Summary:

- Occidental Petroleum gatecrashes Chevron-Anadarko merger

- Significant premium over share price offered

- Support from Total and Berkshire Hathaway secured

- Potential shareholders’ rebellion in case merger goes through

- Occidental (OXY.US) share price declined towards multi-year support zone on the merger news

While Anadarko Petroleum (APC.US) is neither one of the biggest, nor one of the most famous US oil companies, it is probably the most widely discussed one at the moment. This is because both Chevron (CVX.US) and Occidental Petroleum (OXY.US) want to merge with the company. The latter company seems to be closer to winning Anadarko’s backing. In this analysis we will take a look at the details of the deal, how terms have changed over the past month and what could Chevron’s further bidding mean for Occidental Petroleum.

Occidental gatecrashes Chevron-Anadarko merger

Chevron announced on 12 April 2019 that it has entered a merger agreement with Anadarko Petroleum. Under the agreement Chevron was to buy Anadarko for $33 billion in cash and stock - equivalent to $65 per Anadarko share. Under the negotiated break-up provision party that walks away from the deal would have to pay $1 billion fee to the counterpart. However, at the same time Chevron and Anadarko announced merger, rumours surfaced that Occidental Petroleum may submit its bid for Anadarko. This was confirmed few days later when Occidental announced a $76 per share offer financed with cash and stock in equal proportions. Given significant premium offered over Chevron’s bid Anadarko began to review the offer.

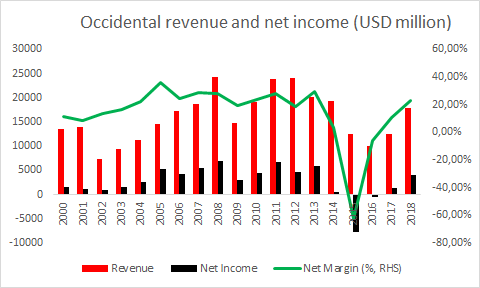

Occidental Petroleum enjoyed an over 20% net margin for the major part of the past two decades. The company began to struggle in 2014 when oil prices dropped significantly. However, it should be noted that the bulk of the 2015 loss was caused by an asset write-down. Spare for this one off the company would show profit. Source: Bloomberg, XTB Research

Occidental Petroleum enjoyed an over 20% net margin for the major part of the past two decades. The company began to struggle in 2014 when oil prices dropped significantly. However, it should be noted that the bulk of the 2015 loss was caused by an asset write-down. Spare for this one off the company would show profit. Source: Bloomberg, XTB Research

Support from the French oil giant and Warren Buffett

Occidental Petroleum is a much smaller company than Chevron and has much smaller balance sheet. In turn, there was a concern that Occidental would have to significantly increase leverage in order to acquire Anadarko. However, Occidental began to act before Anadarko finished the review and secured backing from two strong allies - the French Total (FP.FR) and Warren Buffett’s Berkshire Hathaway (BRKA.US). Total agreed to buy Anadarko’s assets in Africa for $8.8 billion in case Occidental wins over Chevron while Berkshire committed to investing $10 billion in Occidental preferred shares under the same assumption. As Occidental’s share price dropped when the offer to merge with Anadarko was revealed, the company changed the terms of the offer from 50-50 cash and stock to 78% cash and 22% stock. The management reasoned decision saying that following share price drop, the offer may not have been appealing to Anadarko’s shareholders. Higher total price and significant cash component was enough to convince Anadarko’s Board to deem Occidental’s offer superior on Monday, 6 May. Chevron was given 4 days to respond with revised offer or give up the fight.

