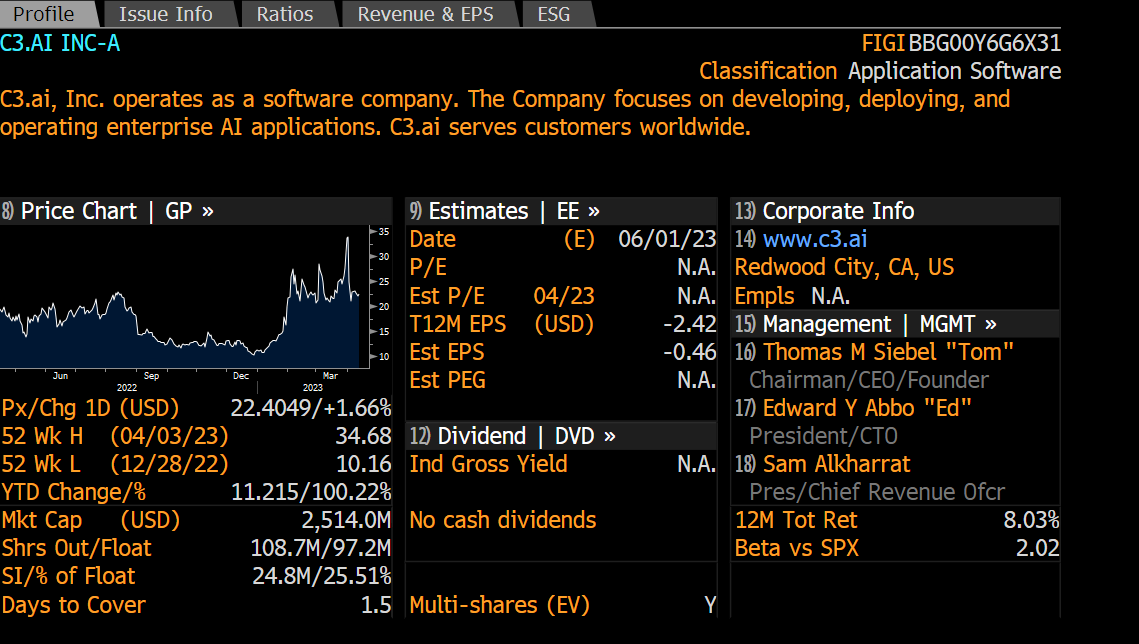

The company faces a huge challenge because speculative interest and rapid growth will confront its actual business capabilities this year. Analysts will be carefully reviewing financial reports, trying to see how the new trend has translated into financial results. The Q1 report will be released on May 30. The company has issued a relatively conservative estimate, expecting 4 to 5% revenue growth this year which gives plenty of room for growth in case of a positive disappointment. C3.ai's CEO and founder Thomas Sieble indicated that the company has recently seen more interest in products in the business segment. However, the market is particularly keen to see how C3.ai's partnerships with Silicon Valley giants will develop this year.

Low capitalization, higher volatility

The relatively low capitalization means that much less investor interest translates into significant increases (or decreases) in the stock price. Since the beginning of the year, C3.ai shares have risen more than 100%, beating Bitcoin and Wall Street's brightest shining stars this year, Nvidia (up 15%), Microsoft (up 85%) and Meta Platforms (up 30%). The market for companies giving direct exposure to the AI industry is very narrow, and C3.ai is the largest of such companies by market capitalization. This means that anyone who wants such exposure can be interested in the stock - after all, it is not offered by Microsoft or Alphabet (Google), whose involvement in AI ultimately has little impact on revenues and margins. Nor does Nvidia, which could become a leading supplier of high-performance chips for machine learning algorithms, represent a 'pure play' investment in AI. Analysts at DA Davidson have also pointed to an advantage in this regard. However, the condition will be for the company to show that the AI trend has affected new orders and revenues in a real and satisfactory way for the market. The CEO also recently conveyed that the company is gradually moving to a more easily scalable model, where the subprime-based model will no longer be the company's main source of revenue.

Short Squeeze?

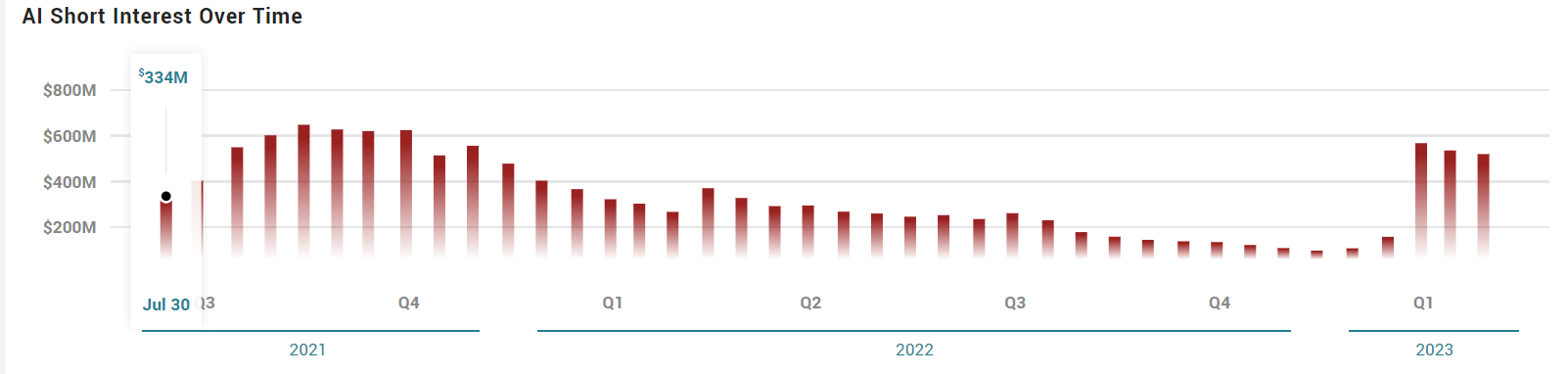

Looking at the amount of short-sold C3.ai (short interest) shares, we can see that the rapid increases in Q1 caused a sudden jump in the amount of shorted shares by speculators. However, the amount of shorted shares has been declining since February. On March 15, 28% of company shares were sold short compared to about 25.5% today. It's still high amount. But the average 'days to cover ratio' near 1.5 shows that a sizable portion of speculators will have to closed their short positions in the coming days and weeks, which may support the bullish scenario of so called short squeeze event. At the same time, it is worth remembering that C3.ai, as a high-risk company, and may be highly dependent on the general sentiment of the market and new technologies.Also informations about wide regulations of AI expantion can weigh on sentiments.

Source: Marketbeat Source: Bloomberg

Source: Bloomberg C3.ai (AI.US) shares, H4 interval. The stock is trading consistently in an uptrend and maintains momentum set by the SMA200 (red line) and the 61.8 Fibonacci retracement of the upward wave, initiated on December 28, 2022. In case of increases, the main resistance level could be the 38.2 Fibo retracement, near $26 per share, and the $29 level, where we see the 23.6 retracement level and previous price reactions. Source: xStation5

C3.ai (AI.US) shares, H4 interval. The stock is trading consistently in an uptrend and maintains momentum set by the SMA200 (red line) and the 61.8 Fibonacci retracement of the upward wave, initiated on December 28, 2022. In case of increases, the main resistance level could be the 38.2 Fibo retracement, near $26 per share, and the $29 level, where we see the 23.6 retracement level and previous price reactions. Source: xStation5

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Arista Networks closes 2025 with record results!

AI scare trade broadens out as we wait for key inflation update

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.