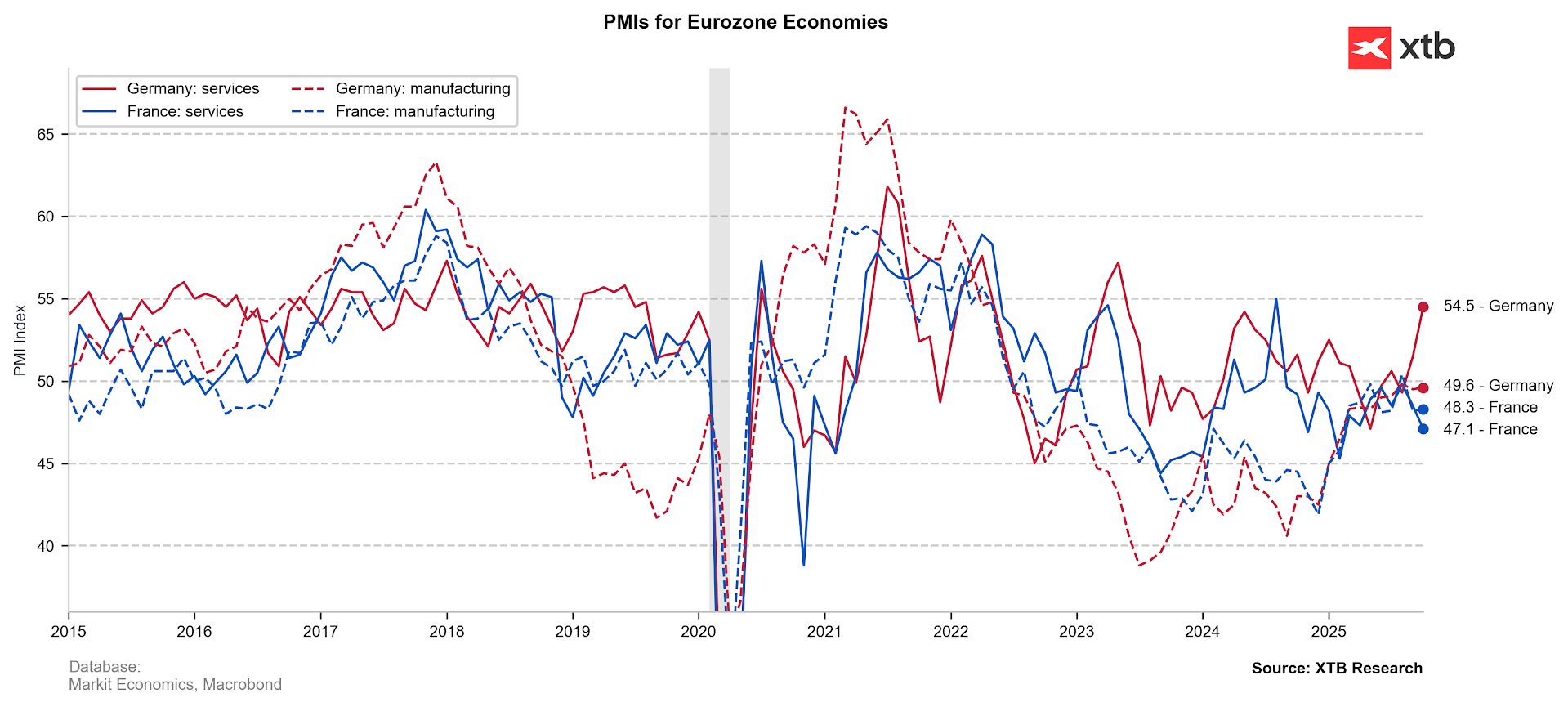

- Rebound in German data, with a clear improvement in the services sector.

- Slight improvement in French manufacturing sentiment, but a significant decline in services.