Occidental’s total revenue in 2018 was 40% higher than Anadarko’s. However, on the chart above we have compared only revenue relating to oil and gas operations (Occidental also operates chemical division). What one may find surprising is the fact that in this major oil industry merger it is the target that has bigger oil operations, not the acquirer. Source: Bloomberg, XTB Research

Occidental’s total revenue in 2018 was 40% higher than Anadarko’s. However, on the chart above we have compared only revenue relating to oil and gas operations (Occidental also operates chemical division). What one may find surprising is the fact that in this major oil industry merger it is the target that has bigger oil operations, not the acquirer. Source: Bloomberg, XTB Research

Occidental’s shareholders do not seem happy

Completion of the merger would create the biggest US company operating in “Oil Exploration and Production” industry. Using end-Q1 valuations Occidental was the second biggest company in the industry while Anadarko was the fifth. The merger would create an industry leader but there is a number of risks tied to the deal. The concern is mostly over the price. Anadarko was trading at P/E of around 20 at the end of Q1 2019 while Occidental was trading at earnings multiple of around 13. However, using Occidental’s bid as numerator causes Anadarko’s P/E to jump to over 33! Another concern was that financing a part of the deal with shares that are currently trading near the lower limit of a decade-long trading range could lead to a significant dilution. Revised offer (with increased cash component) means that equity issuance will not breach a threshold (20% of the outstanding shares) that would require the company to ask for shareholders’ approval. As a lot of Occidental’s stakeholders do not see Anadarko merger as value-enhancing deal, such an approval would be hard to obtain. Unsurprisingly, voices echoed that a move to increase cash component of the bid was aimed at circumventing the need for an approval. We may never know whether it was the case or not but what we know now is that some Occidental’s major shareholders, like for example T.Rowe Price Group, will try to oust the Board. Apart from taking on more financial leverage, this is the main risk in case the deal is completed - possible replacement of management team.

Occidental Petroleum followed quite conservative dividend policy in the early 2000s - it was distributing small portion of earnings as dividends. Thanks to this company could pay dividend exceeding EPS in 2015, 2016 and 2017 and avoid cutting dividend payout. In case the company was distributing the majority of its earnings as dividends, the cut would be inevitable over the long run. Source: Bloomberg, XTB Research

Occidental Petroleum followed quite conservative dividend policy in the early 2000s - it was distributing small portion of earnings as dividends. Thanks to this company could pay dividend exceeding EPS in 2015, 2016 and 2017 and avoid cutting dividend payout. In case the company was distributing the majority of its earnings as dividends, the cut would be inevitable over the long run. Source: Bloomberg, XTB Research

What if Chevron strikes back?

On the other hand, what could lead to Occidental-Anadarko merger being abandoned? It can happen in two ways. The first one would be Anadarko’s shareholders rejecting the offer. However, it seems unlikely given high premium over pre-announcement market price. The other and potentially more probable way for Occidental-Anadarko merger to be dropped is Chevron submitting a revised bid. As we have mentioned earlier Chevron is much bigger company than Occidental and could easily outbid the rival. What could it mean for the Occidental’s share price? Occidental’s share price is highly correlated with WTI price (light overlay on the chart below) but the two diverged as merger news surfaced. Having said that, a major drop in Occidental share price in the aftermath of submitting bid for Anadarko can be ascribed to market discounting significant premium in the merger bid rather than deterioration in operations. In theory, in case Chevron submits superior bid and Occidental drops out of further bidding, the latter's share price could recoup some losses. Apart from that, in case Occidental stops chasing the merger, major shareholders are unlikely to seek removal of the Board. Obviously, lack of management’s replacement would put aside potential concerns over the future direction of the company. However, so far it looks like Chevron is not going to raise its bid.

Occidental Petroleum (OXY.US) saw its share price diverge from WTI (OIL.WTI) as the merger bid was announced. Stock dropped to the multi-year support zone ranging $57.40-59.00 where bulls managed to halt the decline. Source: xStation5

Occidental Petroleum (OXY.US) saw its share price diverge from WTI (OIL.WTI) as the merger bid was announced. Stock dropped to the multi-year support zone ranging $57.40-59.00 where bulls managed to halt the decline. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.