Sugar futures (SUGAR) on the ICE exchange are up more than 2% today, making them the best-performing agricultural commodity. Commitment of Traders (CoT) data from August 12 indicated a modest reduction in speculative short positions, suggesting the market may be entering a phase of “testing the strength” of the downtrend.

Brazilian harvests remain a key driver for the market. UNICA, the country’s largest sugar industry association, reported last week that sugar output in the Centre-South region through July fell 7.8% year-on-year. At the same time, in the second half of July, the share of cane allocated to sugar production rose to 54.10% versus 50.32% a year earlier. This shift contributed to price weakness earlier in the week, but the market is now rebounding on “technical” grounds after reaching multi-year lows.

In India—one of the world’s largest cane producers—the new harvest season begins in less than two months, with forecasts pointing to solid crops, raising uncertainty over whether the rebound can hold. Additional sugar supplies from Thailand are also expected to hit the market later this year. At present, the demand–supply balance appears stable, suggesting prices may move sideways while awaiting a stronger catalyst.

SUGAR (D1 interval)

On the daily chart, prices have been forming higher lows for several weeks, with the contract approaching a test of the EMA50 (orange line). The key short-term resistance zone is currently around 17 USD (price action).

Source: xStation5

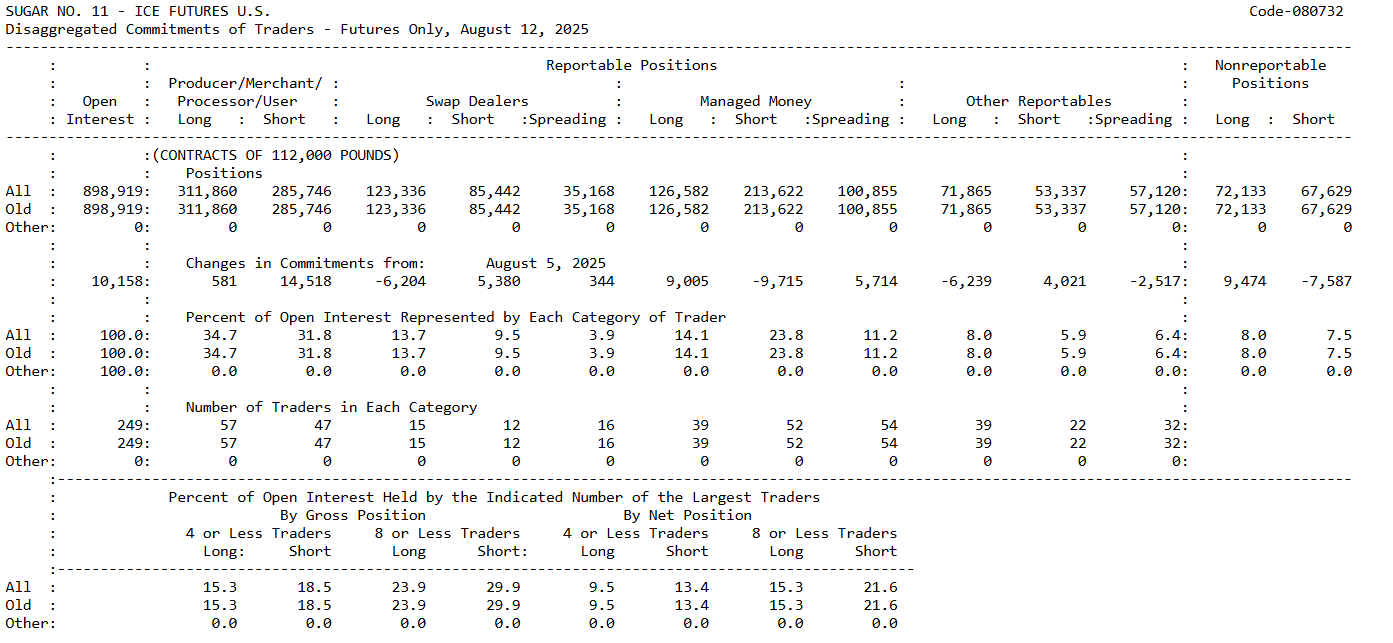

CoT Analysis (August 12)

Commercials – Producers and processors remain strongly positioned on the hedging side. This is evident from the sharp increase in short positions (+14.5k), signaling a stronger push to secure future production against potential price declines. Their net position remains slightly long (~+26k contracts), but the shift toward heavier hedging is clear. For the market, this indicates that physical players do not expect major price rallies and are focused on protecting margins.

Managed Money – Large speculative funds are still holding a distinctly net short exposure (~-87k contracts), maintaining bearish pressure on sugar. However, the latest changes show a notable pattern: +9k new longs and -9.7k shorts cut. This is a classic sign of short-covering and potentially the first stage of a sentiment shift. While funds remain net bearish, the weekly dynamics suggest that some are beginning to position for a rebound. The largest eight traders still control nearly 30% of total short positions. If the trend of short covering among Managed Money continues in upcoming reports, a sustained rally could follow.

Producers are aggressively hedging against further declines, while speculative funds are starting to unwind shorts, pricing in the risk of a trend reversal. Source: CoT, CFTC

An elevated oil price is here to stay as supply concerns grow, equities fall

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

Daily summary: Oil still pressures Wall Street despite favorable CPI data 🗽

🚩Silver loses 3%

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.