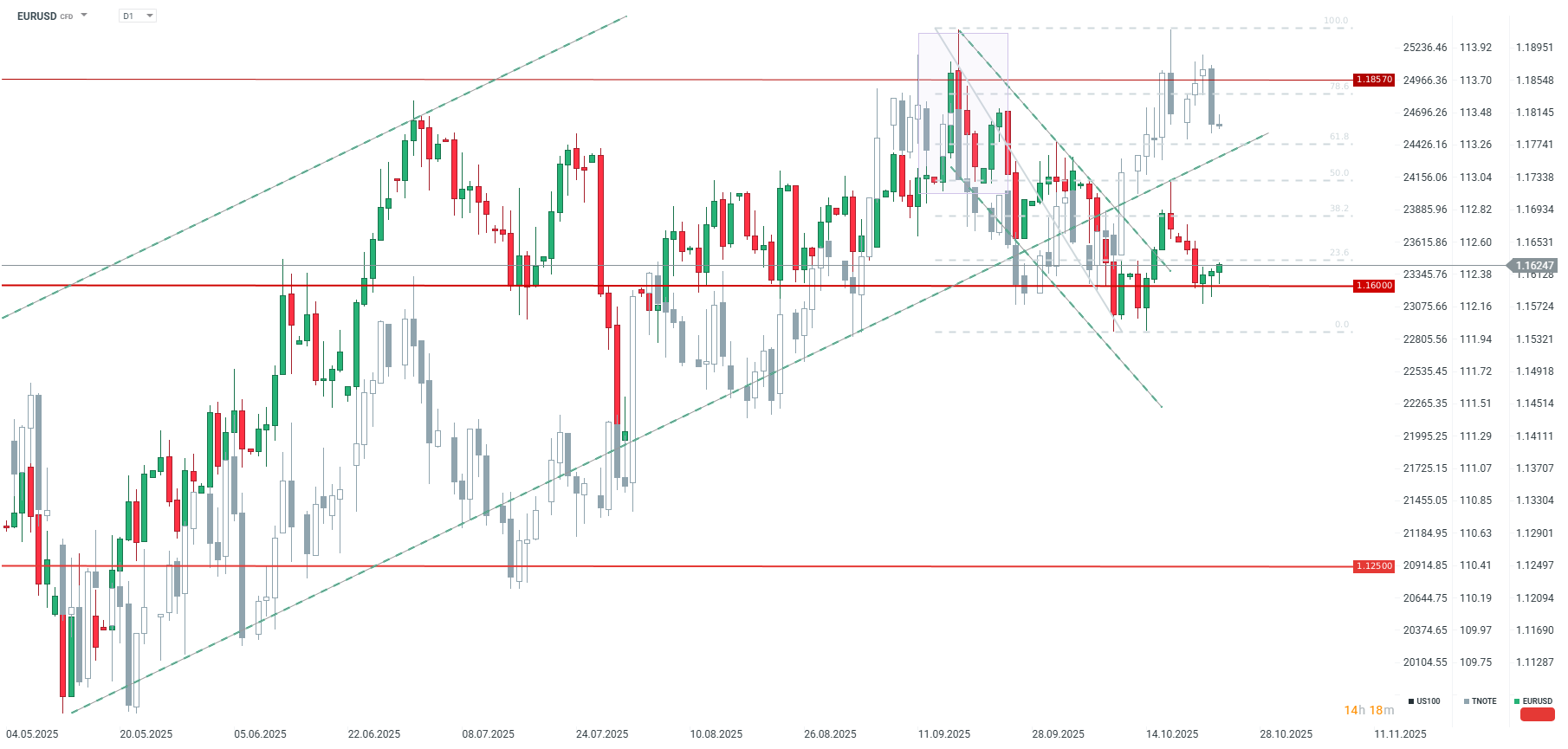

- EURUSD continues to recover.

- Rebound in German data, with a clear improvement in the services sector.

- Slight improvement in French manufacturing sentiment, but a significant decline in services.

- EURUSD continues to recover.

Germany Manufacturing PMI (preliminary, October): 49.6 (expected: 49.5; previous: 49.5)

Germany Services PMI: 54.5 (expected: 51.0; previous: 51.5)

France Manufacturing PMI (preliminary, October): 48.3 (expected: 48.2; previous: 48.2)

France Services PMI: 47.1 (expected: 48.7; previous: 48.5)

Germany PMI: Clear improvement, but risks remain

Germany’s PMI data show the fastest growth in output in over two years, with rising new orders and backlogs in both manufacturing and services. This suggests a strong start to Q4 and a pickup in economic recovery. Particularly positive is the increase in orders and employment in services, although manufacturing continues to see job cuts. Supply-chain uncertainties (notably in semiconductors) persist, negatively impacting sectors such as automotive. Rising labor costs continue to feed through to higher prices, but service firms are managing to pass part of these costs on to clients.

France PMI: Further decline, moderate labor optimism

France’s PMI indicators were weak, with the October Flash Composite PMI falling to 46.8 points, firmly in recession territory. The decline in output across both manufacturing and services points to broad-based demand weakness. Companies remain cautious about the outlook, reflecting a fragile global environment and domestic political uncertainty. On a positive note, labor market resilience and easing price pressures may offer some relief for the ECB. Despite efforts to stimulate sales through price cuts, the French economy continues to face a prolonged period of stagnation.

EURUSD continues moderate gains

Looking at the EURUSD pair, we observe a clear upward attempt over the last three sessions, with buying interest around the 1.1600 level. The U.S. dollar remains uncertain ahead of the Fed’s decision and amid ongoing government shutdown concerns. Although U.S. yields have climbed back above 4%, the EURUSD still shows a significant divergence from TNOTE, suggesting the U.S. dollar may be overvalued.

NFP preview

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.