Summary:

-

Equities rise on trade hopes (again)

-

FTSE approaching prior resistance 7410

-

GBP higher after recent polls

It’s been a bright start to the new week for the stock market here in London and also the pound, with both moving higher in early trade. The FTSE100 has added 50 points to trade back near the 7400 handle and not far from its highest level in a fortnight. The move higher is not just confined to the UK but can be seen around Europe with a sea of green across the board.

UK stocks are working on a 3rd consecutive day of gains but remain largely rangebound, with the 7410 region still seen as possible resistance. Source: xStation

UK stocks are working on a 3rd consecutive day of gains but remain largely rangebound, with the 7410 region still seen as possible resistance. Source: xStation

The gains are most likely a result of some positive trade during the Asian session with shares extending higher following positive noises on the trade front over the weekend. Intellectual property theft has been one of the core issues at the heart of US-Chinese tensions and news that Beijing will increase penalties for perpetrators is a clear attempt at signalling that they are attempting to address one of the main sticking points that is holding back a new trade deal. The will-they-won’t-they nature of the US and China reaching a phase one deal continues to be the main driver of short term swings in the markets, and on the whole investors seemingly remain positioned for a positive outcome on this front.

Sterling moves higher

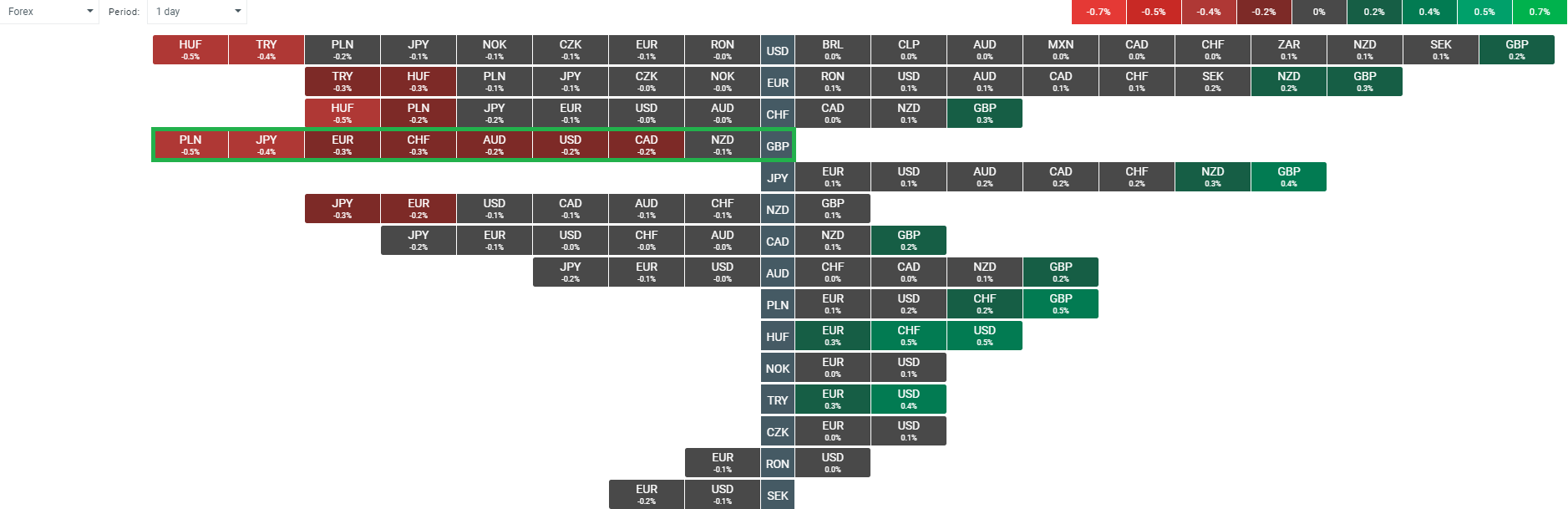

The pound is the best performer major currency at the start of the week, making small but steady gains against all of its peers. The launch of the Conservative manifesto over the weekend was free from any real major surprises and recent polling continues to point to a strong lead for the party. The launch of both the main parties manifestos and two televised debates involving Boris Johnson and Jeremy Corbyn has had a negligible impact on opinion polls and this will be warmly welcomed within the Tory party who will increasingly be feeling that this election is theirs to lose.

The Pound is moving higher in recent trade at the start of the week, aided by the continued strength of the Conservative party in the polls. Source: xStation

There are just over 2 weeks to go until election day and there seems to be two main sources of hope that could see Labour begin a surge higher in popularity ahead of the vote. Firstly, turnout could be a big issue at the election and given that it is the first to be held in December for almost a century there could be a surprise on this front. Friday saw the fourth largest surge in voter registration on record and not only was the 300,000 plus figure only behind previous deadline days around two-in-three of these were under 35 - a demographic that is traditionally the weakest for Conservative support. Secondly, the NHS has the potential to throw up problems for the Tories and a full blown winter crisis ahead of the vote could see voters shun the Tories in favour of Labour who have promised far more spending on healthcare.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.